Ben Hunt

Co-Founder and CIO

Ben Hunt is the creator of Epsilon Theory and inspiration behind Second Foundation Partners, which he co-founded with Rusty Guinn in June 2018.

Epsilon Theory, Second Foundation’s principal publishing brand, is a newsletter and website that examines markets through the lenses of game theory and history. Over 100,000 professional investors and allocators across 180 countries read Epsilon Theory for its fresh perspective and novel insights into market dynamics. As Chief Investment Officer, Ben bears primary responsibility for determining the Company’s investment views and positioning of model portfolios. He is also the primary author of materials distributed through Epsilon Theory.

Ben taught political science for 10 years: at New York University from 1991 until 1997 and (with tenure) at Southern Methodist University from 1997 until 2000. He also wrote two academic books: Getting to War (Univ. of Michigan Press, 1997) and Policy and Party Competition (Routledge, 1992), which he co-authored with Michael Laver. Ben is the founder of two technology companies and the co-founder of SmartEquip, Inc., a software company for the construction equipment industry that provides intelligent schematics and parts diagrams to facilitate e-commerce in spare parts.

He began his investment career in 2003, first in venture capital and subsequently on two long/short equity hedge funds. He worked at Iridian Asset Management from 2006 until 2011 and TIG Advisors from 2012 until 2013. He joined Rusty at Salient in 2013, where he combined his background as a portfolio manager, risk manager, and entrepreneur with academic experience in game theory and econometrics to work with Salient’s own portfolio managers and its financial advisor clients to improve client outcomes.

Ben is a graduate of Vanderbilt University (1986) and earned his Ph.D. in Government from Harvard University in 1991. He lives in the wilds of Redding, CT on Little River Farm, where he personifies the dilettante farmer that has been a stock comedic character since Cicero's day. Luckily his wife, Jennifer, and four daughters, Harper, Hannah, Haven and Halle, are always there to save the day. Ben's hobbies include comic books, Alabama football, beekeeping, and humoring Rusty in trivia "competitions".

Articles by Ben:

“De Blasio’s ‘pay parity’ hypocrisy” is a feature article in today’s NY Post, and a central article in today’s media Zeitgeist.

Dig a little deeper into the “scandal”, and you learn that the “evidence” is complete horseshit.

It’s an article specifically designed to manipulate someone like me … someone who is VERY predisposed to believe the worst about Bill de Blasio because I dislike his politics SO MUCH.

It’s a rage engagement, one of two primary forms of Fiat News used to win the Game of You.

Everything is topsy-turvy in the Upside Down of Stranger Things. That’s the Big Baddie in the picture above, known as the Mind Flayer.

Financial media is a Mind Flayer, too, especially when it comes to coverage of crypto and tech companies.

Yes, we’re still in a zeitgeist of Central Bank Omnipotence, where deflationary shocks simply can’t take the market down for much or for long. That said, the Cohesion measure of both Trade & Tariffs and Central Bank Omnipotence is really breaking down, meaning that there is enormous Narrative confusion over how the rate cut trajectory plays out … far more confusion than the 100% implied market odds of a cut would imply.

Mark Zuckerberg is not The Spanish Prisoner. He’s the guy running the con.

Libra, the cryptocoin promoted by Facebook, is a classic Spanish Prisoner con. This is how the State and the Oligarchy co-opt crypto. Not with the heel of a jackboot. But with the glamour of convenience and narrative.

“You just recently hours ago met with the Chinese president, Xi Jinping,” Carlson said. “Are you closer, do you think after that meeting, to a trade deal?”

“I think so,” Trump replied. “We had a very good meeting. He wants to make a deal. I want to make a deal. Very big deal, probably, I guess you’d say the largest deal ever made of any kind, not only trade.”

He just can’t help himself. And neither can we.

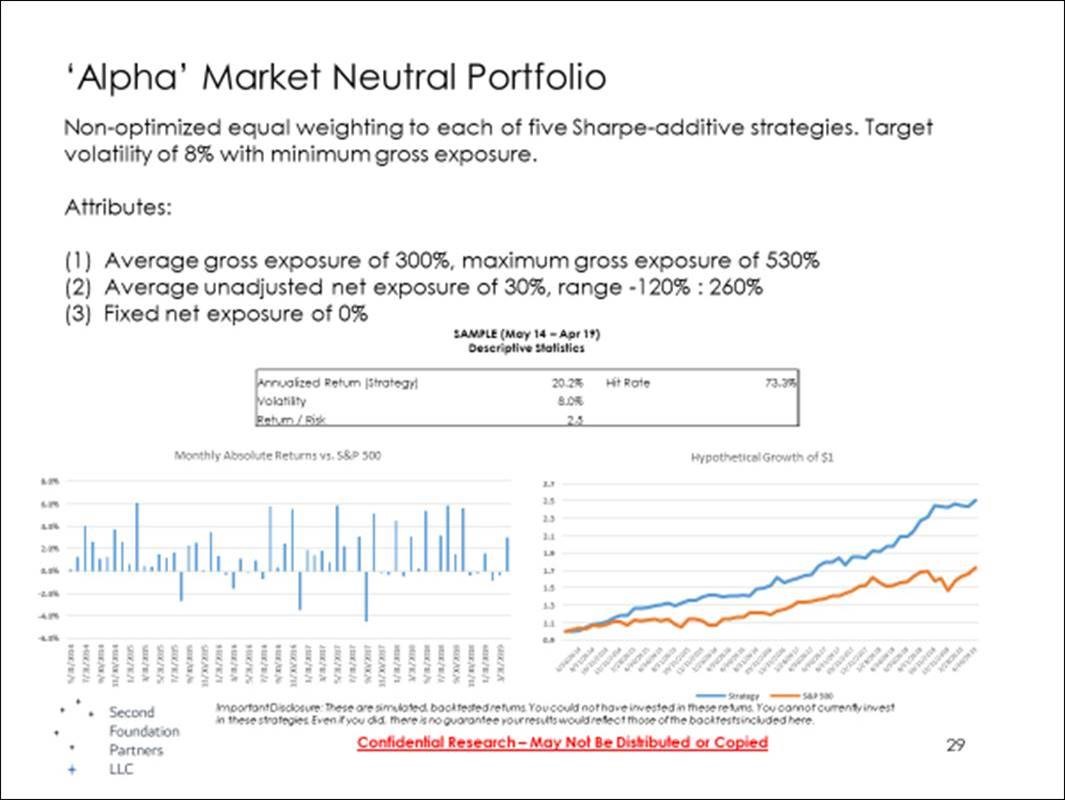

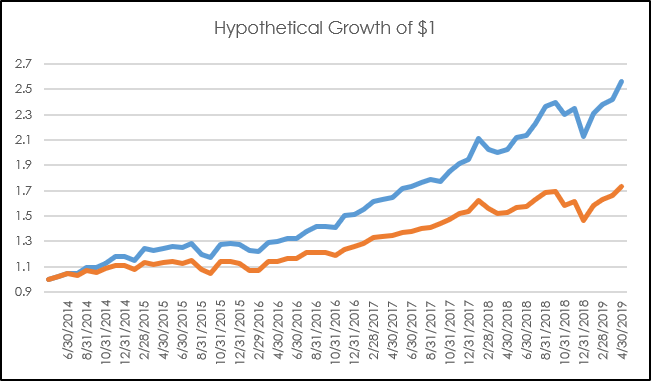

The major update in today’s research deck is a simulation of a market neutral / absolute return strategy using our narrative-driven S&P 500 sector underweight/overweight signals. Prior to this we had presented simulations of an unconstrained “Beta1” portfolio (always 100% net long, but allowing leverage and short positions, roughly the equivalent of a 150/50 portfolio) and a constrained “Long-only” portfolio (always 100% net long AND 100% gross long, so no leverage and no short positions). Both of these strategies were designed to test for an excess return versus the S&P 500, essentially as generic long-equity replacements for S&P 500 exposure.

This is a flat-out damning article about Amazon, relating example after example of how the company screws over legitimate authors on their industry-dominating online bookstore by allowing (if not encouraging) counterfeit publications.

So why does it seem like I am being told how to FEEL about Amazon in this article? Why am I reading this NOW?

Management is not lying to you. It’s probably a really good turn-around plan. It could probably work out fine … IF they are given enough time. But they won’t be. Particularly when it’s the second turn-around plan.

Secularly declining companies ALWAYS run out of time.

It was one of the most expensive lessons of my investing career. And worth every penny.

US Sector Strategies Presentation Deck (downloadable PDF)

For ET Professional subscribers only.

It’s all been leading up to this.

We’re sharing the summary results of our core investment research project with The Narrative Machine.

If you’ve ever wondered, “Gosh, how DO you apply these cool narrative maps to an actual investment strategy?” … well, here’s your answer.