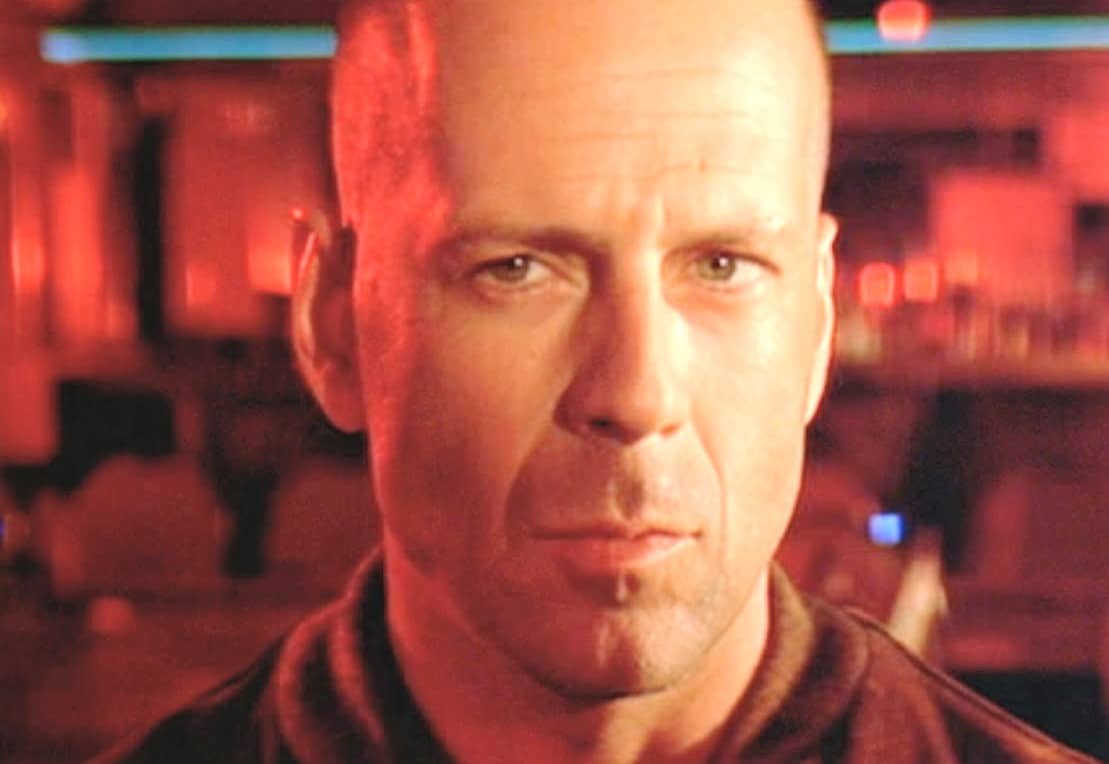

Ben Hunt

Co-Founder and CIO

Ben Hunt is the creator of Epsilon Theory and inspiration behind Second Foundation Partners, which he co-founded with Rusty Guinn in June 2018.

Epsilon Theory, Second Foundation’s principal publishing brand, is a newsletter and website that examines markets through the lenses of game theory and history. Over 100,000 professional investors and allocators across 180 countries read Epsilon Theory for its fresh perspective and novel insights into market dynamics. As Chief Investment Officer, Ben bears primary responsibility for determining the Company’s investment views and positioning of model portfolios. He is also the primary author of materials distributed through Epsilon Theory.

Ben taught political science for 10 years: at New York University from 1991 until 1997 and (with tenure) at Southern Methodist University from 1997 until 2000. He also wrote two academic books: Getting to War (Univ. of Michigan Press, 1997) and Policy and Party Competition (Routledge, 1992), which he co-authored with Michael Laver. Ben is the founder of two technology companies and the co-founder of SmartEquip, Inc., a software company for the construction equipment industry that provides intelligent schematics and parts diagrams to facilitate e-commerce in spare parts.

He began his investment career in 2003, first in venture capital and subsequently on two long/short equity hedge funds. He worked at Iridian Asset Management from 2006 until 2011 and TIG Advisors from 2012 until 2013. He joined Rusty at Salient in 2013, where he combined his background as a portfolio manager, risk manager, and entrepreneur with academic experience in game theory and econometrics to work with Salient’s own portfolio managers and its financial advisor clients to improve client outcomes.

Ben is a graduate of Vanderbilt University (1986) and earned his Ph.D. in Government from Harvard University in 1991. He lives in the wilds of Redding, CT on Little River Farm, where he personifies the dilettante farmer that has been a stock comedic character since Cicero's day. Luckily his wife, Jennifer, and four daughters, Harper, Hannah, Haven and Halle, are always there to save the day. Ben's hobbies include comic books, Alabama football, beekeeping, and humoring Rusty in trivia "competitions".

Articles by Ben:

“Order should not have priority over freedom. But the affirmation of freedom should be elevated from a mood to a strategy.” Yes, please.

An historic night it was.A pleasure to have a private dinner with the Crown Prince of Saudi Arabia, Mohammed bin Salman, his royal family and…

The Ben Sasse Cartoon does not match the Ben Sasse life, and that’s a politically existential problem here in the Widening Gyre.

The thing is, Butch, right now you got ability. But painful as it may be, ability don’t last. You came close but you never made it. And if you were gonna make it, you would have made it before now.

Two emails from soldiers, both asking questions that I can’t answer alone. We need a pack.

The growing strength and coherence of Narrative Machine visualizations show the creation of powerful common knowledge around inflation, where everyone knows that everyone knows that inflation is rearing its very ugly head.

“Briefly stated, the Gell-Mann Amnesia effect is as follows. You open the newspaper to an article on some subject you know well. In Murray’s case, physics. In mine, show business. You read the article and see the journalist has absolutely no understanding of either the facts or the issues. Often, the article is so wrong it actually presents the story backward—reversing cause and effect. I call these the “wet streets cause rain” stories. Paper’s full of them.

In any case, you read with exasperation or amusement the multiple errors in a story, and then turn the page to national or international affairs, and read as if the rest of the newspaper was somehow more accurate about Palestine than the baloney you just read. You turn the page, and forget what you know.”

Your autonomy of mind and spirit cannot be taken away by the State, the Oligarchy or the Mob. But you can give it away. Don’t.

I wrote “Finest Worksong” in September, 2014 (reprinted below). Here’s the money quote: At some point in the not so distant future there will be…

A cat may look on a king, ye know! — Proverbs and Epigrams of John Heywood (1562) Ben’s note: I wrote The Red King in…