Today I want to share three things I think I know based on what Radiant, our platform for analyzing the prevalence of various narratives in markets, has been telling us. Then I want to share what I think I think about what that means.

First, what I think I know. And no, I don't think any of this is particularly earth-shattering or controversial.

I think I know that the prevailing structure of central bank narratives is that the Fed can't, shouldn't and won't move away from a dovish posture.

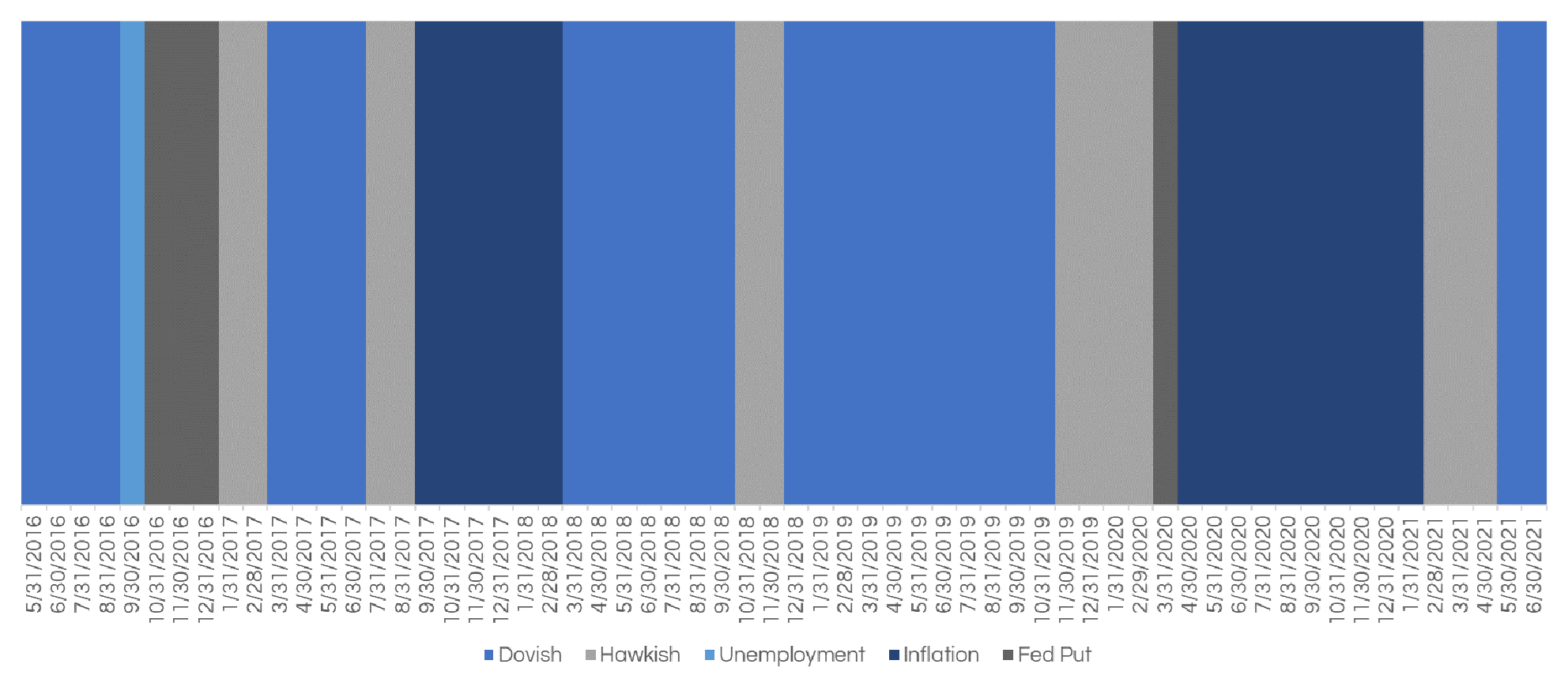

Within financial news coverage of central bank activities and interest rate markets, our models determined that, after a brief flurry of begging for Fed intervention in early 2020, the dominant archetypal language in central bank coverage for most of 2020 was speculative inflation language. Traditional media outlets, the sell side, the buy side and corporate earnings releases which discussed interest rates at all emphasized uncertainty and speculation about potential inflation that might result from aggressive intervention.

That shifted in late 2020 toward a Narrative structure defined less by speculation about inflation and more by speculation about whether hawkish policy would be necessary or whether dovish policy would continue to be feasible. Our judgment was that Common Knowledge tilted away clearly from fears that banks would be forced to intervene in the direction of "inflation is transitory" in mid-April 2021. In other words, we think there's a moderate but generally held belief among investors that other investors and the Fed are betting on transitory inflation. More importantly, we think significant Missionary effort (i.e. effort to shape common knowledge) is being exerted to maintain this narrative.

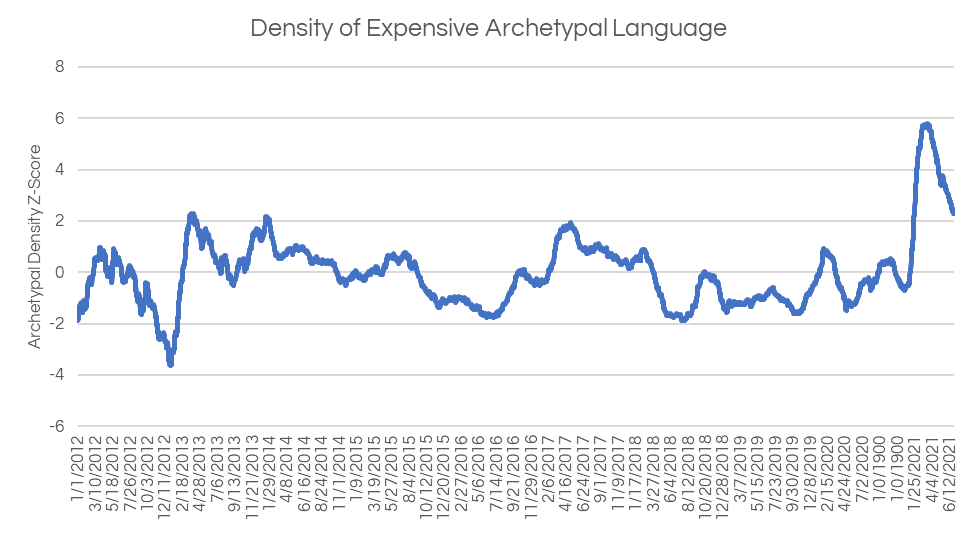

I think I know that the most influential language being used to discuss US markets is less convinced that stocks are overvalued, with an emerging pole of those who believe policy and recovery have created pockets of attractive value. These are both features we think create an asymmetric bias toward more constructive / bullish responses to data.

Linguistic patterns consistent with attempts to create a narrative of the market as expensive or overvalued are still at high levels - apparently the "akshually valuations aren't really historically high, it's just a shift in market cap to sectors that should be more expensive" mafia haven't gotten to everyone just yet. The density of these patterns in financial news, research, press releases and transcripts, however, has also been in a period of rapid descent. More importantly, that descent has taken place during period that has almost perfectly overlapped with the transition of the central bank narrative to the dovish "inflation is transitory" variety observed above.

In short, we observe that low-rates-longer-because-inflation-isn't-really-a-thing stories are demonstrating a pretty strong pro-cyclical relationship with descriptions of how much "value" and "risk" are present in markets. We think, but can't explicitly prove, despite how inherently sensible it is, that this relationship is causal. That is, we think that what everyone thinks everyone else thinks about dovish Fed policy is shaping how they characterize and describe the valuation and riskiness of their own portfolio positions. Accordingly, we tend to think that continued dovish rates and fed policy remains by far the most important market narrative, and the one most sensitive to change.

Interesting. The Fed definitely needs to jawbone markets lower to keep talk about inflation and their impotence to a minimum. Do you think the Fed is conjuring the fake wall of worry to avoid risking crying wolf about being hawkish?

Anyone who has struggled to lose weight knows that the first thing you do is set very realistic, easily achieved goals so you can build momentum at the beginning. Eventually all those little goals, each one surpassed without much suffering, lead to the enormous brick wall that is the basic laws of thermodynamics. That’s when things get hard.

This market just wants to be up. Most participants are long, and ‘stonks never go down’ is waaaay more fun than taking a beating every single quarter, or month, or week, or hour. Delta provided people with just enough of a “sell-off” to allow more people to BTFD. I predict the next “market rout” comes from renewed mask mandates, likely at the Federal level. That’ll be the excuse for a massive, brutal, gut-wrenching 1.3% drawdown that lasts nine hours.

Good article Rusty, makes the market response this week more understandable.

Outside the scope of your points in this article but curious what you and others think of the Fed ( and it’s missionaries) risking their apparently strong credibility with the “inflation is transitory” narrative ?

I.e. if Inflation continues as ugly as it has been does the size of the market fall grow along with the loss of their credibility?

Love this “what we mean by wall of worry is a risk or series of risks that are speciLcally designed by narrative missionaries to be easily climbed.”

Weird that I look at that same quote and get depressed

@chudson : I don’t think it’s really the Fed doing the conjuring, although I’m sure they get how this machinery works.

@Desperate_Yuppie : I feel seen.

@psherman : I don’t think they run much risk to their credibility TBH. I think that at some point, inflation WILL slow, and even if we packed five years of Px increases into the interim, they’ll be able to tell a “transitory” story. Hard for me to see what could really back them into a corner they couldn’t cartoon their way out of.

Rusty,

Until this note, I never thought too hard about the Wall of Worry as I thought I understood it. I get how it works, what I never thought about was that it was intentionally created.

I assumed it was a “real” thing in that the market had real worries and as those faded or were overcome, the market went up. What stupid me never thought was that the Wall itself was created to be overcome (you can never be too cynical, thank you Lily Tomlin).

My questions then are who are and how conscious are the missionaries in building the wall? So, for the Delta variant Wall of Worry, did they (news anchors, Wall St. PMs, Washington officials, others?) intentionally talk up the Delta variant as a risk to markets as they knew, eventually, it would look less bad and the market could then climb the Wall?

As manipulative as this is, you have to hand the missionaries who do this credit for A+ game playing.

Mark, not stupid at all. I think that usage may be the more common, and our interpretation of it simply the more cynical.

That said, I’m not sure that there’s always an explicit and comprehensive design behind an individual wall of worry. Usually there isn’t. I think it is more accurate to say that there is an explicit and comprehensive structuring of the sell side and financial media that benefits from constantly finding single stories for overdetermined outcomes - then talking them down. That is, the editors push a single explanation, then the talking heads spend days dismantling it and showing that it doesn’t justify that level of “sell-off”, and we end up higher than before. The nature of segments, columns and commentary as they exist necessitate the creation of these walls of worry without any specific intent required, and so they’ve become part of the bullish fuel for markets. I think the DESIGN of sell side and financial news to always find a new axe is absolutely conscious and intentional. Which topic becomes that thing is nearly always less so, at least in my opinion.

It also makes the role of the missionary even more important. When the right structure for constantly creating these narratives exists, it doesn’t take many influential voices who do have that conscious intent to create common knowledge.

I believe the only way the market gets bearish here, is if covid and the Delta variant goes away. The Fed has “cover” for staying dovish, probably even continuing QE if the virus surges. Market has proven again and again, that the human element means nothing and liquidity trumps everything. I want to be bearish, trying to find a reason for lower multiples, but we’re just not there yet.

News as a service. A loyal servant. A helpful friend.

“What a large viewer base you have Grandmedia!”

“The better to tell you with” replied the Wolf.