Ben Hunt

Co-Founder and CIO

Ben Hunt is the creator of Epsilon Theory and inspiration behind Second Foundation Partners, which he co-founded with Rusty Guinn in June 2018.

Epsilon Theory, Second Foundation’s principal publishing brand, is a newsletter and website that examines markets through the lenses of game theory and history. Over 100,000 professional investors and allocators across 180 countries read Epsilon Theory for its fresh perspective and novel insights into market dynamics. As Chief Investment Officer, Ben bears primary responsibility for determining the Company’s investment views and positioning of model portfolios. He is also the primary author of materials distributed through Epsilon Theory.

Ben taught political science for 10 years: at New York University from 1991 until 1997 and (with tenure) at Southern Methodist University from 1997 until 2000. He also wrote two academic books: Getting to War (Univ. of Michigan Press, 1997) and Policy and Party Competition (Routledge, 1992), which he co-authored with Michael Laver. Ben is the founder of two technology companies and the co-founder of SmartEquip, Inc., a software company for the construction equipment industry that provides intelligent schematics and parts diagrams to facilitate e-commerce in spare parts.

He began his investment career in 2003, first in venture capital and subsequently on two long/short equity hedge funds. He worked at Iridian Asset Management from 2006 until 2011 and TIG Advisors from 2012 until 2013. He joined Rusty at Salient in 2013, where he combined his background as a portfolio manager, risk manager, and entrepreneur with academic experience in game theory and econometrics to work with Salient’s own portfolio managers and its financial advisor clients to improve client outcomes.

Ben is a graduate of Vanderbilt University (1986) and earned his Ph.D. in Government from Harvard University in 1991. He lives in the wilds of Redding, CT on Little River Farm, where he personifies the dilettante farmer that has been a stock comedic character since Cicero's day. Luckily his wife, Jennifer, and four daughters, Harper, Hannah, Haven and Halle, are always there to save the day. Ben's hobbies include comic books, Alabama football, beekeeping, and humoring Rusty in trivia "competitions".

Articles by Ben:

Containment has failed. And so now we must fight.

That means doing everything possible to bolster our healthcare systems BEFORE the need overwhelms the capacity.

That means calling out our leaders for their corrupt political responses to date, and forcing them through our outcry to adopt an effective virus-fighting policy for OUR benefit, not theirs.

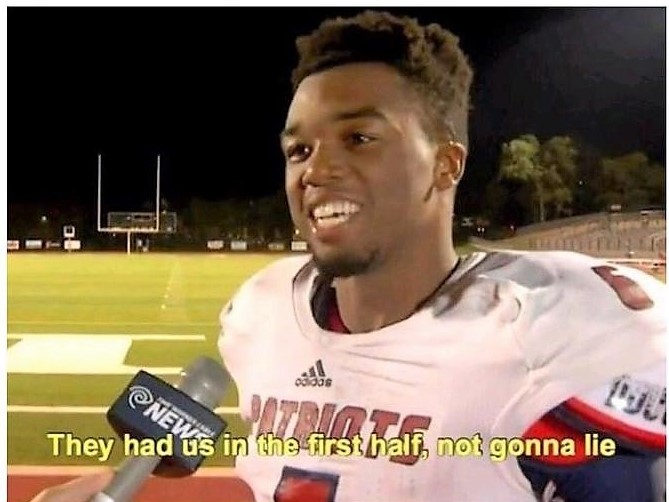

Not gonna lie … this virus got us in the first half.

But if we prepare and strengthen our healthcare systems NOW, particularly in cities like Jakarta, we can still win the game.

Within a few months, the reality of COVID-19 will overtake the propaganda of the CCP and their toadies at the World Health Organization, as real-world companies begin making real-world economic decisions to maintain their enterprises in the face of a real-world threat.

Those decisions will be led by sports franchises.

To date, WHO leadership has simply been part of the Chinese narrative machine.

It’s not just a betrayal of the researchers and clinicians who do important work under WHO auspices. It’s a betrayal of the world.

Two narratives jumped sharply in structural attention scores over the past few months.

One is something we’ve already written a lot about – Inflation.

The other is something we’re writing a lot about now – China is lying with its nCov2019 data.

China is fighting nCov2019 exactly like the US fought North Vietnam … with policy driven more by narrative control than by what’s best to win the war.

That was a disastrous strategic mistake for the US then, and it’s a disastrous strategic mistake for China today.

Every once in a while, narrative-world gives you a gift that just keeps on giving. So it is with outgoing CEO Ginni Rometty’s regime of despair at IBM.

Today my focus is on the IBM-sponsored hagiography that is springing up like slime molds on the underside of rotting swamp cabbages.

Outgoing IBM CEO Ginni Rometty has filed 167 SEC Form 4s detailing her stock transactions in the company.

So I downloaded and compiled all of them to see how much money she has sucked out of IBM, just like I did for outgoing Boeing CEO Dennis Muilenburg.

There is a median narrative theorem that can serve as a central pillar of a NEW approach to social choice theory, an approach less pedantic in its assumptions about human nature and less naive in its assumptions about modes of social power.

The median narrative theorem generates powerful predictive hypotheses about elections, hypotheses that predicted Trump’s Republican primary victory in 2016 and – if current data holds – predicts Sanders’ Democratic primary victory in 2020.

Forget about impeachment and its partisan Kabuki theater. It’s a joke.

If there’s some rich dude who bought his way onto that Wuhan evacuation flight, and you know there is … if this Administration is forsaking its ONE JOB to protect American citizens, and you know they are …

THAT’S what brings down this government.