Ben Hunt

Co-Founder and CIO

Ben Hunt is the creator of Epsilon Theory and inspiration behind Second Foundation Partners, which he co-founded with Rusty Guinn in June 2018.

Epsilon Theory, Second Foundation’s principal publishing brand, is a newsletter and website that examines markets through the lenses of game theory and history. Over 100,000 professional investors and allocators across 180 countries read Epsilon Theory for its fresh perspective and novel insights into market dynamics. As Chief Investment Officer, Ben bears primary responsibility for determining the Company’s investment views and positioning of model portfolios. He is also the primary author of materials distributed through Epsilon Theory.

Ben taught political science for 10 years: at New York University from 1991 until 1997 and (with tenure) at Southern Methodist University from 1997 until 2000. He also wrote two academic books: Getting to War (Univ. of Michigan Press, 1997) and Policy and Party Competition (Routledge, 1992), which he co-authored with Michael Laver. Ben is the founder of two technology companies and the co-founder of SmartEquip, Inc., a software company for the construction equipment industry that provides intelligent schematics and parts diagrams to facilitate e-commerce in spare parts.

He began his investment career in 2003, first in venture capital and subsequently on two long/short equity hedge funds. He worked at Iridian Asset Management from 2006 until 2011 and TIG Advisors from 2012 until 2013. He joined Rusty at Salient in 2013, where he combined his background as a portfolio manager, risk manager, and entrepreneur with academic experience in game theory and econometrics to work with Salient’s own portfolio managers and its financial advisor clients to improve client outcomes.

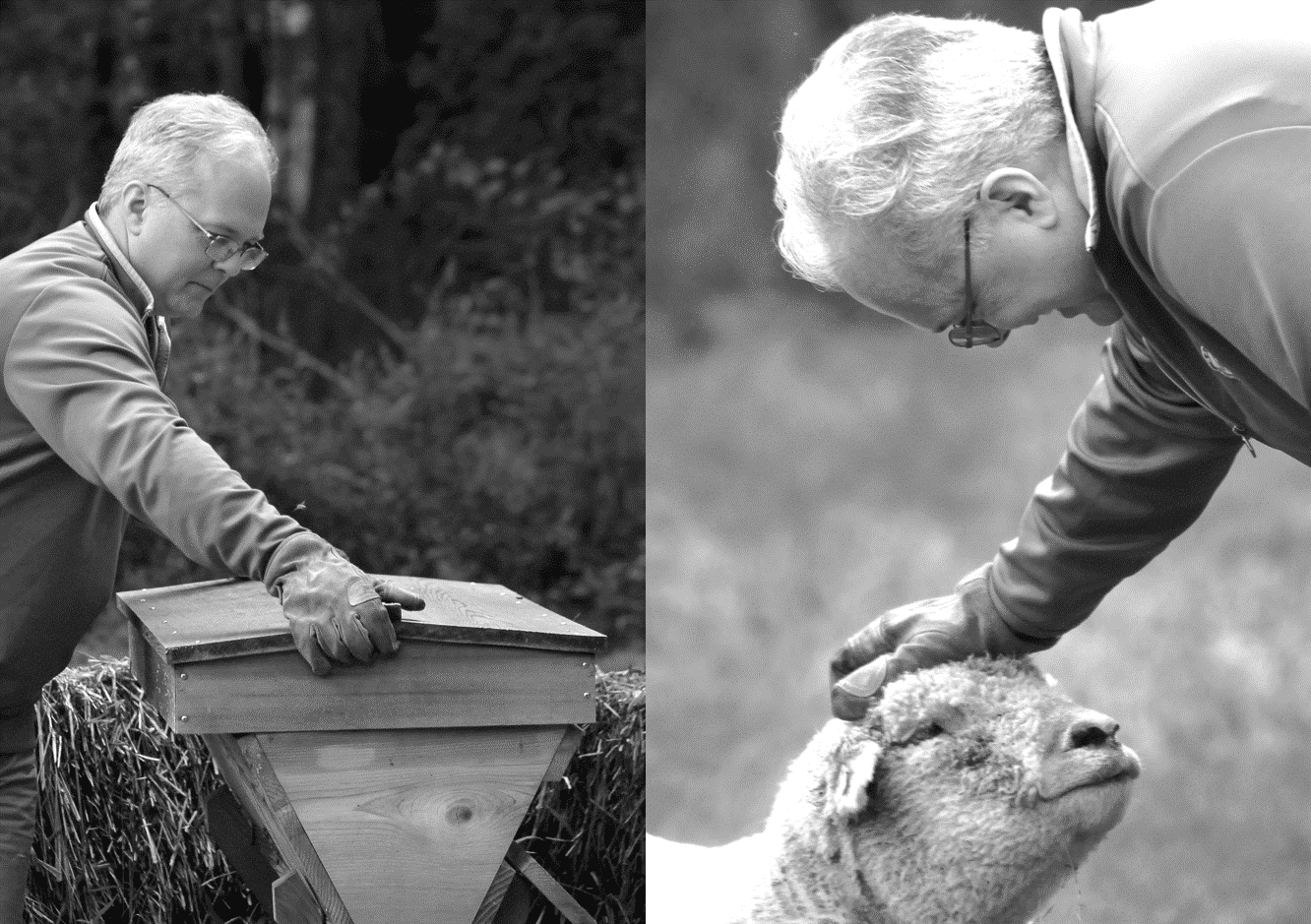

Ben is a graduate of Vanderbilt University (1986) and earned his Ph.D. in Government from Harvard University in 1991. He lives in the wilds of Redding, CT on Little River Farm, where he personifies the dilettante farmer that has been a stock comedic character since Cicero's day. Luckily his wife, Jennifer, and four daughters, Harper, Hannah, Haven and Halle, are always there to save the day. Ben's hobbies include comic books, Alabama football, beekeeping, and humoring Rusty in trivia "competitions".

Articles by Ben:

I am increasingly convinced that it’s not only interest rates that have become unmoored in Narrative-world, but also our banking system and our housing finance system … and our domestic political system and our international security system.

We’ve moved from an unmooring of long-dated interest rates to an unmooring of everything.

On Wednesday, October 11, the 30-year yield declined 13.8 bps (NY to NY last trade), its third biggest one-day decline in yields since November 2020.

Yesterday, October 12, the 30-year yield rose 16 bps. This was the biggest one-day increase since March 2020.

This is what unmooring looks like!

The narrative archetype “Supply and Demand” tm is typically trotted out to describe a market move that no one has a better answer for. It’s not particularly useful for a directional trade, though, as it is inherently cyclical and mean-reverting.

It’s important to recognize that a Big Trade is a long campaign made up of dozens of narrative battles and skirmishes. We won the first battle – and that’s great! – but now it’s on to preparing for the next.

Why did the Fed slap down Mr. Market’s expectations of massive rate cuts in 2024?

Because the most important thing for the Fed is not to be right, but to be believed.

In narrative-world, we have now redefined core CPI to not only exclude food and energy prices directly, but also indirectly. If airfares went up in-line with or ‘because of’ rising fuel prices, then obviously we need to ‘adjust’ those airfare readings for a ‘true’ core CPI, right?

The ghost of Arthur Burns haunts us still.

The latest narrative development I’m seeing is that the US economy has “decoupled” from the other Big Three economies: China, Germany and Japan, and that has a couple of important implications for market-world, I think.

Last week I wrote that the Big Idea (unmoored long-end of rates curve) had been discovered, which always means that the counter-narrative isn’t far behind.

That counter-narrative is Bad News Is Good News TM.

Just in the past week, a new viral thread in narrative-world to support the ‘unmoored long-dated rates’ trade.

TRIGGER WARNING:

This note will make many readers anxious and angry, because you have been told by the political entrepreneurs of your tribe that neither Oliver Anthony nor Greta Thunberg is ‘political’ at all, and that anyone who says otherwise is a bad person.

The political entrepreneurs of your tribe are lying to you.