Author’s note: I’m trying something a little different in today’s note. I’m

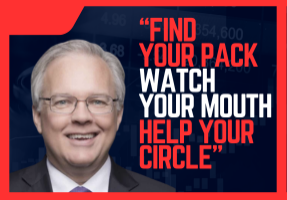

ChaChaCha!

To learn more about Epsilon Theory and be notified when we release new content sign up here. You’ll receive an email every week and your information will never be shared with anyone else.

Continue the discussion at the Epsilon Theory Forum

The Latest From Epsilon Theory

DISCLOSURES

This commentary is being provided to you as general information only and should not be taken as investment advice. The opinions expressed in these materials represent the personal views of the author(s). It is not investment research or a research recommendation, as it does not constitute substantive research or analysis. Any action that you take as a result of information contained in this document is ultimately your responsibility. Epsilon Theory will not accept liability for any loss or damage, including without limitation to any loss of profit, which may arise directly or indirectly from use of or reliance on such information. Consult your investment advisor before making any investment decisions. It must be noted, that no one can accurately predict the future of the market with certainty or guarantee future investment performance. Past performance is not a guarantee of future results. Statements in this communication are forward-looking statements. The forward-looking statements and other views expressed herein are as of the date of this publication. Actual future results or occurrences may differ significantly from those anticipated in any forward-looking statements, and there is no guarantee that any predictions will come to pass. The views expressed herein are subject to change at any time, due to numerous market and other factors. Epsilon Theory disclaims any obligation to update publicly or revise any forward-looking statements or views expressed herein. This information is neither an offer to sell nor a solicitation of any offer to buy any securities. This commentary has been prepared without regard to the individual financial circumstances and objectives of persons who receive it. Epsilon Theory recommends that investors independently evaluate particular investments and strategies, and encourages investors to seek the advice of a financial advisor. The appropriateness of a particular investment or strategy will depend on an investor’s individual circumstances and objectives.

This commentary is being provided to you as general information only and should not be taken as investment advice. The opinions expressed in these materials represent the personal views of the author(s). It is not investment research or a research recommendation, as it does not constitute substantive research or analysis. Any action that you take as a result of information contained in this document is ultimately your responsibility. Epsilon Theory will not accept liability for any loss or damage, including without limitation to any loss of profit, which may arise directly or indirectly from use of or reliance on such information. Consult your investment advisor before making any investment decisions. It must be noted, that no one can accurately predict the future of the market with certainty or guarantee future investment performance. Past performance is not a guarantee of future results. Statements in this communication are forward-looking statements. The forward-looking statements and other views expressed herein are as of the date of this publication. Actual future results or occurrences may differ significantly from those anticipated in any forward-looking statements, and there is no guarantee that any predictions will come to pass. The views expressed herein are subject to change at any time, due to numerous market and other factors. Epsilon Theory disclaims any obligation to update publicly or revise any forward-looking statements or views expressed herein. This information is neither an offer to sell nor a solicitation of any offer to buy any securities. This commentary has been prepared without regard to the individual financial circumstances and objectives of persons who receive it. Epsilon Theory recommends that investors independently evaluate particular investments and strategies, and encourages investors to seek the advice of a financial advisor. The appropriateness of a particular investment or strategy will depend on an investor’s individual circumstances and objectives.

Ben, never considered this, but how do direct option purchases other than grants show up for Insiders? I was just thinking, as many SEC filings as I’ve read, can’t remember seeing a Form 4 with regard to direct option purchases.

I would wager that cha-cha-cha played the Delta game with more than 50% of all MEME stocks, with out-of-the-money call options. He announced it regarding GME, tweeted it out on several others 1Q 2021.

Keep exercising those financial analyst skills! Ben has asked on the Forum what are the most powerful ways to tell the stories that need telling. Seeing posts like this, that just state the facts, rank way up there for impact. Not every bit of skullduggery is as cut and dried and has the facts at hand to point out for those with the skill to do it. Glad to have Ben’s keen eye looking out for the Pack.

That’s a great question, Carl. My sense is that when options are used in this manner (cough, cough, Elon), it’s through cut-outs like a friendly HF.

Good reporting. Thank you. Nothing to see here, move on. Much like…

Does SPCE ever become a buy henceforth?

I was early money on the MRNA insider selling. For a while it was as smart and as productive as pissing into the wind. Nobody cared. Moar jabs. NGU. Now that it’s come down to earth people have started to notice.

I’d have to look at their cash position before I’d even hazard a guess. Looks like they’re totally focused on the “near space tourism opportunity”, and that strikes me as a long slog under the best of circumstances.

How many $400,000 tickets can you really sell? At least SpaceX is focused on commodity space freighting, not hauling the sons of oligarchs and lottery winners to the Karman line.

Looks like someone was paying attention or read your note.

I should have read this thread before getting involved with Cha Cha Cha! After watching ChaCha on CNBC, I thought this guy was a genius, and bought IPOC which turned into Clover Health. Then I realized I had been had so I converted my IPOC to OpenDoor, another ChaCha SPAC. Now, I’m going to ride these 'investments down to the ground" just like my first investment: Coleco. No pain, no gain!