"Briefly stated, the Gell-Mann Amnesia effect is as follows. You open the newspaper to an article on some subject you know well. In Murray's case, physics. In mine, show business. You read the article and see the journalist has absolutely no understanding of either the facts or the issues. Often, the article is so wrong it actually presents the story backward—reversing cause and effect. I call these the "wet streets cause rain" stories. Paper's full of them.

In any case, you read with exasperation or amusement the multiple errors in a story, and then turn the page to national or international affairs, and read as if the rest of the newspaper was somehow more accurate about Palestine than the baloney you just read. You turn the page, and forget what you know."

– Michael Crichton (1942-2008)

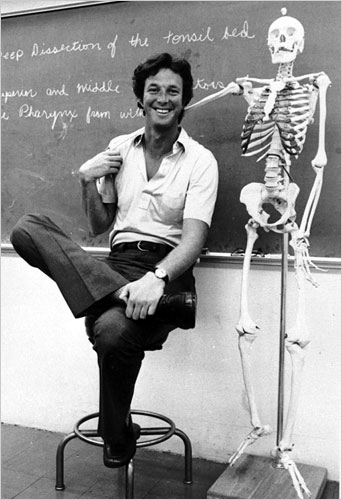

That's Michael Crichton, the physician turned novelist turned director, talking about his physicist friend Murray Gell-Mann, who discovered (and named) the quark. Crichton pretty much invented the techno-thriller genre of books and film, starting with The Andromeda Strain, which is one of the most influential books in my life, for sure. Crichton is probably best known for his Jurassic Park novels, but take a look at his bibliography sometime ... it's astonishing how much influence he has had on modern American culture, period. That cover photo on this note, from the 1973 version of Westworld, is one of Crichton's, too.

I've written about the Gell-Mann Amnesia effect before, but I wanted to highlight it in a standalone Brief. Why? Because I think it's the primary driver of the social pathology we have today regarding media in general and social media in particular.

If you or your company has EVER been the primary subject of a newspaper article, you know exactly what Crichton is talking about. The article is simply wrong. Not just wrong in minor detail, but wrong in motivation, cause, implication, fundamental facts ... everything. You read it and you think, "how can I get this travesty of an article edited/retracted/rewritten? how is it possible that the writer got this situation so wrong?"

And yet, despite having this searing experience with media articles where we actually have meaningful personal knowledge, we believe without hesitation the next story we read where we don't!

We are hard-wired to respond to Missionaries, and when I say hard-wired I truly mean that in a biological sense. It's what makes Fiat News - the projection of opinion as fact - work. It's what powers the Trump Train and the Team Elite Club alike. It's not that facts don't matter. They do! But the presentation by a Missionary that a statement is a fact is enough to make it a fact within the Common Knowledge Game. That IS the Common Knowledge Game. All it requires is an effective Missionary.

Everyone is in on the secret. Everyone is in on the act. Everyone who can is playing the Common Knowledge Game as a Missionary. And everyone who can't is being played.

When I read stuff in the papers on a topic I know a lot about, and it’s wrong, I have to wonder how much of what they write about stuff I don’t know much about is also wrong.

When I worked at Time Inc. many years ago, one of the ways newbies were introduced to the business by old hands was with the caveat that Time was a great magazine until it wrote about something you knew a lot about. Briton Hadden and Henry Luce were arguably the greatest Missionaries of the twentieth century.

Understand the need to be skeptical, guess I struggle where skepticism becomes paranoia? I find it exhausting sometimes to go through life trying to calculate all the angles and hidden agendas. No point in being naive though.

“…and read as if the rest of the newspaper was somehow more accurate…”

This reminds me of Malcolm Gladwell’s conclusion of ‘default to truth’ from his recent book “Taking To Strangers.” I finished it today. It deserves another read, or at least additional consideration and reference in my life. As always, I find Gladwell’s writing, analysis and conclusions inspiring.

Same with the Epsilon team.

That’s exactly what I thought when reading the note. I think the example of Harry marcopoulos (sp} in Gladwell’s book is really instructive. He was ultra skeptical about everything. which helped him uncover the Madoff fraud before anyone else. years before anyone else. at the same time it kind of crippled him professionally and personally because he never defaulted to truth.