All Epsilon Theory Content

Everything we have published at Epsilon Theory since 2013, an archive of more than 1,000 evergreen notes.

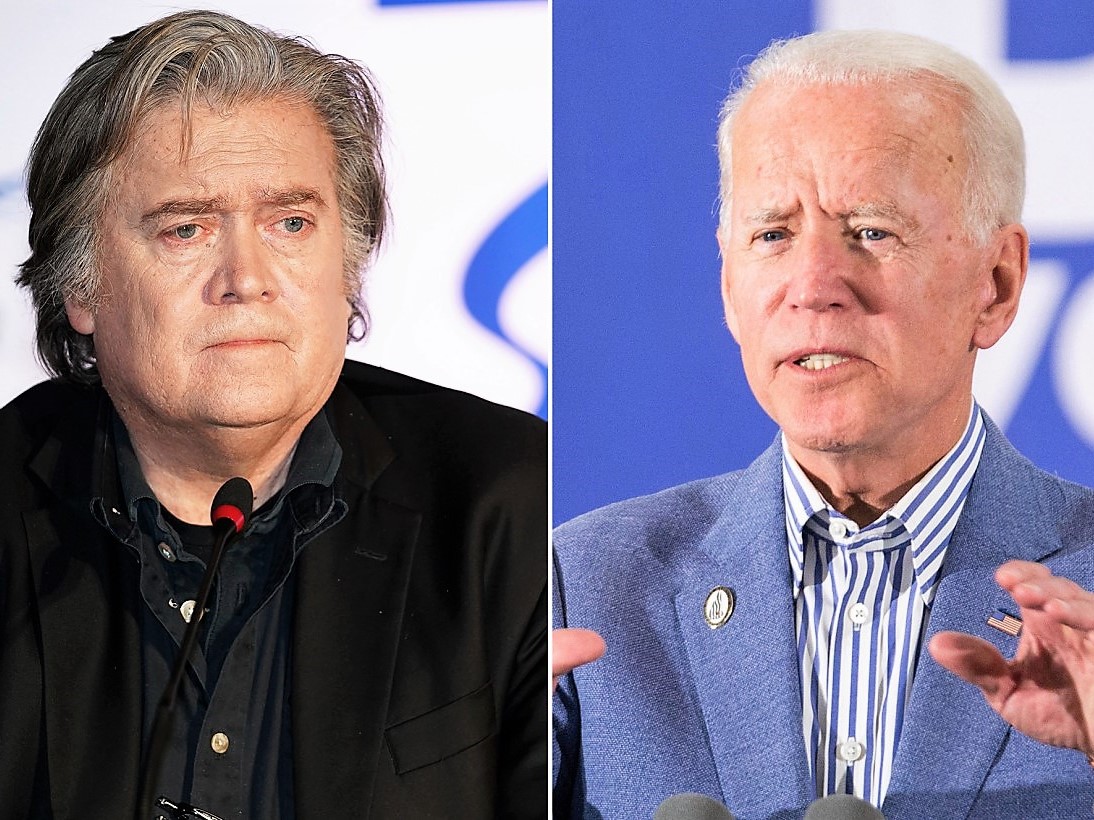

Bannon and the rest of the America First brigade (which includes a LOT of bedfellows you see all the time on CNBC, like Kyle Bass) are going full-McCarthy. They’re going to have a “list”. They’re going to accuse anyone and everyone of “treason”.

It’s part and parcel of the China Narrative transformation that Rusty and I have been talking about for a month now: the US-China narrative is now a national security narrative, not an economic trade narrative, and you can’t walk that narrative back until after the 2020 election.

Certificate programs like “Impact Investing for the Next Generation”, a course offered by Harvard’s Kennedy School and the World Economic Forum (yes, the Davos guys), are a great way to fleece the suckers. And by suckers I mean rich Asians.

I know of which I speak. Because I used to do the fleecing.

It’s the Weekend Zeitgeist, in which a lovely sentiment is enough to convince us to include a soccer piece, a thoughtful observation on symbols is enough to convince us to include a Gawker piece, and language colors what we treat as acceptable political views.

Any shift in the Trade narrative away from economic issues and toward national security issues is highly problematic for a market-friendly resolution in US-China negotiations. Why? Because the political stakes are much higher for both Trump and Xi in a national security game of Chicken than they are in an economic game of Chicken. It is much easier to be “the chicken” in an economic game and claim some sort of face-saving feature than in an national security game, so the latter is almost always a protracted affair of brinksmanship and high stress.

It’s happening.

Nancy Pelosi’s chief of staff is now Facebook’s chief lobbyist. Big Tech just gave the Internet Freedom Award to Ivanka Trump. The head of the antitrust division of the Justice Dept. is a former Google lobbyist.

They’re. Not. Even. Pretending. Anymore.

Great Truths can be important engines for social unity and shared identity. In the hands of some, however, they can become tools for obscuring actual truth – facts – in service of cynical use of the emotional memes attached to those Truths.

The narratives of Central Bank Omnipotence and Trade & Tariffs have merged into a superstorm.

We are tracking its movement across the map of narrative-world, and as you might expect … it packs a punch.

It’s the truest thing I know about the State: what begins as emergency government action ALWAYS becomes permanent government policy.

So now here we are, where “whatever it takes” has morphed from saving the entire European project to … [checks notes] … preventing a garden-variety recession.

In today’s narrative-connected news, New Mexico makes a major shift in their portfolio allocation, away from broad equity indices and core fixed income, and towards real assets.

It’s a very Zeitgeist-aware portfolio shift, and boldly done. I love it!

Ben and Rusty update subscribers on the shift from cooperative to competitive games and our narrative research program, with a focus on the China Trade War and US electoral politics.

It’s the Weekend Zeitgeist! In which we get a flood of flood coverage, everybody is a contrarian, Bloomberg covers abortion, Time magazine does Time magazine things and Raleigh invites an unexpected guest or two to the 2019 Zeitgeist.

We spend a lot of time on our trade ideas, and do a lot of hand-waving at what we believe that everyone else believes. It’s a core problem for investors, and one that can’t be avoided.

The pecking order is a social system designed to preserve economic inequality: inequality of food for chickens, inequality of wealth for humans. We are trained and told by Team Elite that the pecking order is not a real and brutal thing in the human species, but this is a lie.

It’s like he’s a drunk dentist in Vegas for a convention, sitting down at the poker table and getting bored after three hands. So he decides that he can “impose his will” on the table by opening up out of position with rags and making a continuation bet all the way through the river. Like everyone else at the table doesn’t see him for EXACTLY who he is.

This isn’t a US thing. This isn’t a China thing. This isn’t a Trump thing. This isn’t a Xi thing.

This is a social animal thing.

The words are not lies. The words are not wrong. The conflict may be just.

But you are being played nonetheless.

I’m not sure that people who aren’t immersed in this world realize how crappy B3 debt is. Or how much of it is getting pushed into the market.

THIS is financialization.

How will you know that the US-China trade narrative is shifting towards a protracted game of Chicken?

When the narrative becomes dominated by national security language and clusters.

Rusty and I have been all over this for a year. More to the point, we have been right. If you want to know what’s happening with the Trade & Tariff narrative structure, you should subscribe to ET Professional. This is what we DO.

It’s easy to get waaaay too precious when it comes to professional kitchens, whether we’re talking about restaurants or a trading desk.

But credit default swaps are like chef knives. They’re not an affectation, but a necessary tool for so many tasks. Even if you don’t cook or trade a portfolio professionally, you’ll want to own a good knife and you’ll want to know the mechanics and the rationale of a CDS trade.

The word “spree” is so evocative in narrative-world, implying at a minimum some sort of wantonness and excess, some sort of moral bankruptcy.

How threadbare and slow-growing is the financial services world today? It’s a “hiring spree” just to open up a New York office. With 30 people. By 2022.

Facebook is a master at implementing price increases under the narrative of “optimization”, as if the company was doing you a favor by raising their ad prices so much. Now Amazon is reading from the same playbook in their advertising business.

Time to break up the trusts. Again.