Dave Nadig has forgotten more about market structure than I will ever know. He co-founded Cerulli Associates in the early 1990s, went on to be Managing Director at Wells Fargo Nikko before selling the firm to Barclays to form BGI, before THAT got bought to become Blackrock/iShares as it exists today. In the early 2000s Dave joined what would become ETF.com, where he helped build their ETF Data and Analytics business which was sold to FactSet in 2017 or so. Most recently Dave was part of the team that formed and sold VettaFi to the TMX group from 2020 to 2023. Dave is currently an “independent financial futurist” and will tell you what that means as soon as he figures it out!

Dave writes an excellent substack called Echo Beach where you can read this note and many others. You can contact Dave at [email protected] and on Twitter at @DaveNadig. As with all of our guest contributors, Dave’s post may not represent the views of Epsilon Theory or Second Foundation Partners, and should not be construed as advice to purchase or sell any security.

This is not a post about whether bitcoin will go up or down.

This is not a post about whether bitcoin “works” or not.

I will beg, constant reader, that you grant me some basic bona fides in the crypto space. I have read all of the original foundational documents and most of the additional information that has come out in things like the no-Wright-isn’t-Satoshi trial. I have run Bitcoin and Ethereum nodes, written smart contracts, minted and purchased NFTs, traded various silly alt-coins, and played around with both US and internationally-based DeFi protocols (before FTX blew most of the fun ones up). Heck, as far as I know I’m the only one teasing out 10bps ineffeciencies in the ETFs.

Assume “I Get It.” As always, my big questions are about the “… and thus” of it all.

#Winning

$11 billion in new flows, to an AUM pushing $30b in two months. That’s a lot eh? Following the daily flows and trading in the 10 products is now a cottage industry. Folks like Scott Melker (who writes the best crypto Substack, The Wolf Den) have spent the last 4 years getting very smart about ETFs to match their smarts on Crypto. Meanwhile, folks like Bloomberg have gotten very smart about Crypto.

BTC market cap is about $1.5 Trillion, vs about $45T for the S&P 500, or $50T for the U.S. bond market, or $120T for commodities, of which about $13T is gold. This makes Bitcoin absolutely a meaningful asset class, and the ETFs have worked, essentially, perfectly, despite me spending a month trying to find cracks in the sidewalk.

So, mission accomplished. Price will go up. Price will go down. Now what?

Psychological Commodities

The challenge in figuring out “what comes next” is that bitcoin doesn’t exist.

Bitcoin is, of course, a digital fiction created in code and is currently the most valuable psych experiment in the world. Bitcoin, like Gold, is fundamentally a psychological commodity. Psychological commodities are extremely cool and there are surprisingly few of them.

A psychological commodity is an asset whose value is solely and completely determined by others’ willingness to pay a specific price. Most luxury and intangible values are inherently bolstered by their status as psychological commodities: Louis XIII doesn’t affect the human body differently than cooking wine, and “goodwill” is greatest the accounting slop-bucket of all time.

This is cool! After all, in a very real sense anything we ascribe value to above the bottom of Maslow’s hierarchy of needs is largely a collective fiction we all agree on.

We, people of the planet, have decided on a ruleset to manage planetary resources. We tend to forget this most of time, until the rules get broken: Russia just decides it wants to own Ukraine again. Then a whole other set of rules we may or may not choose to follow – those covering international conflict – come in to play.

Ordered society is fundamentally based on these psychological fictions, so I actually think it’s very cool that certain clearly non-utile assets, like art, or Bitcoin, or Gold, have been ascribed value. Think how monochromatic the world would be if it were any other way!

So calling bitcoin a psychological commodity is in no way a diss. But it is true. There is no floor bitcoin based on some rational Book value, nor is there some Ceiling other than global economic domination. Bitcoin’s dollar-value (or euro-value, or oil-value) at any level requires that there are others willing to exchange at that value, period.

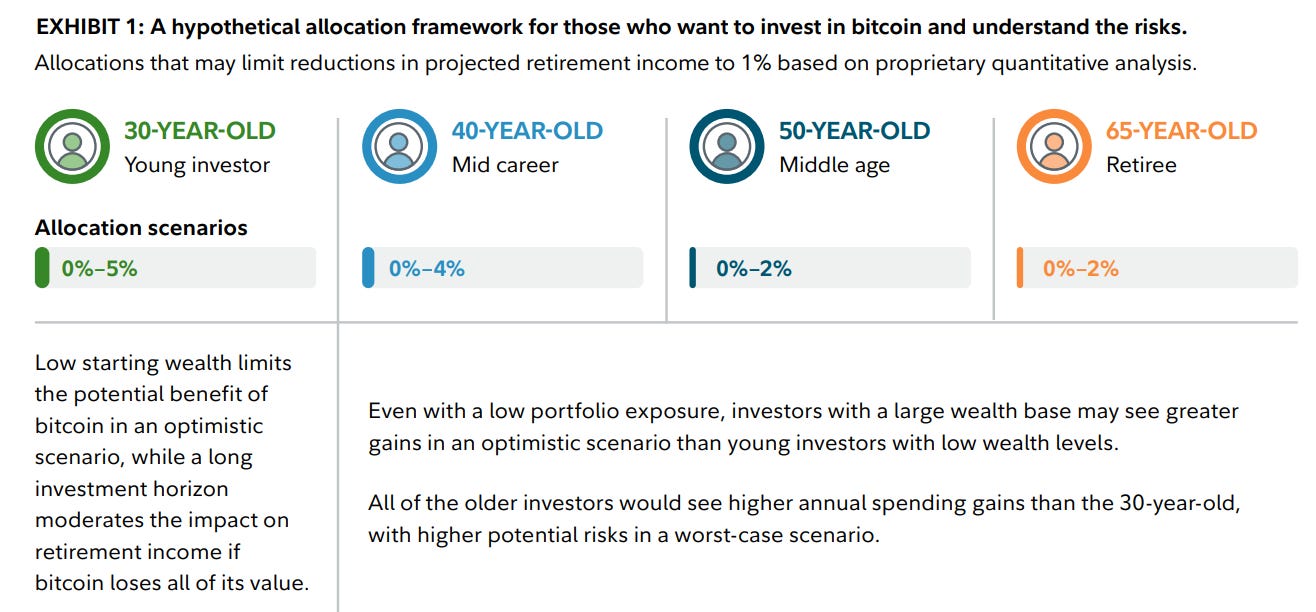

How then, do we deal with this next phase of the Bitcoin story, where every asset manager is now promoting it as a portfolio asset in some version of this chart (from Fidelity):

As I see it they are basically two end states for bitcoin.

The Bullest Case for BTC is Awful for Humanity

If one version of the techno-optimist/Fiat-is-a-crime/taxation-is-theft maxi-credo is right, then global fiat-based economic systems will spiral into a cycle of inflation and bad policy that is net-impoverishing and rife with social unrest. Those who put power-reserves (i.e. – excess capital) outside that system are metaphorically moving their chests full of shiny rocks to some island to wait out the chaos. In even a middling version of this scenario (which plenty are arguing is the now), then there is a massive wealth transfer

FROM: the late-and-slow large pools of Fiat in the world (mostly the assets of governments {those would be *our* assets} and massive institutions).

TO: crypto enthusiasts who got in early enough.

12 years ago an analyst on the team (who I will call Bob) had pocketed a handful of BTC at movie ticket prices. Assuming that they HODLd, they are now on paper worth $1 million where before they were worth nothing. That million dollars “came from” people who just bought in at $72,000 — because that’s what sets a price: a recent transaction on the tape. If they liquidate back to dollars, Bob’s windfall is a very real and tangible transfer of power.

But importantly for Bob to DO anything with that power — buy a car, donate to a politician, feed the homeless — they need to sell some bitcoin get something that will be used for a medium of exchange – the dollar (or whatever). So unless the ONLY thing Bob cares about, for the rest of their lives, is accumulation of value in a ledger, someday they have to sell some to gain real-world power, or a Lamborghini.

Who’s buying so Bob gets his Lambo or Politician? Folks who are now just jumping on the bandwagon in ETFs. Whether those people are “greater fools” I will let you decide.

Moving back to 30,000 feet: this is a transfer of economic power from two classes: slow hyperagents – those who currently bend the global ruleset around them, and average joes now “participating” because folks like Fido are Nudging. That power is transferred to a new class – early crypto natives). Early crypto natives become the new “elite,” who, on moving back into the fiat world, arrive with the pocketbooks to be hyperagents, dominating politics, dictating policy and accelerating the slide into corporate oligopoly.

In this “hard money wins” world, the suffering implied for the rest of humanity — those folks who basically work for a wage, pay taxes, and spend most of what they earn — is immense. It is, frankly, Argentina on a bad day for most of us.

The Bubble Case isn’t Great

So what’s the second possible outcome? The naive and hopeful getting rugged.

Great article, and unfortunately the scenarios you lay out of the consequences of $1m Bitcoin do seem plausible. But might there be a different – more hopeful - possibility that a surging Bitcoin price could act as a sort of modern day ‘bond vigilante’ that signals to Team Elite that it really does need to make some changes, impose some constraints, etc? So Bitcoin doesn’t reach $1m, but the fear of god (satoshi? ) that it puts into Team Elite as it keeps rising higher forces changes that lead to not only needed structural change, but also a lower Bitcoin price as its ‘Govt/Central Bank disaster insurance’ use case becomes less useful. The probability of this may be low, as Team Elite is more likely to act out of vengeance towards ‘outsider’ Bitcoin in a way that they wouldn’t to the ‘insider’ bond market, but…

) that it puts into Team Elite as it keeps rising higher forces changes that lead to not only needed structural change, but also a lower Bitcoin price as its ‘Govt/Central Bank disaster insurance’ use case becomes less useful. The probability of this may be low, as Team Elite is more likely to act out of vengeance towards ‘outsider’ Bitcoin in a way that they wouldn’t to the ‘insider’ bond market, but…

And while you focus on the hyper success of Bitcoin possibly leading to an even more entrenched Big Tech oligopoly (Option B), it is worth mentioning the narrative (expressed well by Chris Dixon in his new book Read, Write, Own) that what crypto (crypto, NOT Bitcoin) is trying to build and can build is a future digital economy that is not dominated by Big Tech, but that instead decentralizes power and control over data and the internet to users. The hope is that this can be an arrow aimed at the heart of Oligopoly. Too good to be true, or too unrealistic? Maybe, and this stuff is still very theoretical and frustratingly slow to take off. But this is a very different and much more hopeful vision than the ‘Bitcoin is the one hard money to rule them all and I, the early Bitcoin adopter, will rule in our dystopic future’ vision.

Looking forward to discussing all of this in person at Epsilon Connect!

I want to caveat what I write next with the fact that I respect Dave’s deep knowledge of all things ETFs, and his willingness to go deep in the topic before voicing a strong opinion. Even as I think that many of the areas mentioned (ETH, smart contracts, NFTs and alt-coins) are irrelevant when what follows is an argument against the ascent of BTC alone.

I also have a couple of observations about the merits of his arguments that I think anyone reading this should keep in mind.

First of all, I personally believe that there is plenty to discuss about what this world will look like if the most hardened Bitcoin-maxis out there are correct about the end game scenario of our current economic system. So many valid points are ripe for the making along the lines of “be careful what you wish for” and so many strongly held beliefs among many Bitcoin-enthusiasts are, frankly, based on ignorance about the system we currently live in.

But Dave loses me right away when he attempts to label Bitcoin proponents overall as belonging to the fairly radical “techno-optimist/Fiat-is-a-crime/taxation-is-theft maxi” cohort of the Bitcoin universe. Perhaps this is the failings of hanging out on Twitter/X and believing that the loudest voices there are somehow representative.

There are plenty of people holding Bitcoin who are not hardened techno-optimists, who don’t believe that the the current system of fiat currencies represent a crime (however much we worry about the state of it) and certainly don’t consider all taxation to be theft. I am sure that Dave knows this, which is why I think it is disingenuous to use this red herring as a basis for the scaremongering argument that followed. Essentially, that “these are the crazy people who are coming for OUR money - imagine what that scenario will look like!”

However much I agree that the Bitcoin space (don’t even get me started on “crypto” in general (lumping BTC in with crypto is a separate powerful red herring…) has its fair share of “radicals” - it takes a real leap of paranoia to frame the issue of fiat versus BTC as a battle between a new elite of “crazy techno-optimists” versus salt-of-the-earth/ "work for a wage, pay taxes, and spend most of what they earn " people… If anything, this framing has it up side down!

From where I am sitting, it is the current system that does not care about people who work hard for their wage, pay their taxes and end up spending almost everything they have! If BTC lives up to its promise, it will be the savings technology that helps end the current madness, all the speculative investing (frankly gambling) that people who never aspired to be investors or speculators have been forced to engage in - just to be able to maintain the value of the money into retirement…

My own completely unfounded assertion, based on purely anecdotal personal experience since 2015 is that for every crazy number-go-up BTC holder, there are two others (possibly more) - carefully allocating a modest portion of their earnings in fiat currencies into BTC in the hope that it will allow it to maintain its value (and hopefully a little bit more) into the future. Personally, I have never sold Bitcoin - only purchased it - and at a modest level. If the notion of that qualifies as being “awful for humanity” then I don’t know what to say…

Moving on to the second scenario (in this artificial framing of only two different scenarios…) I am inclined to agree with the view that many will be hurt during the ascent of BTC. as money (as store of value, medium of exchange and unit of account). If you buy BTC today, without the ability to hold steady while it spikes, halves, makes new ATH and then halves again…well then BTC will not be a good fit for you. Neither are penny stocks, derivatives or any number of other readily available gambling opportunities. As Dave writes, gambling is the rational response of the dispossessed. If I disagree with something here it would be the backwards logic that everything that is gambled on by the dispossessed is by nature harmful.

Finally, I disagree deeply with the overall idea that we are looking at a world that pits early adopters of BTC against the current hyper-agents, rather than the alternative and less black and white way of thinking about this. Which is that BTC, with its PofW protocol, scarcity and decentralisation is not so much a shiny island to reside on, as it is a corrective force for the current system.

It has the power to create a course-correction for a system that would otherwise struggle to make the really tough decisions. BTC is not “out to destroy” the world as we know it, it wants to bring about a renaissance!

Alex Gladstein, Chief Strategy Officer at the Human Rights Foundation, wrote the following as part of the foreword in a very interesting book called “Bitcoin is Venice”:

Like I said in the beginning of this reply, I am very interested in nuanced discussion about what the slow or sudden breakdown of our current system will look like and how we go about making it as undramatic as possible. I absolutely agree that a meaningful portion of Bitcoin enthusiasts are blissfully ignorant of what they are cheering for. But those people’s ignorance and general lack of appeal is not, in my opinion, a very good argument against Bitcoin.

I agree completely that HODLing is a terrible basis for social mobility and I remain disappointed at the lack of serious applications built on BTC and ETH.

Still, what I can’t shake is the sense that its our current elites that are fueling the growing valuation of BTC and ETH because of misguided fiscal and monetary policies. Right now, BTC seems like a reasonable hedge against elite mismanagement and greed.

We all know that the pie is shrinking - that nominal wealth and actual wealth need to shrink their yawning chasm.

It’s our current elites that have given us sports gambling, payment for order flow and Zero DTEs. HODLing a little BTC and ETH seem like trivial crimes in comparison.

Our economics has been conditioned to thinking soft money good, hard money bad. It forgets that a very good majority of modern Western history was built on hard money (as defined by pegging state- and bank issued money to money with a naturally constrained supply.)

While transitioning from soft to hard money will probably be quite painful for many, not doing so seems only to delay and make the outcome even worse.

I’m reminded of Hugo Stinnes (Hugo Stinnes - Wikipedia). The ‘money quote’:

“Stinnes used his access to hard foreign currency during the period of inflation in the Weimar Republic to borrow vast sums in Reichsmark, repaying the loans with nearly worthless currency later. This earned him the title of “Inflationskönig” (Inflation King)”.

I’m concerned a future Wikipedia may say

“Saylor used his access to cheap convertible notes during the period of Bidenomics in the United States to borrow vast sums in dollars, repaying the loans with nearly worthless currency later”. This earned him the title of “Bitcoinkönig” (Bitcoin King)".

GBTC (the trust) was the ponzi vehicle that kited bitcoin in 2021-22. When it traded over NAV, Grayscale issued more GBTC and hoovered up all the bitcoin. This worked until GBTC no longer traded over NAV.

MSTR (the company) is the ponzi vehicle that is kiting bitcoin in 2024. When MSTR trades over NAV, Mike Saylor issues more MSTR debt and hoovers up all the bitcoin. This will work until MSTR can no longer issue cheap convertible debt.

On 3/06/24 MSTR raised over $680M to acquire more bitcoins. “The notes will be unsecured, senior obligations of MicroStrategy, and will bear interest at a rate of 0.625% per annum”.

On 3/11/24 MSTR disclosed in a regulatory filing it purchased about 12,000 bitcoins for approximately $821.7M in cash.

On 3/13/24 offered $500 of convertible senior notes due 2031.

On 3/19/24, MSTR disclosed in a regulatory filing it purchased 9,245 more bitcoins for $623M.

Talk about lack of pretense! I don’t know what, if anything, stops this, other than Bitcoin going back under $30K and staying there.

MSTR now owns ~1% of all the Bitcoin that will ever exist. Meet the new income inequality, same as the old income inequality.

I enjoyed reading about Stinnes, but there are a few issues with this comparison.

kiting is not an appropriate term, say what you want about Saylor (I am no Saylor evangelist, just an observer like everyone else) but he is not kiting anything. He is publicly acting on a conviction, within the current regulatory framework. Using debt to accelerate his position. If you believe that he is wrong, then it will right itself in the end. If you are concerned that he is right, that’s a different story.

Stinnes used his privileged position to access foreign currencies that others could not. Saylor is buying Bitcoin which is available for anyone to buy, at any time of the day. 24 hours, no account with GBTC or any other ETF required.

Agreed, the introduction of a “harder” form of money into our current system is no cure for inequality. It’s likely just going to look like a different form of the Cantillon effect observed in the wake of the GFC and the massive stimulus deployed.

The article proposes a problem with the potential futures it lays out. I don’t see anything from stopping anyone concerned with those futures from buying and HODLing Bitcoin as a counter strategy. It’s $65K-ish right now. If someone is that concerned Bitcoin might grow to $1M at some point in the future that the HODLers of today become so filthy rich they take over society… well that’s enough of a risk/reward scenario for them to warrant buying some coins to even the scales. Right?

I’m listening to Evgeny Morozov’s interview and this statement,

“This new regime, it’s not just feudal, it’s actually techno-feudal, in the sense that technology plays a key role in enabling these new tendencies.” seems relevant to the greater conversation on Epsilon …