All Epsilon Theory Content

Everything we have published at Epsilon Theory since 2013, an archive of more than 1,000 evergreen notes.

There’s a critical, indispensable feature of a free nation we call a free press. And then there’s the Meme of free press!. The latter is a pure Narrative construction, and a thing well supplied in the DC market.

Join us here at 2PM Eastern today for the latest edition of Office Hours. Today’s edition is all about the grotesque charades and cartoons being used to cynically manipulate narratives. Not one to miss.

It’s all been leading up to this.

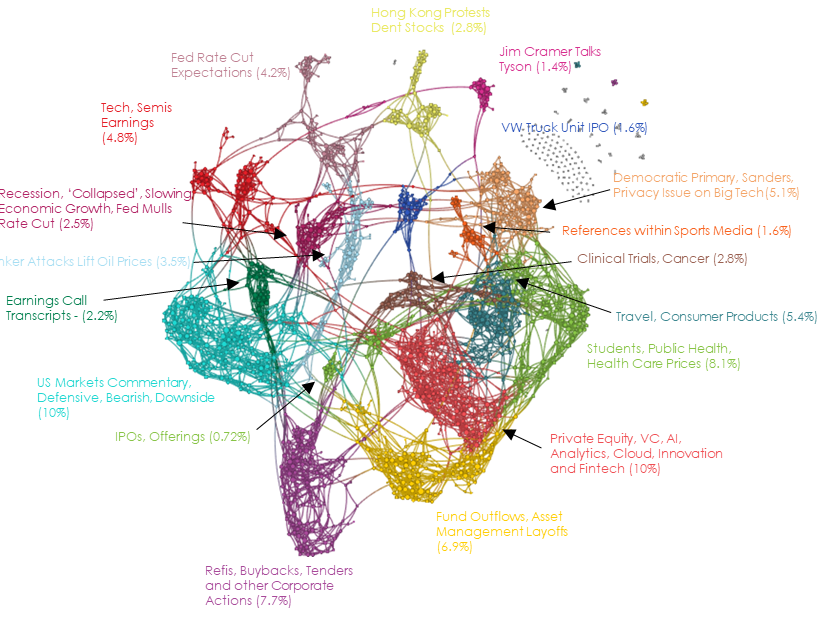

We’re sharing the summary results of our core investment research project with The Narrative Machine.

If you’ve ever wondered, “Gosh, how DO you apply these cool narrative maps to an actual investment strategy?” … well, here’s your answer.

A tug-of-war is only a tug-of-war if both sides, y’know, are capable of pulling on the rope.

Every morning, we run The Narrative Machine on the past 24 hours worth of financial media to find the most on-narrative (i.e. interconnected and central)…

If you’re going to trade on story and sentiment, more power to you. But over time, the mind naturally searches for justification and credibility for continued ownership of something. Take care when you start to feel that pull.

Sometimes a news article that’s all over the map is just a badly written article. Sometimes it’s like a glitch in the matrix. I think the changing narratives and weakening Common Knowledge around Big Tech are causing the latter.

What’s the most valuable commodity Gordon Gekko knows? Information.

How valuable is Wall Street research? How much information does Wall Street research have? LOL.

MIFID II is making the jump from Europe to the US. Time to polish those sell-side research resumes. As if you weren’t already.

There’s a point in any human activity – investing, politics, religion, or business – where a thing we do together becomes a thing in-itself. It’s a point that changes our thinking and the moral questions we are forced to answer. Knowing where this point lies is in all our activities is important.

The need to control and influence common knowledge knows no boundaries. And I mean literally no boundaries.

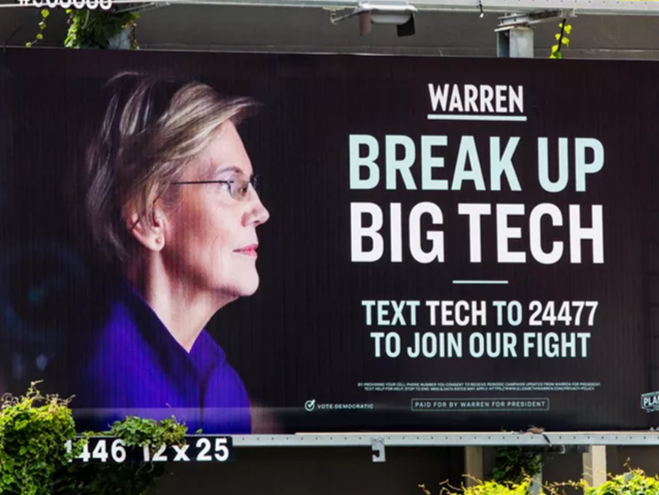

There are two narrative structures that have grown to a size and a level of cohesion that makes them impossible to be politically ignored.

One is the student loan “crisis”. The other is the Big Tech “monopoly”.

And yes, I’m putting those words in air-quotes, because the first isn’t really a crisis and the second isn’t really a monopoly. But since when did that matter in narrative-world?

Vanguard just announced a joint venture with Ant Financial in Shanghai. They’re not waiting around for a trade “deal”, and they’re not clutching their pearls about Chinese IP “theft”.

No, Vanguard is going to do what they always do … they’re going to obliterate their competition with the pricing power that comes from government collaboration.

Bannon and the rest of the America First brigade (which includes a LOT of bedfellows you see all the time on CNBC, like Kyle Bass) are going full-McCarthy. They’re going to have a “list”. They’re going to accuse anyone and everyone of “treason”.

It’s part and parcel of the China narrative transformation that Rusty and I have been talking about for a month now: the US-China narrative is now a national security narrative, not an economic trade narrative, and you can’t walk that narrative back until after the 2020 election.

Certificate programs like “Impact Investing for the Next Generation”, a course offered by Harvard’s Kennedy School and the World Economic Forum (yes, the Davos guys), are a great way to fleece the suckers. And by suckers I mean rich Asians.

I know of which I speak. Because I used to do the fleecing.

It’s the Weekend Zeitgeist, in which a lovely sentiment is enough to convince us to include a soccer piece, a thoughtful observation on symbols is enough to convince us to include a Gawker piece, and language colors what we treat as acceptable political views.

Any shift in the Trade narrative away from economic issues and toward national security issues is highly problematic for a market-friendly resolution in US-China negotiations. Why? Because the political stakes are much higher for both Trump and Xi in a national security game of Chicken than they are in an economic game of Chicken. It is much easier to be “the chicken” in an economic game and claim some sort of face-saving feature than in an national security game, so the latter is almost always a protracted affair of brinksmanship and high stress.

It’s happening.

Nancy Pelosi’s chief of staff is now Facebook’s chief lobbyist. Big Tech just gave the Internet Freedom Award to Ivanka Trump. The head of the antitrust division of the Justice Dept. is a former Google lobbyist.

They’re. Not. Even. Pretending. Anymore.

Great Truths can be important engines for social unity and shared identity. In the hands of some, however, they can become tools for obscuring actual truth – facts – in service of cynical use of the emotional memes attached to those Truths.

The narratives of Central Bank Omnipotence and Trade & Tariffs have merged into a superstorm.

We are tracking its movement across the map of narrative-world, and as you might expect … it packs a punch.

It’s the truest thing I know about the State: what begins as emergency government action ALWAYS becomes permanent government policy.

So now here we are, where “whatever it takes” has morphed from saving the entire European project to … [checks notes] … preventing a garden-variety recession.