Ben Hunt

Co-Founder and CIO

Ben Hunt is the creator of Epsilon Theory and inspiration behind Second Foundation Partners, which he co-founded with Rusty Guinn in June 2018.

Epsilon Theory, Second Foundation’s principal publishing brand, is a newsletter and website that examines markets through the lenses of game theory and history. Over 100,000 professional investors and allocators across 180 countries read Epsilon Theory for its fresh perspective and novel insights into market dynamics. As Chief Investment Officer, Ben bears primary responsibility for determining the Company’s investment views and positioning of model portfolios. He is also the primary author of materials distributed through Epsilon Theory.

Ben taught political science for 10 years: at New York University from 1991 until 1997 and (with tenure) at Southern Methodist University from 1997 until 2000. He also wrote two academic books: Getting to War (Univ. of Michigan Press, 1997) and Policy and Party Competition (Routledge, 1992), which he co-authored with Michael Laver. Ben is the founder of two technology companies and the co-founder of SmartEquip, Inc., a software company for the construction equipment industry that provides intelligent schematics and parts diagrams to facilitate e-commerce in spare parts.

He began his investment career in 2003, first in venture capital and subsequently on two long/short equity hedge funds. He worked at Iridian Asset Management from 2006 until 2011 and TIG Advisors from 2012 until 2013. He joined Rusty at Salient in 2013, where he combined his background as a portfolio manager, risk manager, and entrepreneur with academic experience in game theory and econometrics to work with Salient’s own portfolio managers and its financial advisor clients to improve client outcomes.

Ben is a graduate of Vanderbilt University (1986) and earned his Ph.D. in Government from Harvard University in 1991. He lives in the wilds of Redding, CT on Little River Farm, where he personifies the dilettante farmer that has been a stock comedic character since Cicero's day. Luckily his wife, Jennifer, and four daughters, Harper, Hannah, Haven and Halle, are always there to save the day. Ben's hobbies include comic books, Alabama football, beekeeping, and humoring Rusty in trivia "competitions".

Articles by Ben:

Nuke the site from orbit. It’s the only way to be sure.

It’s the best line from a movie full of them.

I couldn’t help but think about nuking inhuman monsters from orbit, when I read the PR releases from Prince Andrew and Les Wexner about their “relationship” with Jeffrey Epstein.

Throwing words like “Fraud!” and “Traitor!” around so casually … it doesn’t reveal the true frauds and the true traitors.

It makes it easier for them to hide.

On Tuesday, the Macy’s Narrative was “I think they can make their comps.”

On Wednesday, the Macy’s narrative was “I think they can cover their dividend.”

This is what it means for a narrative to go bad. This is what it means for a story to break.

And when a story breaks, so does the stock. Not just for a little while, but for a loooong time.

Just ask GE.

The news about Jeffrey Epstein’s death on Saturday hit me hard, as did the escalation in the Hong Kong protests over the weekend, as did the collapse in Argentina’s currency and stock market on Monday. As the kids would say, I was shook. And I’m still trying to figure out what I think about all this, both as a citizen and as an investor.

“I’m a superstitious man, and if some unlucky accident should befall him — if he should get shot in the head by a police officer, or if he should hang himself in his jail cell, or if he’s struck by a bolt of lightning — then I’m going to blame some of the people in this room.” – Vito Corleone

Same.

The Nudging State and the Nudging Oligarchy cannot be defeated on a single point of failure like Jeffrey Epstein’s testimony at trial. Or like the bankruptcy of AIG.

But a million effin’ points of failure? A refusal to vote for ridiculous candidates and buy ridiculous securities? A refusal AT SCALE?

Yeah, that can work.

It’s my favorite part of any Batman movie … that scene where the henchman pays a visit to the crazed supervillain – the Joker is the gold standard here – and you just know that the meeting is about to go terribly, terribly awry for the thug.

It’s a funny scene in a movie.

It’s a crappy way to run a country.

The First Horseman was a tightening Fed, and markets suffered its wrath in Q4 last year.

Markets are now suffering the Second Horseman, as China “surprised” markets with a sharp devaluation of the yuan last night in response to higher/broader tariffs that Trump threatened to impose last week.

Here are the questions Rusty and I are asking now, along with our answers …

My point in relating the fable of the Donkey of Guizhou is not that I believe China is the tiger and the United States is the donkey in our current trade-war-going-to-currency-war.

My point in relating the fable of the Donkey of Guizhou is not that I believe the current United States president is a braying donkey in his “easy to win” trade-war-going-to-currency-war.

I mean … I do, but that’s not my point.

My point is that Chinese political leadership believes that they are the tiger and the current United States president is a braying donkey.

The Long Now is everything we pull into the present from our future selves and our children.

We are told that the economic stimulus and the political fear of the Long Now are costless, when in fact they cost us … everything.

Tick-tock.

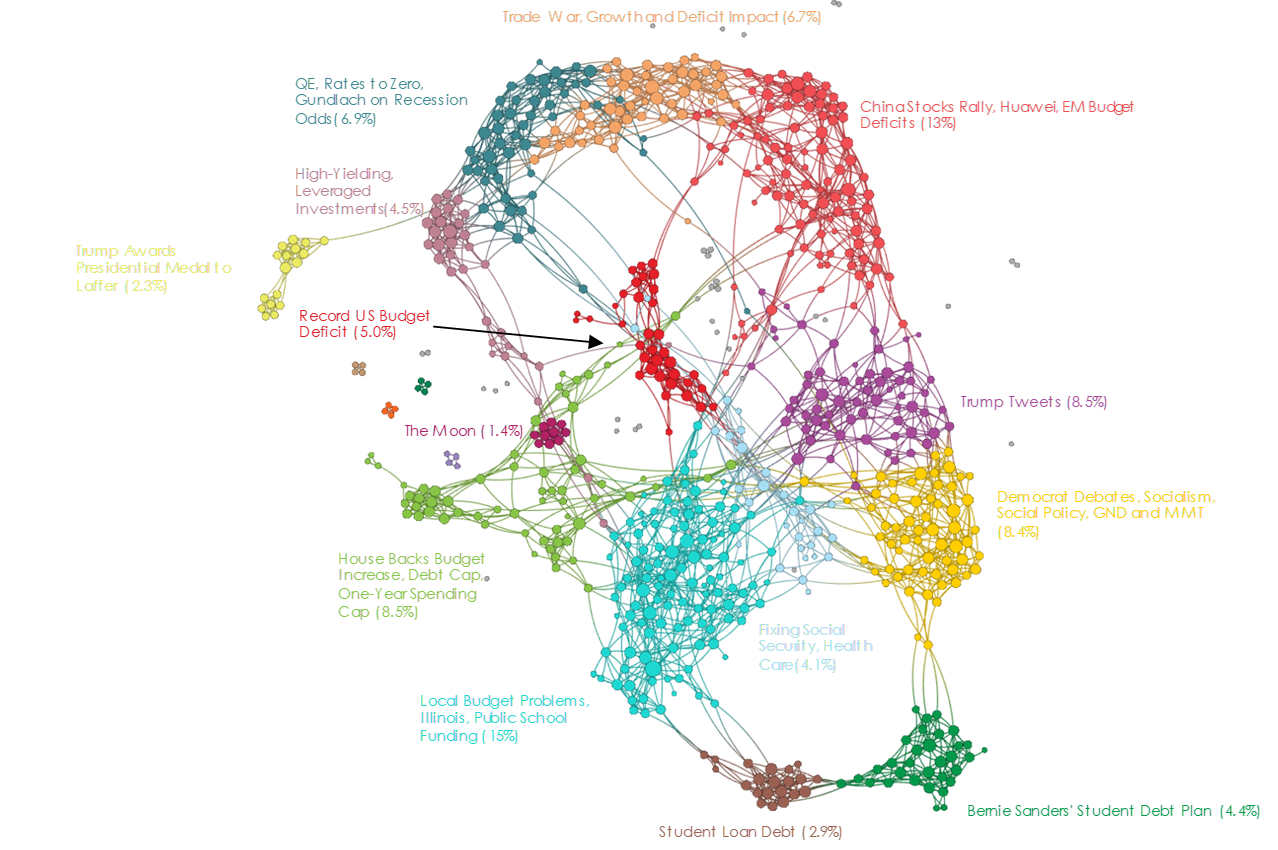

I’ve been looking at narrative maps for a long time now, and I don’t think I’ve ever seen as complacent a market narrative as what our Narrative Machine research is showing around US Fiscal Policy.

Here’s how we analyze this research.