All Epsilon Theory Content

Everything we have published at Epsilon Theory since 2013, an archive of more than 1,000 evergreen notes.

If you don’t see that the crypto “industry” has become just as blindingly corrupt, just as oozingly fatuous, just as profoundly captured by the Nudging Oligarchy as the traditional financial services industry it was supposed to replace … well, you’re just not paying attention.

Trading is hard. Your odds of success are heavily influenced by the seat you choose. Retail trader or bank trader or PM, here are metrics to evaluate that seat.

We’ve all fallen victim to a bad retcon at some point in our lives. It’s Sherlock Holmes coming back from the dead. It’s the reveal that an entire season of Dallas was only a dream. It’s the author changing their mind and trying to convince you that it’s all part of the plan. I don’t buy it. And neither should you.

What does your money/happiness curve look like? Is it curved or linear? Does it flatline somewhere? If so, where?

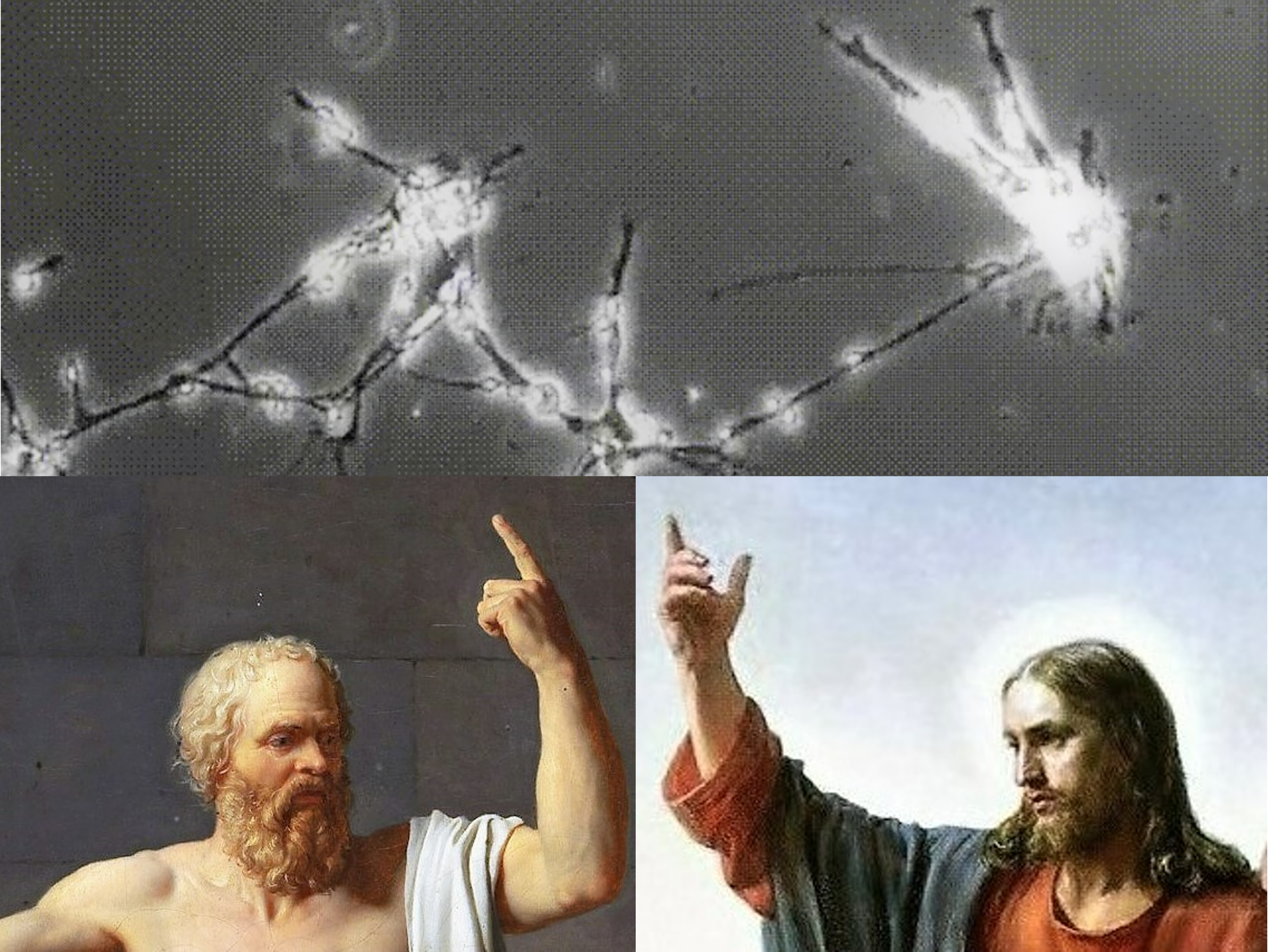

There’s the game of trading and the metagame of life. To win the latter, you have to Know Thyself.

The most damaging stories and narratives are not those that others tell us, but those that we tell ourselves.

In the days leading up to their invasion of Ukraine, Russia successfully mounted a largescale cyberattack on Ukrainian banks, utilities and government agencies. Since then … crickets.

What are the vulnerabilities of Western financial systems to a new and wider attack?

The Big Oil Windfall Profits Tax Act is an abomination. It won’t lower gas prices, it will raise them. And the sponsors of the bill know it.

This bill was not written to become a good law. It was written to tell a good story.

We’ve all felt insecure about our looks at one point or another. Especially in our chronically online world where how you look can be your whole brand. So with plastic surgery rates on the rise, let’s peel back the layers of this industry and see how information (and lies) about procedures spread and examine the real price of beauty.

Using NATO to escalate a shooting war with Russia – either directly through a no-fly zone or indirectly through a Polish cut-out and NATO “backfill” – is exactly what Putin wants. It’s the only thing that can save him. It’s how we ALL lose.

Reckless Drivers! is the dominant narrative for increased traffic deaths in the US. It’s dominant not because it’s true (it’s not), but because it serves the interests of the Nudging State to blame and the Nudging Oligarchy to spend.

in the spirit of the question we are always asking ourselves at Epsilon Theory – WHY AM I READING THIS NOW? – Brent asks a slightly different question about announcements of senior management departures. DOES WHAT I’M READING NOW MATTER?

Someone once said there’s no such thing as bad publicity. With all due respect, this person is an idiot. Publicity, both good and bad, can have major ramifications. Even if you don’t play a part in creating it.

The international “negotiations” over Ukraine are 100% designed for domestic Russian consumption. They are as necessary a part of successfully invading Ukraine as mobilizing troops and tanks.

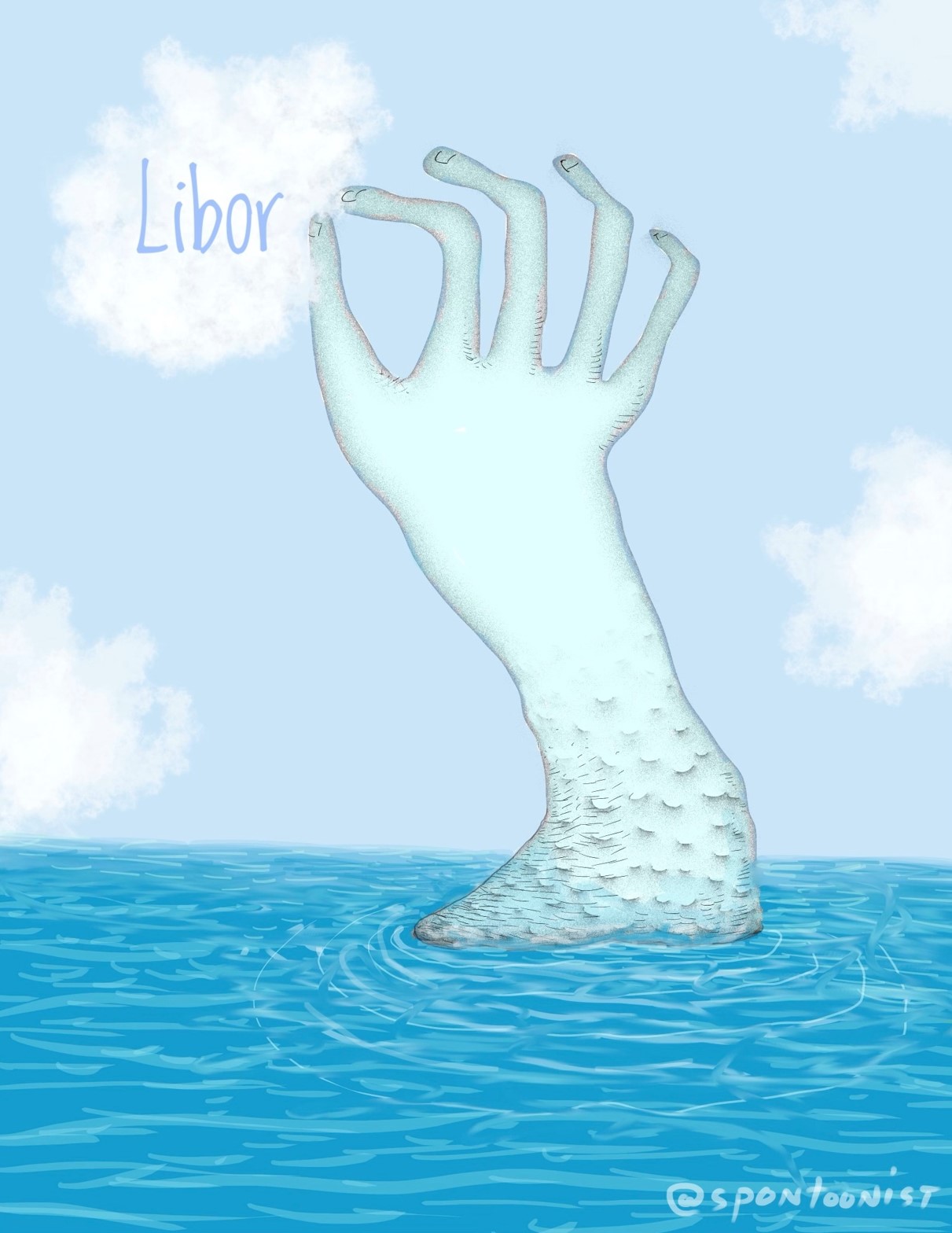

Jonathan Plotkin is a longtime ET reader and brilliant cartoonist. For years he’s been sending Ben illustrations inspired by our notes and we’ve been dying…

Jonathan Plotkin is a longtime ET reader and brilliant cartoonist. For years he’s been sending Ben illustrations inspired by our notes and we’ve been dying…