Ben Hunt

Co-Founder and CIO

Ben Hunt is the creator of Epsilon Theory and inspiration behind Second Foundation Partners, which he co-founded with Rusty Guinn in June 2018.

Epsilon Theory, Second Foundation’s principal publishing brand, is a newsletter and website that examines markets through the lenses of game theory and history. Over 100,000 professional investors and allocators across 180 countries read Epsilon Theory for its fresh perspective and novel insights into market dynamics. As Chief Investment Officer, Ben bears primary responsibility for determining the Company’s investment views and positioning of model portfolios. He is also the primary author of materials distributed through Epsilon Theory.

Ben taught political science for 10 years: at New York University from 1991 until 1997 and (with tenure) at Southern Methodist University from 1997 until 2000. He also wrote two academic books: Getting to War (Univ. of Michigan Press, 1997) and Policy and Party Competition (Routledge, 1992), which he co-authored with Michael Laver. Ben is the founder of two technology companies and the co-founder of SmartEquip, Inc., a software company for the construction equipment industry that provides intelligent schematics and parts diagrams to facilitate e-commerce in spare parts.

He began his investment career in 2003, first in venture capital and subsequently on two long/short equity hedge funds. He worked at Iridian Asset Management from 2006 until 2011 and TIG Advisors from 2012 until 2013. He joined Rusty at Salient in 2013, where he combined his background as a portfolio manager, risk manager, and entrepreneur with academic experience in game theory and econometrics to work with Salient’s own portfolio managers and its financial advisor clients to improve client outcomes.

Ben is a graduate of Vanderbilt University (1986) and earned his Ph.D. in Government from Harvard University in 1991. He lives in the wilds of Redding, CT on Little River Farm, where he personifies the dilettante farmer that has been a stock comedic character since Cicero's day. Luckily his wife, Jennifer, and four daughters, Harper, Hannah, Haven and Halle, are always there to save the day. Ben's hobbies include comic books, Alabama football, beekeeping, and humoring Rusty in trivia "competitions".

Articles by Ben:

“What do you mean you don’t make side orders of toast? You make sandwiches, don’t you?”

Bobby thinks he has lots of choices, but really he only has one.

We’re all Bobby today.

Take back your vote.

Take back your distance.

Take back your data.

How to make our way as citizens in a fallen world, with Clear Eyes and Full Hearts to make it better.

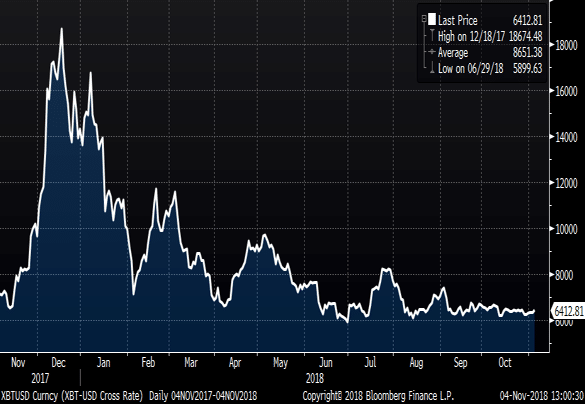

A quick note on no-coiners, people (like me) who have never owned Bitcoin, but have just watched from afar. We’re being played. Not to buy Bitcoin, but to obey the logic of the flock.

In the construction of Fiat News, it’s the choice of facts and the choice of words that preserve the power to make us feel. Because that’s the only thing that really matters – how do the words make you FEEL?

How can US household net worth continue to outpace US economic growth if the Fed won’t play ball with easy monetary policy? History shows another way to keep the party going

There’s a dog that didn’t bark in the midterm campaign. And its silence tells me a lot about where this country is going.

One way or another, boredom must be eliminated. It’s as much an iron law of markets as the impact of greed and fear. And it’s just as powerful.

It’s the defining quote for any performance-based social system, whether it’s football, politics, or markets. So let me ask you this: who owns your record?

A stalking horse is a familiar shape that a hunter hides behind in order to get close to his prey. Once you start looking for them in markets, you will see them EVERYWHERE.

I can’t advise you on the Answers. I won’t advise you on the Answers. But I will advise you on the Process. Because that’s what we do for our fellow pack members.