All Epsilon Theory Content

Everything we have published at Epsilon Theory since 2013, an archive of more than 1,000 evergreen notes.

WHO beclowns itself with its “fact-finding mission” to Wuhan.

When we talk about bias, we usually think about a political bias. But the world of 2021 now supports persistent idiosyncratic biases and frames through which information is passed. How do we ensure that our information consumption habits account for this?

What’s happening with Reddit and Gamestop and Robinhood is a revolution, but not the revolution you think.

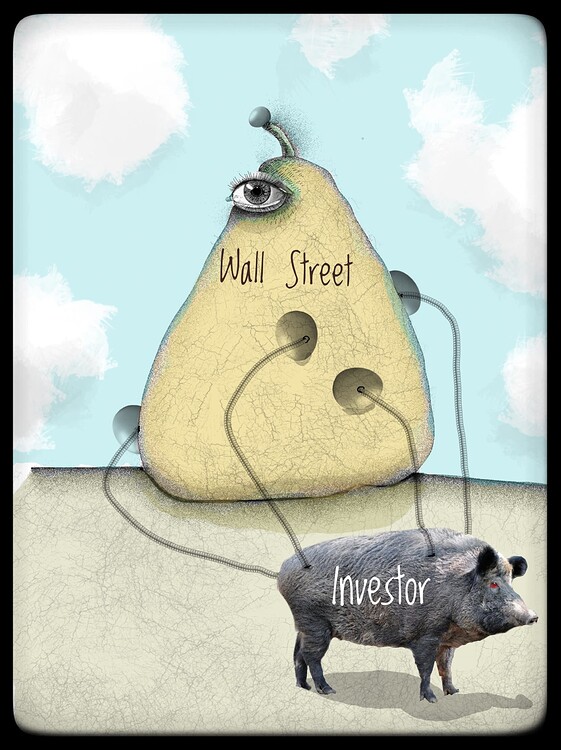

This isn’t a “democratization” of Wall Street. You were played. Again.

It’s a revolution in Common Knowledge. And that changes everything. Again.

You have been told that the odds are ever in your favor. You have been told this for your entire life. More and more, you suspect this is a lie.

You have been told a new story. A brave story. That by banding together and acting as one, you can “democratize” the stock market. Today, as you see the collapsing stock prices of the companies you supported, you suspect that this was a lie, as well.

What’s happening now in equity markets isn’t the product of some paradigmatic democratization of finance. It’s just another bubble that will end badly.

The Very Serious Investor is quite disturbed by recent goings-on in illiquid, small cap stocks with high short interests. These happenings represent an assault not only on the Very Serious Investor’s livelihood, but his entire cosmology. People placing profitable discretionary trades in the financial markets when they lack even a single Ivy League degree. Imagine!

No, the real story here probably isn’t about a revolution against Wall Street. But that doesn’t mean that there isn’t an opportunity to build a movement – right now – to transform it toward fair, free and open markets.

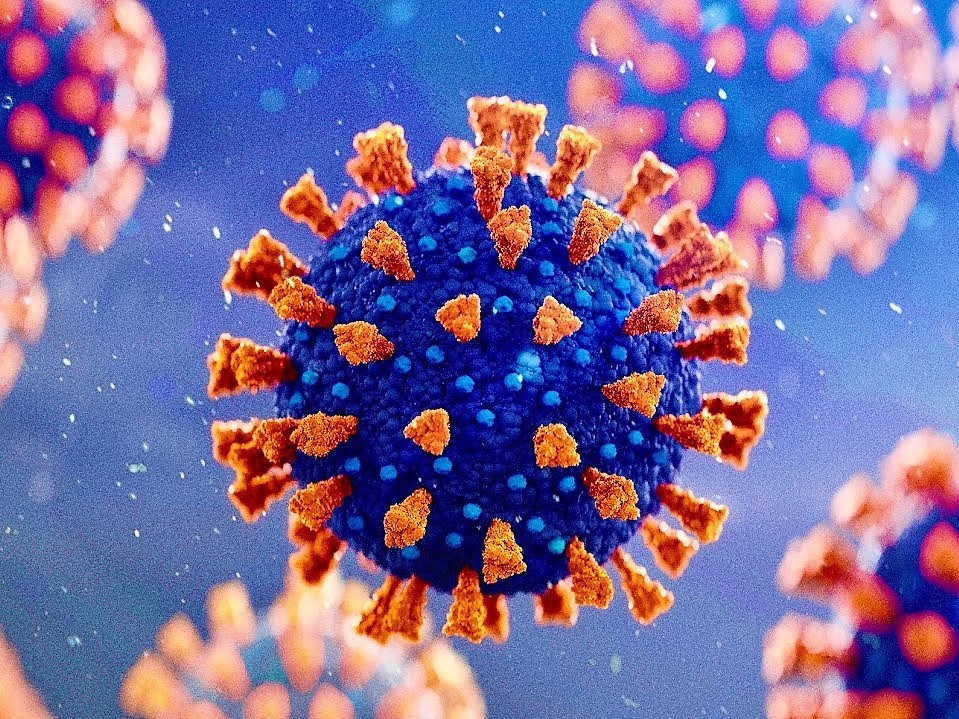

The South African variant virus (501.V2) is not the immediate threat to the United States as the UK variant virus (B117). But 501.V2 has the potential to create a far more powerful narrative – vaccine resistance – that can have a greater market impact than the more pressing issues of B117.

More and more, I think the variant viruses create a tradeable event for markets.

O judgment! thou art fled to brutish beasts,

And men have lost their reason. Bear with me;

My heart is in the coffin there with the American dream that once was,

And I must pause till it come back to me.

Everything you always wanted to know about r/Wallstreetbets and Gamestop*

*but were afraid to ask

The light research poured into sentiment analysis misses one rather important fact: that’s the game we used to play. Today’s Fiat News is a different game altogether.

The spread of B117 in a Covid-fatigued country like the US is a profoundly deflationary, risk-off, dollar higher, flight to safety event in real-world.

Does it matter to market-world?

Jonathan Plotkin is a longtime ET reader and brilliant cartoonist. For years he’s been sending Ben illustrations inspired by our notes and we’ve been dying…

Check out the January 19 Office Hours, where Ben and Rusty talk with you about the latest ET notes.

In episode #3 of the Epsilon Theory podcast, Rusty and I discuss the spike in Covid cases in Ireland and the risk of seeing a similar “Ireland Event” here in the US.

The time to act is NOW, not with indiscriminate lockdowns, but with strong restrictions on international and domestic air travel to contain the UK-variant virus while we accelerate vaccine delivery.

I believe there is a non-trivial chance that the United States will experience a rolling series of “Ireland events” over the next 30-45 days, where the Covid effective reproductive number (Re not R0) reaches a value between 2.4 and 3.0 in states and regions where a) the more infectious UK-variant (or similar) Covid strain has been introduced, and b) Covid fatigue has led to deterioration in social distancing behaviors.

There is a brief window where I think we have the opportunity to commit to building a common national identity together. Seizing this opportunity will mean leaving a lot of anger we will feel is entirely justified at the door.

Not seizing it, I fear, will mean that we all reap the whirlwind.

ET contributor Pete Cecchini isn’t buying the reflation / small-cap rally narrative, even with a mini Blue Wave.

Jonathan Plotkin is a longtime ET reader and brilliant cartoonist. For years he’s been sending Ben illustrations inspired by our notes and we’ve been dying…

On Christmas Day, Nashville was attacked by a suicide bomber terrorist. But not by a “Suicide Bomber”. Not by a “Terrorist”.

Why not? Because his terrorist goals didn’t fit neatly into a useful political narrative like “Antifa!” or “Proud Boys!”

Here’s what this looks like in the Narrative Machine.