All Epsilon Theory Content

Everything we have published at Epsilon Theory since 2013, an archive of more than 1,000 evergreen notes.

Three blow-ups in three months: Archegos, Greensill, and Melvin Capital.

What do they have in common? Insane leverage employed to maximize private gain while socializing potential losses.

What do you get when you give a Raccoon billions of dollars AND invisibility from regulators? Collusion and insider trading.

Most of us are under the impression that a protracted conflict within China will increase national unity. Not this time.

ET contributor Brent Donnelly talks with Howard Marks about why traditional value investing is likely permanently impaired as a strategy and why Growth vs. Value is a false dichotomy. Boomshakalaka!

We’re going to Pack-source a slate of investment strategies for an inflationary world. Here are five tentpoles to organize and support that effort.

I think that the collapse of Greensill Capital has a lot of systemic risk embedded within it, particularly as the fraudulent deals between Greensill and its major sponsors – Softbank and Credit Suisse – come to light.

This is the first Big Fraud I’ve seen in 13 years with the sheer heft and star power to ripple through markets in a systemic way. Not since Madoff.

Excessive complexity in a deal or structure isn’t necessarily nefarious, but it also isn’t a good sign. The distraction and confusion you and I feel reading about these deals is usually not the problem.

It is the point.

An in-depth look at the interdependence of inflation, Treasury supply, and the Fed reaction function.

Bottom line: inflation is the Fed’s kryptonite.

Increasingly, the Common Knowledge of our investment world – what everyone knows that everyone knows – is that inflation is a problem and you should be focused on it.

In 2008, the US housing market – together with a Fed that thought the subprime crisis was “contained” – delivered the mother of all deflationary shocks to the global economy.

In 2021, the US housing market – together with a Fed that thinks inflationary pressures are “transitory” – risks delivering the mother of all inflationary shocks.

The ET Pack is going to figure this out … together.

Very little investing today is buying and selling shares of common stock in individual companies. Instead, we buy and sell what Wall Street calls “products” – mutual funds, ETFs, options, REITs, SPACs, etc.

Dave Nadig, who literally wrote the book on ETFs, helps us understand the history and future of the business of Wall Street.

In the same way that Narrative shaped a conversation about the role of police going forward in 2020, narrative can shape a conversation about the role of teacher unions and public sector unions more broadly. My money is still on the status quo, but I’ve been wrong before.

Every political movement has a political philosophy, and for Trumpism and MAGA it’s the Dominion theology of the charismatic/Pentecostal church.

Neither the rise of Donald Trump nor the attack on our Capitol can be understood without an examination of this faith and its constructed political narratives.

Believe it or not.

WHO beclowns itself with its “fact-finding mission” to Wuhan.

When we talk about bias, we usually think about a political bias. But the world of 2021 now supports persistent idiosyncratic biases and frames through which information is passed. How do we ensure that our information consumption habits account for this?

What’s happening with Reddit and Gamestop and Robinhood is a revolution, but not the revolution you think.

This isn’t a “democratization” of Wall Street. You were played. Again.

It’s a revolution in Common Knowledge. And that changes everything. Again.

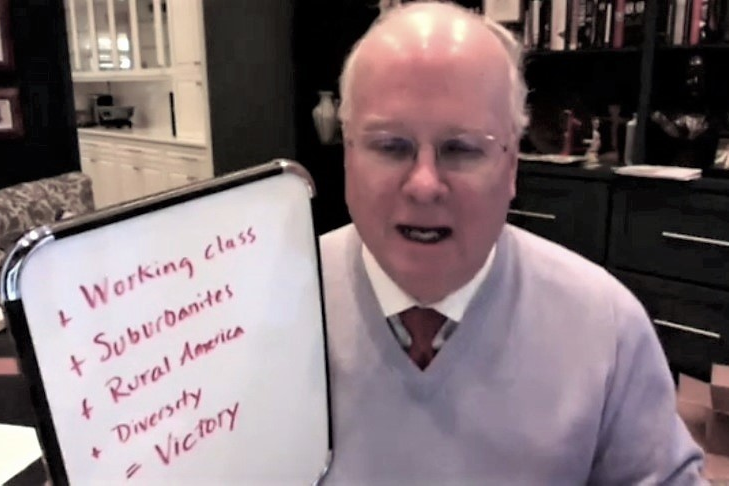

You have been told that the odds are ever in your favor. You have been told this for your entire life. More and more, you suspect this is a lie.

You have been told a new story. A brave story. That by banding together and acting as one, you can “democratize” the stock market. Today, as you see the collapsing stock prices of the companies you supported, you suspect that this was a lie, as well.

What’s happening now in equity markets isn’t the product of some paradigmatic democratization of finance. It’s just another bubble that will end badly.