Every morning, we run The Narrative Machine on the past 24 hours worth of financial media to find the most on-narrative (i.e. interconnected and central) stories in financial media. It’s not a list of best articles or articles we think are most interesting … often far from it.

But for whatever reason these are articles that are representative of some sort of chord that has been struck in Narrative-world.

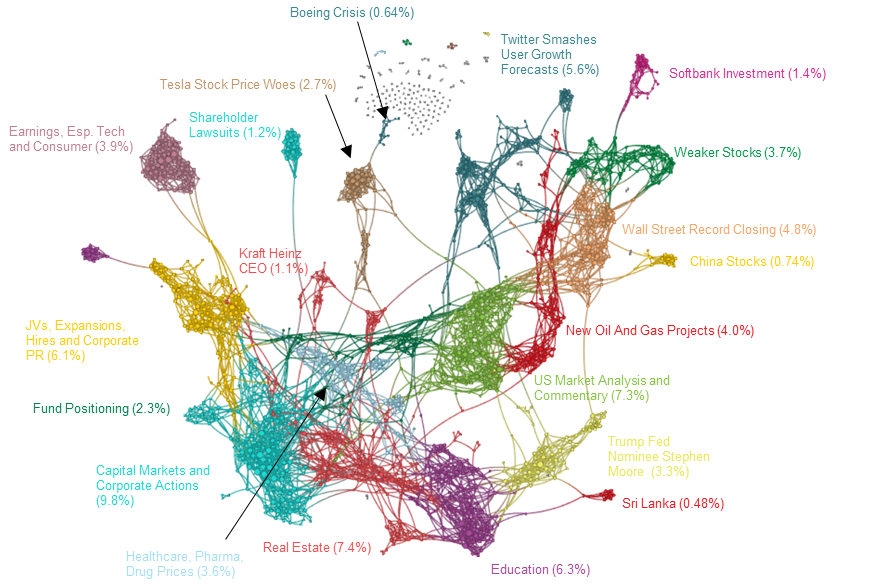

April 24, 2019 Narrative Map – US Equities

Wall Street Analyst Sentiment Stays in a Funk, but Earnings Trends Still Positive in Q1 2019: 361 Capital Wall Street Mood Monitor [Press Release]

“Since September of last year, sell-side research analysts made more negative revisions to earnings estimates than positive ones,” said John Riddle, CFA, chief investment officer for 361 Capital. “While the mood remains gloomy, the good news is that earnings trends, as measured by surprises versus disappointments, were on balance positive.”

Wait … you mean that companies beat their pro forma non-GAAP performance targets? Whaaaaat?

Russell Wilson gifts entire Seahawks offensive line Amazon stock after signing new contract [CBS Sports]

With Amazon being the conglomerate that it is, the gifts have the potential to keep growing. Amazon shares are currently valued at just under $2,000 ($1,926.29) as of Tuesday morning.

Every sports article I’ve read about Russell Wilson’s gift to his O-line (six shares of Amazon stock each) has mentioned that the gift “could get larger over time” as Amazon’s stock continues its inexorable climb higher.

18 months ago this is the coverage that a gift of Bitcoin would have received.

You don’t see this at the bottom.

Stocks are at an all-time high. Here’s what stopped the last 12 bull runs [CNN]

How much longer can the good times roll?

It’s anyone’s guess, but bull markets and economic expansions don’t die of old age. Credit crunches, political uncertainty, wars and rampant speculation have ended previous bull markets.

Bull markets end when easy money stops being so easy. #SavedYouAClick

Twitter is surging and the rally shows no signs of slowing, chart analyst says [CNBC]

This quarter will be the last for which Twitter will report Monthly Active Users (MAUs), the company announced during its last earnings report. As a replacement, Twitter began to report what it calls monetizable daily active users (mDAUs) last quarter, which it said would better reflect its audience. This metric includes “Twitter users who log in and access Twitter on any given day through Twitter.com or our Twitter applications that are able to show ads,” according to the company.

Say what you will about @jack, but he understands the necessary and sufficient condition for being a successful CEO today: create a Wall Street-supported non-GAAP narrative to describe your company’s financial results.

Tired: the MAU narrative.

Wired: the mDAU narrative.

The Biggest Threat to Endowment and Foundation Portfolios [Institutional Investor]

The biggest threat to endowment and foundation investment portfolios is a slowdown in global growth, according to a survey by consulting firm NEPC.

Narrator: this was not the biggest threat.

Nothing shows how much it’s all a game and that everyone is on the same side than that Wall Street plays along with all this non-GAAP narrative nonsense. Everyone just wants a story to sell. It’s obnoxious, but worse, it all feels hollow.

I seem to remember a few high profile people years back - like the model Gisele - publicly stating they would only accept payment in Euros not dollars when the Euro was at about 130 - kind of like taking shares of Amazon today.

It was likely just currency diversification. TB was already in USD, and surely Gisele was worried about the real. Don’t the <0.1% all do currency diversification? Why pay both exchange and xfer fees? BTW that’s what BTC is all about, n’est ce pas?

When the Fed started this ZIRP/QE nonsense after the GFC, I told a friend it was both corrupt and corrupting. I’ve seen nothing in the past decade that has changed my mind.