Ben Hunt

Co-Founder and CIO

Ben Hunt is the creator of Epsilon Theory and inspiration behind Second Foundation Partners, which he co-founded with Rusty Guinn in June 2018.

Epsilon Theory, Second Foundation’s principal publishing brand, is a newsletter and website that examines markets through the lenses of game theory and history. Over 100,000 professional investors and allocators across 180 countries read Epsilon Theory for its fresh perspective and novel insights into market dynamics. As Chief Investment Officer, Ben bears primary responsibility for determining the Company’s investment views and positioning of model portfolios. He is also the primary author of materials distributed through Epsilon Theory.

Ben taught political science for 10 years: at New York University from 1991 until 1997 and (with tenure) at Southern Methodist University from 1997 until 2000. He also wrote two academic books: Getting to War (Univ. of Michigan Press, 1997) and Policy and Party Competition (Routledge, 1992), which he co-authored with Michael Laver. Ben is the founder of two technology companies and the co-founder of SmartEquip, Inc., a software company for the construction equipment industry that provides intelligent schematics and parts diagrams to facilitate e-commerce in spare parts.

He began his investment career in 2003, first in venture capital and subsequently on two long/short equity hedge funds. He worked at Iridian Asset Management from 2006 until 2011 and TIG Advisors from 2012 until 2013. He joined Rusty at Salient in 2013, where he combined his background as a portfolio manager, risk manager, and entrepreneur with academic experience in game theory and econometrics to work with Salient’s own portfolio managers and its financial advisor clients to improve client outcomes.

Ben is a graduate of Vanderbilt University (1986) and earned his Ph.D. in Government from Harvard University in 1991. He lives in the wilds of Redding, CT on Little River Farm, where he personifies the dilettante farmer that has been a stock comedic character since Cicero's day. Luckily his wife, Jennifer, and four daughters, Harper, Hannah, Haven and Halle, are always there to save the day. Ben's hobbies include comic books, Alabama football, beekeeping, and humoring Rusty in trivia "competitions".

Articles by Ben:

Huawei Founder Says U.S. Won’t Disrupt Business As Analysts Warn Of Sales Slowdown [Forbes]

The Fed Is Likely to Make an ‘Insurance’ Rate Cut [Bloomberg]

Retirement plan menus are ground zero for what is delightfully referred to as “choice architecture” … steering and Nudging you into making the “right” choice.

Ad men understand choice architecture. So do mob bosses. It’s all about creating a Hobson’s Choice … a choice that’s no choice at all.

It’s not a Wheel. It’s a Carousel.

“According to the Aspen Institute, close to 6 in 10 working-age Americans do not have a retirement account. Sadly, the Aspen Institute also warns that things are likely to get worse due to the changing nature of work.”

The American worker is the proverbial boiled frog. Or Milton from Office Space. Same thing.

The best part of Robert Smith’s pledge to repay student loans? The pressure this puts on other billionaires when they get an invite from alma mater.

Then again, most billionaires are high-functioning sociopaths, so they truly believe that their words and moving speeches are reward enough for graduates.

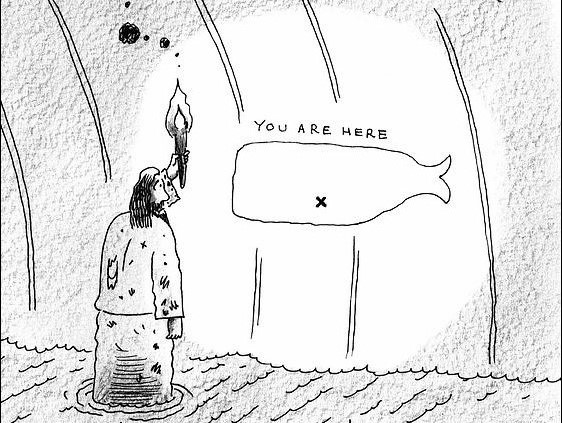

That’s a live shot of me today, reading an important and useful paper by a Fed economist. Seriously.

Also, a Mr. Wonderful bot, and Bill de Blasio winning those Midwestern hearts and minds one camo-wearing diner patron at a time.

Preparing today’s Zeitgeist, I couldn’t stop staring at this picture of Larry Kudlow.

There’s a famous body of work on how serving as President ages you in office, and I’ve got some examples of that here in the note.

My strong sense of the Trump White House is that The Donald will look exactly the same when he leaves as when he entered. It’s the people working for him that age in dog years.

I’m old enough to remember the Asian financial crisis of 1997, and what happened to the Vietnams of the world the last time we had a shock currency devaluation.

I’m old enough to remember Q4 2015, and what happened to the Vietnams of the world the last time China started threatening a currency devaluation.

It was Barzini all along.

Each month we update our five Narrative Monitors and summarize the main findings from each.

The big reveal for May? There’s a tremendous amount of narrative complacency out there, particularly on Trade and Tariffs, which means this market has a long way down if the narrative focuses on negotiation failure. It’s not focusing there yet, but that’s what you want to watch for.

Cheer up, farmers! Sure, you f’d up by trusting our current frat house leadership, but I’m sure that the crack team at USDA has a great plan in the works to buy up all your soybeans and corn and give it away to the poors.

Will that work?

Hey, it’s gotta work better than the truth.