Matt Zeigler is a Managing Director and Private Wealth Advisor with Sunpointe Investments, and he’s been helping people with their money for more than 15 years. He’s also one heck of a writer and publishes an excellent daily (!) note on his Cultish Creative blog and newsletter, which you can subscribe to here.

You can contact Matt at [email protected] and on Twitter at @cultishcreative. As with all of our guest contributors, Matt’s post may not represent the views of Epsilon Theory or Second Foundation Partners, and should not be construed as advice to purchase or sell any security.

6th grade tried to kill me.

It wasn’t just the “new” school, the one 3x as big as the elementary school, with infinitely more older, stronger, and meaner kids. It wasn’t just the administrative computer error, that accidentally took my Z-beginning last name and randomly assigned my classes in a mysterious web that would take months to untangle and fix. And it wasn’t even the self-flooding locker I was assigned, stationed in the basement of the school, next to a busted water fountain that banked a stream of lukewarm water off the concrete wall and into my absorptive books.

No. I wore my Achilles heels like my high-top Chuck Taylors. Only my weakest point wasn’t my Chucks. My kill-spot was literally fashioned just above them. My 6th-grade death wish came in the form of a pair of yellow pants.

Identities are funny things. We act our way into them. I would love to tell you we’re strategically thinking our way into each choice we make, but – we’re not. One moment of weakness in front of a passing crowd of older middle schoolers can slap a label on you so fast you’ll… oh, you’ve been there too? Middle school is a darkly funny place. And if we want to better understand the construct of identity, it’s worth looking back.

My identity, reduced to a pair of hand-me-down yellow jeans, is what tried to kill me in 6th grade.

My identity, expanded beyond a pair of hand-me-down yellow jeans, is what would save me.

BUT, no spoilers. This identity journey is – finally – fun to revisit. And, given how broadly its lessons apply, well, I’ve got a story for you.

It was the beginning of the 6th grade school year and I was lost. Again. The previously mentioned name-biased scheduling error was still unknown to be an error, and I was trying to figure out why I had to travel all over the building to find my classes. Given the 3-minute allotted transition time plus me being hopelessly lost, the halls were quickly emptying.

I rounded a corner and walked into a crowd of 8th graders. Not just any 8th graders either. These were the deliberately-late-to-class cool kids.

“Nice yellow pants, *freak*” (insert snickers and a growing awareness of the attention I was getting).

“Guys, check out the 6th grader.” “What’s he even wearing?” “Oh my god – what a loser.” “He must be one of the new skater kids.” Then, a cry to outside of their clique – “Hey Ryan – is this one of your new LOSER friends?”

Ryan approached from the edge of the circle. He had baggy jeans and slightly purpled hair. He was as textbook early ‘90s skater kid as they come “Nice pants” he said, instantly de-escalating the situation.

The crowd’s boredom set in. They all seemed to sense they were the exact right amount of late to their classes at the same time. The clique fell away as quickly as I had walked into it. “See you around,” Ryan said as the group dissipated. I was back to being alone and lost in a hallway.

I knew I had dodged a bullet. But now I had a bigger problem. Not only was I NOT cool and specifically identified as such, I was definitely, definitively, irrefutably NOT a skater kid. They just didn’t know it yet. Rather, they just hadn’t figured it out yet.

My stomach clenched as I realized I was about to be double-dumped. From mainstream student to alternative “freak” status to… a soggy textbook with no homeroom, rejected by the rejects, in less than 3 weeks flat. Pre-teen death was knocking.

Flash forward 3 decades or so, and I’m thinking about one of the investment industry’s favorite terms: “intrinsic value.” The CFA Institute defines the intrinsic value of an asset as, “its value given a hypothetically complete understanding of the asset’s investment characteristics.” In plain English, it means a thing is worth a complete understanding of all the contributing factors to its identity.

In even simpler terms, an asset is worth its composite actions. Which is great for smiling, happy, cash-flow-producing financial entities. It is not so great for… rocks. Which is why I’m thinking about “intrinsic value” on this particular day – or rather, what feels like a lack of intrinsic value. Because I’m at work trying to answer a person’s question on how much they should allocate to gold given all the craziness in the world.

Gold Bugs will tell you the intrinsic value of gold comes from its scarcity, durability, and historic role as being the last thing of value whenever financial shenanigans have ensued. They’re not “wrong.”But the mainstreaming of gold over the past few decades, from alternative asset with lots of quirks of owning to “there’s an ETF for that” (aka Gold™ as my friend Ben Hunt would call it) – that’s what seems to have killed most of its traditional intrinsic value arguments once and for all.

Gold sold out. Or, gold got sold out. Which is just what happens when something alternative goes mainstream.

The extrinsic value of gold is easier to define these days. The prevalence of exchange-traded gold products means nothing about owning gold feels scarce anymore. You used to need a physical safe to hold your Krugerrands. Now you just need a brokerage account that can buy and sell GLD shares.

Sure, the underlying metal is still durable and the the asset class might even still be a hedge against financial and political instability, but if it’s so easy the E*Trade baby can do it (and that kid must at least be in 6th grade by now), then the times, and the way we think about “the intrinsic value of gold,” have existentially changed.

The actions, the social constructs surrounding them, and most obviously – the sheer technological advancements from mining to storage to trading vehicles – they’re inescapable. They’re the flowback water in which we swim. And not even an identity with thousands of years of history as a store of value is immune to being slapped with a fresh label.

“Think about it this way, the whole portfolio is like an outfit you’re wearing into the future you’re investing for. I’m not saying don’t wear any Kevlar ever, but I am asking how bulletproof you want to be in the specific future you think is coming. It’s your money, so I just need to know how far we’re taking this. Are we wearing just a bulletproof vest? Adding armored pants? Do you want a full-body battle suit?”

“OK, I get it. I’ll think about it more, so let’s hold on the gold allocation for now. But one more question.”

“Shoot.”

“What about crypto?”

When I found my next class, I couldn’t think. All I could do was panic daydream. I thought about the only skateboard I had ever owned and how it was from K-Mart. How it was a toy. But at that moment, while I tried to figure out my impending identity crisis, god did I wish it was something more. Why couldn’t it be a magic skateboard – one with a Tony Hawk genie? He’d snap his fingers and have me gleaming cubes with all the confidence and impeccable hairstyle of a young Christian Slater.

If only.

Extrinsically, my entire value had been reduced to the yellow pants. Without cool-kid jeans, I was a freak. And even with freak-jeans, I still wasn’t a skater.

I played the future scenarios forward in my mind. Ryan would walk up to me outside of school. He’d casually ask where my board was, and it would take him all of 6 seconds to figure out I wasn’t a skater. The same way the cool kids had laughed me off instantaneously, he’d do the same. Only it’d be crueler.

Such is excommunication. Such was my fate. It was already written.

I rode the bus home that afternoon with my buddy Derek. His last name enviously started with a “D.” It meant he had a normal schedule, a single homeroom, and little more to offer me than a, “That sucks. I guess you’re screwed!” The only bright spot was we were on our way to his house to play guitars.

On the bus ride, Derek told me his brother was home to visit. His older brother was a lot older than us. He’d left Pennsylvania for California a few years prior. I didn’t have any older brothers, so their whole relationship felt exotic. Especially because he was A. nice, B. cool, and C. would share his worldly wisdom with us like, well, like a friend’s cool, older brother should.

The bus dropped us near Derek’s house and his brother was outside waiting. As always, he had come bearing gifts. He loved that we were into guitars and music, and his gifts were usually directed at both of those interests. It was 1993. Alternative rock had already gone mainstream with grunge (Alternative Rock™?!), and a new era of punk was about to go mainstream in a matter of months. Nobody knew it yet.

Derek’s brother was in this mystical SoCal punk scene. He’d already introduced us to Green Day, Rancid, Op Ivy, and more. On this trip, knowing Derek and I were increasingly into finding stuff we could play on guitar together, he told us about NOFX.

“They added a really good new guitar player on their last record – so now there’s two guitar parts in these songs. You guys could totally learn how to play these songs together! It’d be sick.”

Cool older brother suggestion? Gold. We acted on his advice immediately.

While we weren’t “good” at guitar, we imitated playing these songs as best we could. We were just two 6th graders, with one blessing of an older brother, playing distorted practice amps next to a cranked-up boombox. And we all agreed – This. Sounded. AWESOME. None of us looked for validation outside of that bedroom. We didn’t need to. We already knew NOFX “got us.” I can still hear the lyrics,

Can’t keep my thoughts from flying ’round

Not sure what I’m thinking about,

I got soul doubt

No doubt, I didn’t have enough clout to be a sellout in the 6th grade, but I did have enough anxiety to know what “soul doubt” meant. Apart from seeing Derek and his brother, my intrinsic value felt like zilch before we picked up our guitars that day. In hindsight, I know his brother sensed something was up. He handed me a ½ inch NOFX pin before I left and said, “Good luck with school. I hated that place. Kids are the worst – it’ll get better eventually. At least you have good tunes to throw on.” “Thanks, man.”

I put the pin on my backpack’s shoulder strap. It did look pretty cool I thought. Cooler than my yellow pants at least. My Dad picked me up in front of his house. I thought to myself, “I guess there’s always California…”

Crypto has become the new Gold. Or, more specifically, Bitcoin™ is the new Gold™. This is what happens when alternatives go mainstream.

Just like the coming wave of punk bands in early ‘94 would storm in like a revolution and fade out into the reality of HOT TOPIC “Anarchy!” t-shirts, the Crypto Bros are having a similar moment in 2024. With the launch of the Bitcoin ETFs, the alt-jig is up. Crypto Bros are fast at risk of becoming our generation’s Gold Bugs.

And I’m worried about them. It’s a little sad to see them get sold out. It’s hard to see the Franklin Funds laser eyes promos online, all in the name of selling Bitcoin ETFs. I’m genuinely worried about the Crypto Bros. They used to be weird, but more importantly, they used to be fun.

When NFTs and s***coins and apes ruled the COVID-days, it felt like a scene. The identity was in the action. The action didn’t always make sense, but an alternative scene never does. It was community reinforced by quirkiness, and that’s kind of all that matters. The OG Crypto Bros wore Decentralized Finance like a badge of honor. It was their skateboards and band buttons – and even the cool kids recognized it.

The cool older kids – in this case, the Traditional Finance crowd – were always watching. What does the mainstream do when the alternative scene gets too cool to ignore? It absorbs it.

Every. Single. Time.

The same way GLD took the scarcity away from gold and brought Gold Bug off-grid prepper sensibilities to the always online Robinhood class, the Bitcoin ETFs have catalyzed the Bitcoin Bros into a Blockchain or Die! halfpipe of hopeless hopefulness.

It’s never really about the music, it’s always about what happens to the music scene. Bitcoin pre- and post-2024 feels like Greenday pre- and post-1994. Selling out is about an identity being perceived to be purchasable. The ghost of the old scene is stolen away in the name of new business lines. But the spirit of the old scene, it doesn’t have to die, it just has to transform.

Death and (re)birth. They go hand in hand. Everywhere and always.

This is the good news. Crypto isn’t all dead. It’s mostly dead, which means it’s slightly alive. Gold and Gold™ are still out there, just like there are still punk bands on the fringes and on the charts. It all just has to transform.

And the real news is Bitcoin™ can never, ever, under any circumstance be DeFi, because Bitcoin™ is definitionally TradFi.

Such is selling out. Such is being sold out. And if you don’t transform, it can get dark.

Institutional allocators can now put a Bitcoin position on, or take it off, without any concern for digital wallets, gas fees, or any special knowledge. Clients can now ask advisors, after a whimsical potential gold allocation question invariably tied to Election ‘24, “If not gold, then what about Bitcoin?”

Ladies and gentlemen, TradFi HOT TOPIC is open for business, and they have your old favorite band’s t-shirts on sale.

Ryan and his friends saw me get off the bus, outside of school but still very much at a bus stop, just before the school day started. I had 100 yards between me and relative safety. This would be my trial. Ryan would be my judge. About 7 other kids, lurking behind him – all bigger, all older, all cooler – they would be my jury.

I was alone. No Derek, not on my bus. This morning, it was just me and them.

Ryan called out, “Hey, you’re the kid from the hall – with the yellow pants.” “Yeah,” I swallowed hard. Proving time.

“So, you skate, or something?”

“Uhh, not really, actually…” This was not going well. I looked at the ground and awaited the sting of being pronounced excommunicado.

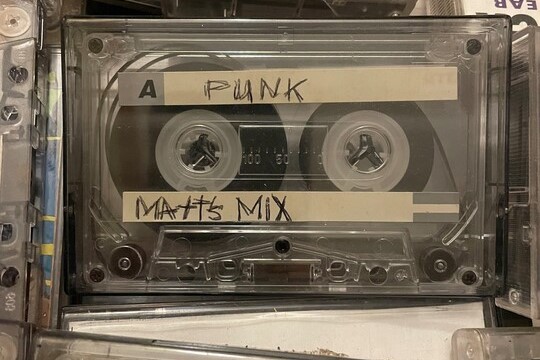

“Oh man, is that a NOFX pin?” Another kid, behind Ryan, had suddenly perked up. “You know them? What are you, in like, 6th grade?!”

The NOFX pin glimmered on the hunch of my shoulder. 4 simple block letters on a half-inch pin. And they were louder than my yellow jeans.

“Yeah. They’re cool. I have a couple of their albums. My friend’s brother lives in California. He’s seen them live – and he got me this pin.”

“Dude, that’s so cool. Which albums – wait, if I give you some blanks, could you copy them for me?” Remember, in the early 90s, cassettes were still a form of currency. With tape and CD prices on the rise, if you could distribute physical copies to your friends in a pre-internet world, you had power. I had power.

The bell rang. The crowd of us drifted towards the front of the school, together. I wasn’t out. I was more than a pair of yellow pants. “What’s your name, freak?”

“I’m Matt.”

“Cool. I’ll find you later. And we’ll bring you tapes! Can’t believe there’s a new kid who knows NOFX. How awesome is that? Look for us at lunch.”

I wasn’t sold out. I didn’t have soul doubt anymore either. I didn’t skate but – they didn’t care. I was transformed. All because the skaters didn’t only care about skating. How?! Did it even matter?

If intrinsic value is driven by a hypothetically complete understanding of an asset’s qualities, then the more qualities an asset has, the more the “value” of that asset is up for discussion.

If everything can be extrinsically reduced into one quality, i.e. “supply scarcity and idiot central bankers are why this is everything!,” which you probably recognize as the reductionist arguments of doomer Gold Bugs and maximalist Crypto Bros, then intrinsic value ceases to exist.

These asset classes don’t have any intrinsic value because they don’t have cash flows. There’s way more than a dismissive Berkshire cool kid handwave going on here. These asset classes don’t have any clear intrinsic value because there’s nothing left to discuss.

Price becomes all that matters. And price is determined by flows. The entire investment thesis ends up hinging on whatever dollar amounts are flowing in or out of the most “liquid” vehicles for these asset classes at any point in time. The magic of “products” is little more than the capitalist math of commoditization. It happens every time art moves from “alternative” to “mainstream.”

One story to rule them all. Gold™ . Bitcoin™. Alterative Music™. It’s a product with flow you can charge management fees on and sell ad space around. Welcome to HOT TOPIC. Where anarchy isn’t a philosophy, it’s what’s for sale.

BUT WAIT, THERE’S MORE! There’s more than this crap. There’s hope.

So your scene got sold out. You don’t have to sell out too. You get to choose. You can choose to stay the same and daydream about a future where you’re proven “right,” OR, you can choose to take action and transform. New alternative scenes are springing up all of the time. They’re built with the spirits of scenes past, binding communities around Big Meaning instead of Big Business™.

I’ll start with gold. Gold Bugs! If you made it this far – here’s some freshly panned nuggets: YES, gold has been a reliable store of value over the millennia, and YES, some central banks continue to buy it in record amounts to hedge geopolitical risks in this very millennia, BUT ALSO, let’s not forget – YES, gold has an incredible personal side too.

In the past year, I’ve purchased rings for our engagement and wedding. We found a local vendor to make them. Totally custom. Using physical gold, not some Gold™ product. The rings are art. And there’s only one place to buy these bespoke rings, from one particular artist. Non-scary scarcity – it’s a real (and profitable) thing.

If you want to find the real intrinsic value of gold (and not Gold™), start by looking at the cottage industries. It’s not so much a financial allocation, although the rings certainly did cost money. But it is a story-of-my-life allocation, which is a different kind of valuable.

It didn’t take the end of the world to make our engagement and wedding rings have “worth.” It didn’t take a Gold Bug pitching us. It took us looking for an artist who could help give our relationship an important layer of meaning.

Crypto – we’ll do you next. Crypto Bros! And all crypto, including the DeFi folks, HODLers, and whoever else is in your orbit. Maybe the battle is lost for Bitcoin at the highest level. But remember how deliciously weird you all got a few years ago? Blockchain doesn’t have to be dead. Smart contracts still seem like a cool idea, and they still aren’t everywhere or hardly anywhere (yet). Those goofy NFTs and s***coins – they weren’t all good ideas, but they weren’t all bad either.

Take your lesson from the gold story above – hot topics can exist without HOT TOPIC. Intrinsic value is about a diversity of actions. These are identities that contain multitudes. These are punk rock bands that refuse to sell out. These are ideas of the people, not ideas being soullessly sold to the people.

Middle school was a hard transition. I eventually got my schedule worked out. I even got my locker switched and was assigned a permanent homeroom. And I did it all in time to – get this – switch schools again in 7th grade when my mom got a job at a private school across town.

Death and rebirth. Labels and identities. Transformations.

This is why the lesson of the yellow pants stays with me.

Life is about uncertainty. It’s about how uncertainty creates multiple perspectives on who we are and what we’re curious about at different points in time. Past, present, and future. And uncertainty can feel like soul doubt, especially when our values are called into question – but the beauty of living is we get to keep figuring it out. Past, present, and futures.

I once had a pair of hand-me-down pants I thought were cool. And I also had a guitar, and a NOFX pin, and friends, and family, and – I still let getting called a “freak” make all those other details blind to me. Nobody is immune to getting slapped with a label. It’s why sharing stories about how we’ve survived being labeled matters.

Reject the narrowness of extrinsic labels. Resist the commoditization of identity. Reject the Big Business™ crowd as much as you can, and join as many Big Meaning scenes as it takes to fill your heart. Be a freak. Because I’m here to remind you – it’s freakin’ awesome.

We are all intrinsically valuable when we stay full of actions. It’s our future. And it’s not for sale.

Ps. Special thanks to Ben for helping me think through some of this on Breaking News in our “Harvard Material” episode, and for sharing so many of the Epsilon Theory pieces exploring the “Yay” and “™” and “Flow” ideas present here. Extra special thanks to Scott and Val for their help editing this idea into an essay with me. Bonus gratitude to Herminia Ibarra’s book, “Working Identity,” which has thoroughly kicked my butt into a new dimension on these topics too.

Pss. If you need any musical accompaniment for this piece, might I suggest “Anarchy For Sale” by Dead Kennedys, “Soul Doubt” by NOFX, and “Personality Crisis” by the New York Dolls. These were all stuck in my head while I was writing this. If you can think of more related songs, get in touch, because if any piece deserves a playlist, it’s this one.

-Matt

Just a quick note while I’m listening to NOFX for the first time in my life, now it’s “the idiots are taking over”.

Wonderfully entertaining and informative note, like your “breaking news” summaries.

Pure gold NOTM, and no goal doubt

thanks Rob!

And that’s not even my favorite NOFX song (but it sure was fitting). If you’ve got anything else to add to the “inspired by playlist” - do send it along.

Matt, thanks for sharing that was a great read! Whenever I hear the hard core bitcoin or gold theses I always think back to Ben’s Three Body Problem note from some time ago. Sure there is a role for assets like these to play in modern society but don’t ever fool yourselves thinking anyone one thing is the “A”nswer as that creates an ideology which crowds out wisdom.

As an aside there’s a very interesting narrative battle going on in Bitcoin with the recent ordinals phenomenon. I’m less interested in the technical ramifications of this debate and more interested in the potential narrative ramifications. This was one of the most fascinating bitcoin conversations I’d heard in years. Well worth your time if anyone is interested in such topics.

https://youtu.be/YqDkuIsgfY0?si=URrNIuGDhcp3hJ8t

@MZeigler3 It’s so wild to me how similar our stories are, at least in terms of music and culture and how they shaped our formative years. I’m maybe a year older than you so the two pre Dookie albums Green Day put out (to little attention outside the East Bay) hit me starting in 7th grade with Op Ivy coming along in my life my freshman year of high school. I still remember being haunted by this line in Knowledge:

Whatcha gonna do with yourself

Boy better make up your mind

Whatcha gonna do with yourself

You’re running outta time

Imagine being 14 and feeling like that is what was speaking to you. I didn’t have the intellectual capacity at the time to understand it, but that was my moment where I realized the future was not a promise but a threat.

As the resident bass player I had the impossible task of trying to learn how to play Rancid songs in the band I was in. For those who are unaware Rancid’s guitar and drum tracks were pretty simple and didn’t take a ton to master, especially not for my friends who had been playing for years. But the bass parts are…look, their bass player Matt Freeman is a fucking virtuoso. Here’s a YouTube guy playing his top ten favorite Rancid baselines (skip to 1:30).

The number one is a song called ‘Journey to the End of the East Bay’. This was a song we played. Live. In front of people. People I knew, including girls. Girls who I would not have minded impressing. That is a lot of pressure to put on someone who had been playing for less than a year and had serious self esteem issues. The first 18 seconds are just the bass intro with a little guitar feedback. There’s no hiding out behind the drums. No vocals to cover your tracks. No wailing power chords to conceal any errors. Playing music live and wrestling both taught me the same lesson: you have no idea how long 18 seconds can actually be.

Here’s what the full song sounds like: https://www.youtube.com/watch?v=XM5VohknC2U

It’s actually a great biographical story about Freeman and his experience with poverty and how chasing his dream lead him to being homeless and then eventually finding like minded friends who shared his dreams of punk rock and little else. 29 years later and I still get chills when I hear that intro.

thanks so much Brian! And especially for this link. When I was working on this piece I was trying really hard to stay out of these sub-battles/intra-scene-identities. Not because they don’t matter, but because - well, like with music, there’s just so much going on and never enough time (!).

I see the Three Body Problem in this one too. I especially see @rguinn’s follow-on piece comment, You don’t have to be French to drink their wine, y’all. Being part of the Epsilon Theory pack doesn’t mean buying into narratives. It means understanding that in a market, if it matters to someone, it should matter to everyone. And narratives matter to a whole lot of someones.

This is what and why we’re here!

I am pretty sure I wrote this essay mostly to hear stories like this from people like you. Incredible. More importantly, beautiful. I get the “Journey to End of the East Bay” sentiment so hard. Both in how long 18 seconds can be when you’re on a stage, and in the “these are the stories of our people.” Not to mention these songs are always stuck in my head still, if not just stuck in my heart.

Bonus points: Tim Armstrong’s lyrics on “Among the Dead” - he’s still thinking of those formative years. Most importantly, he’s still preaching that even from “among the dead, we will rise.”

Lovely. I went through the first revolution. While reading, I’m hearing New Rose because I was Damned Damned Damned…

Damn @MZeigler3 (and I say this with love), no thanks for the flashback to middle school! It was truly awful, wasn’t it? I don’t think I have any life lessons from that time, other than try not to let anyone throw gum in your hair in art class, lol.

The song I’m hearing during this is “Midlife Crisis” by Faith No More, which seems a bit incongruous given the title, but I think those dudes were in their 20s when they wrote it so perhaps it fits.

Thanks so much Britton. And, Damned in truest essence of '77 too, but what a revolution to live through. I’m going to be saying, “Is she really going out with him?” all day.

Thanks Tanya! Sorry for any future therapist bills, but I’m truly glad to hear your hair has stayed gum-free. “Midlife Crisis” is a great add. Not just because it’s so 1992, but - this Mike Patton quote on the song (denying it’s about having a midlife crisis, and instead saying), “it’s more about creating false emotion, being emotional, dwelling on your emotions and in a sense - inventing them.” I think he’d be ok with us adding, “or allowing others to incept them for you.”

ps. I remember seeing this video all of the time