All Epsilon Theory Content

Everything we have published at Epsilon Theory since 2013, an archive of more than 1,000 evergreen notes.

Over the last 6 months, there’s been a mass influx of new hedge fund PMs, many from bank trading seats leaving for greener (?) pastures. I’ve been in both seats. I’ve had good years and disappointing years. So I present this advice with the utmost humility …

I want to change the language of crypto from mining to growing. I do not mean this in a metaphorical sense. I mean a proof-of-plant method for literally growing cryptocurrency tokens as a representation of the value stored in the human cultivation of plants.

The Fast and Furious movies are famous for intense action and ridiculous plots. But the truth about how these stories get made has more to do with the drama happening behind the camera than in front of it.

We write a LOT about work. And the responses we get are … weird.

Once again, the most important narratives are the ones we tell ourselves.

If you’re like me, you’ve been put off from digging deeper into DeFi by the terrible signal-to-noise ratio of anything crypto-related on the interwebs. That’s why I found this DeFi primer (using Maker DAO as a specific example) by ET contributor and banking analyst Marc Rubinstein to be so fantastic.

The future of remote work after the pandemic ends has been a part of the zeitgeist for more than a year.

Now it IS the zeitgeist. It is also a narrative battlefield being actively conflated with a half dozen other major social and policy topics.

What is Deadly Theatre?

It’s corporate logos for Pride Month. It’s speaking gigs for Deborah Birx. It’s the cover up for Leon Black.

#BITFD

Lemonade (LMND) isn’t just an insurance company. No, no … they’re an AI Company! ™.

Plus Chamath is up to his old tricks.

I hate raccoons.

An ET Pack member sent me this. Anyone else come across ads that directly call out inflation expectations? Would love to collect more screenshots like…

The Bitcoin Is Art thesis that I put out back in 2015 (The Effete Rebellion of Bitcoin) and recently put forward again (In Praise of…

Pack member Rob H. brought this up at last week’s Office Hours, and it deserves its own thread (as well as some attention from The…

I think a homeschooling VMPT is a natural for the ET Forum! On last week’s Office Hours conversation, ET Pack member Dan W. brought this…

This has been a bad week for Bitcoin and Bitcoin! TM alike. There’s no getting around that.

But whenever Paul Krugman and the Wall Street Journal agree on something … I want to be on the other side of that trade!

Mortgages are pretty standard fare in the world of finance, but the American version is special: it grants its user a free option to refinance if they can get a cheaper rate elsewhere.

Every lender thinks they can thrive in this market. But every lender can’t be right.

As a non-American there are many things I don’t understand about America.

Most of all though, I don’t understand the most American of products: the 30-year fixed-rate fully prepayable mortgage.

The Colonial Pipeline embarrassment will accelerate the US gov’t’s efforts to control and co-opt crypto.

Binance, Kraken, BitMEX … they’re all squarely in the wrathful gaze of the Eye of Sauron now.

Over the past four quarters, the United States has generated more wage inflation than at any point over the past 40 years.

This is not an anomaly. This is not a single quarter aberration. A wage-price inflation cycle is here.

I’m not predicting. I’m observing.

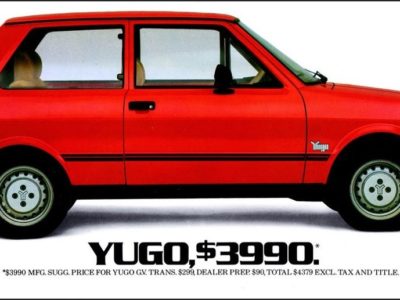

A Honda Accord cost $12,000 in 1990 and it costs $25,000 now.

A Mustang was $9,000 and now it’s $27,000.

The BLS has new car prices close to unchanged over the past 30 years.

ET contributor Brent Donnelly tries to wrap his brain around hedonic adjustments to CPI.

Our weekly digest on what we’re working on …

Including this article from the WSJ: Millions Are Unemployed. Why Can’t Companies Find Workers?

I dunno, if only there were some mechanism by which companies could entice people to work for them. Weird.

Bitcoin has been subverted by the neutering machine of Wall Street and the regulatory panopticon of the US Treasury Dept.

What remains is a constructed narrative that exists in service to Wall Street and Washington rather than in resistance.