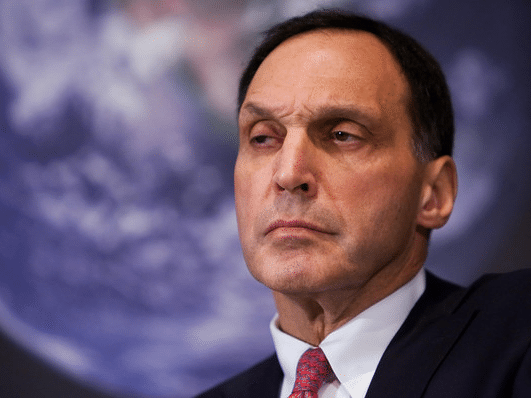

Ben Hunt

Co-Founder and CIO

Ben Hunt is the creator of Epsilon Theory and inspiration behind Second Foundation Partners, which he co-founded with Rusty Guinn in June 2018.

Epsilon Theory, Second Foundation’s principal publishing brand, is a newsletter and website that examines markets through the lenses of game theory and history. Over 100,000 professional investors and allocators across 180 countries read Epsilon Theory for its fresh perspective and novel insights into market dynamics. As Chief Investment Officer, Ben bears primary responsibility for determining the Company’s investment views and positioning of model portfolios. He is also the primary author of materials distributed through Epsilon Theory.

Ben taught political science for 10 years: at New York University from 1991 until 1997 and (with tenure) at Southern Methodist University from 1997 until 2000. He also wrote two academic books: Getting to War (Univ. of Michigan Press, 1997) and Policy and Party Competition (Routledge, 1992), which he co-authored with Michael Laver. Ben is the founder of two technology companies and the co-founder of SmartEquip, Inc., a software company for the construction equipment industry that provides intelligent schematics and parts diagrams to facilitate e-commerce in spare parts.

He began his investment career in 2003, first in venture capital and subsequently on two long/short equity hedge funds. He worked at Iridian Asset Management from 2006 until 2011 and TIG Advisors from 2012 until 2013. He joined Rusty at Salient in 2013, where he combined his background as a portfolio manager, risk manager, and entrepreneur with academic experience in game theory and econometrics to work with Salient’s own portfolio managers and its financial advisor clients to improve client outcomes.

Ben is a graduate of Vanderbilt University (1986) and earned his Ph.D. in Government from Harvard University in 1991. He lives in the wilds of Redding, CT on Little River Farm, where he personifies the dilettante farmer that has been a stock comedic character since Cicero's day. Luckily his wife, Jennifer, and four daughters, Harper, Hannah, Haven and Halle, are always there to save the day. Ben's hobbies include comic books, Alabama football, beekeeping, and humoring Rusty in trivia "competitions".

Articles by Ben:

China’s Belt and Road Initiative is back, baby! Just needed a little Narrative happy face of “respect for global debt goals” and “promotion of green growth”. That plus multi-billion dollar non-recourse loans at 2% for a high-speed rail to nowhere.

Plus more on Walmart robots, ESG, and of course Free College!

Just another day of you can’t make it up, fresh from the ET Zeitgeist.

Why does it matter whether you think profit margin expansion has been driven more by globalization (Bridgewater) or financialization (Epsilon Theory)?

Because central banks can continue to drive financialization and earnings margin expansion even as globalization collapses.

What Herman Cain would bring to the Fed, what Socrates brings to the MMT debate, what Pinterest and Zoom bring to the IPO market, and what work European PMs bring home when the markets are closed.

All in a day’s work for a Good Friday Zeitgeist.

Turns out that we may not be on the precipice of a global recession after all, that AOC may be pretty good at this politics game, and that parasitic companies enjoy Insane Clown Posse more than most. Also, Bob Pisani reveals CNBC’s noble mission.

Capitalist productivity has become capitalist financialization.

Wall Street gets something to sell, management gets stock-based comp, and the White House gets re-election.

What do YOU get out of financialization? You get to hold up a card that says “Yay, capitalism!”.

It’s not even a wall of worry any more. More like tiny little speed hurdles that we set up to clear by a mile. Just another day’s work for the Fiat News machine.

They’re not even pretending anymore.

My father owned a red Corvair almost exactly like this one. He loved that car. Almost died in it, too, when he was t-boned at an intersection on his way to work in Bessemer, Alabama. That was in 1966. I was two years old.

The Boeing 737 MAX is our generation’s Chevy Corvair.

Unsafe At Any Speed.

Today in the Zeitgeist, an HBR article about the “mourning patterns” of Lehman employees. Color me triggered.

If you don’t know what Repo 105 was, you should. If you do know what Repo 105 was, you should find someone who doesn’t and tell them about it.

Wait … an article about Puerto Rico that’s not about tax shelters or bond defaults or crappy local government or Trump idiocy or crypto bros? … an article that’s about entrepreneurship and the sort of small businesses that are the life blood of a vibrant local economy? What the hell, New York Times?

Not to worry, though, there’s plenty of Fiat News and the usual raccoonery here in the rest of the daily Zeitgeist.

Whether you’re a trader or a portfolio manager or a financial advisor or an allocator, ET Pro can help you identify both the inflection points and the trajectory of the market Zeitgeist – particularly the question that any long-term portfolio owner MUST get roughly right in order to succeed: are we in an inflationary or deflationary world, and how quickly (if at all) and in what ways is that world changing?