To receive a free full-text email of The Zeitgeist whenever we publish to the website, please sign up here. You’ll get two or three of these emails every week, and your email will not be shared with anyone. Ever.

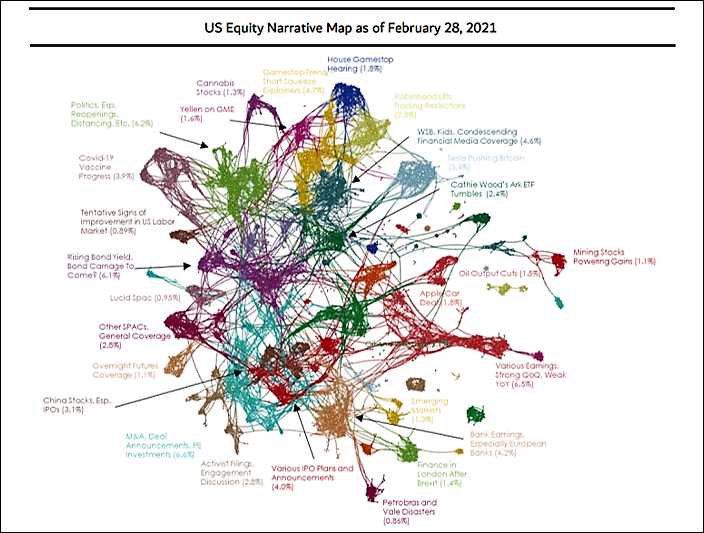

Every morning, we take the previous day’s financial news – all of it – and run it through The Narrative Machine to see if any interesting clusters pop out as a topic for us to write about in one of these quick Zeitgeist notes. And when I say clusters, I literally mean clusters – the building blocks of a graphical representation of linguistic connectivity.

But when I say clusters, what I really mean is patterns. I really mean changes in the narrative structure.

We’re not doing this to learn new facts. We’re not really interested in the specifics of what people are saying. We are very interested, though, in how people are saying it. We’re looking for changes in how we talk about what is important in markets and investing.

We’re looking for changes in the water in which we swim.

That water is changing today. It’s changing a lot.

Increasingly, the Common Knowledge of our investment world – what everyone knows that everyone knows – is that inflation is a problem and you should be focused on it.

For example, today in a popular financial news media aggregator, RealClearMarkets.com, of the 21 articles highlighted on their frontpage aggregator, 6 of them were about inflation … is it here? is it coming? what does it mean for your portfolio? does Bitcoin fix this? etc. etc.

Again, I have zero interest in the specifics or the facts or the message or the sentiment of these selected articles (even though one of them was yesterday’s Epsilon Theory note). What interests me a lot, though, is the CHOICE made by the editors and algorithms of RealClearMarkets.com to select these articles over all of the other financial news stories available to them. What interests me a lot is the recursive ENGAGEMENT that these articles and their shared linguistic structures trigger in readers, such that they will look for more articles on this topic, which means that more articles on this topic will be written. This is how common knowledge happens. This is how the water in which we swim changes.

Now, you might personally believe that inflation is NOT a big deal or a big concern. That’s fair. Reasonable people can disagree on this. You might also look at the consensus about inflation in this metric or that metric and similarly conclude that inflation is NOT a big deal or a big concern. Also fair.

Fair. But it doesn’t matter. At least not for making money. Neither what you personally believe (what Keynes called 1st-level decision making in the famous game theory example he called the Newspaper Beauty Contest) nor what everyone apparently believes (the consensus, or what Keynes called 2nd-level decision making) will make your investment decisions work out successfully for you.

The thing that moves markets – the thing that will make your investment decisions work out successfully for you – is what everybody believes that everybody believes.

It’s 3rd-level decision making. It’s common knowledge.

This has been the core message of Epsilon Theory from the start. This IS the Manifesto. Over the past eight years, we’ve published more than 1,000 notes on Epsilon Theory, and every single one of them starts here.

The Epsilon Theory Manifesto

Our times require an investment and risk management perspective that is fluent in econometrics but is equally grounded in game theory, history, and behavioral analysis. Epsilon Theory is my attempt to lay the foundation for such a perspective.

Today we’re building an active community of investors and citizens who see the world through the Clear Eyes of narrative and common knowledge. And more importantly, treat each other with Full Hearts. Clear eyes, full hearts, can’t lose!

I think that the Epsilon Theory Pack can work together to understand what’s really happening with inflation in both real-world and narrative-world, and then figure out effective investment strategies to deal with it.

If you want to read more about what we’re doing and why we’re doing it, here you go:

The Opposite of 2008

In 2008, the US housing market – together with a Fed that thought the subprime crisis was “contained” – delivered the mother of all deflationary shocks to the global economy.

In 2021, the US housing market – together with a Fed that thinks inflationary pressures are “transitory” – risks delivering the mother of all inflationary shocks.

And if you’re interested in digging even deeper to find out how the Narrative Machine can help with your investment decisions, please consider ET Professional. If you send an email to [email protected] we’d be happy to share some of our research and monthly narrative Monitors to see if it’s a useful research service for you. It’s not inexpensive ($2,950/yr), but the license covers a small investment team and, in the immortal words of Don Barzini, we are not Communists!

Ben, hi, at one point, some major news organization (I think it was the WSJ, but that’s from my wobbly memory) was not captured in your “narrative machine,” has that changed or, more likely, am I just all wrong?

You are remembering quite correctly, Mark, and it is no longer the case.

Thank you Rusty. Good to know one or two memory cells are still functioning. Looking forward to OH at 2pm today.