Ben Hunt

Co-Founder and CIO

Ben Hunt is the creator of Epsilon Theory and inspiration behind Second Foundation Partners, which he co-founded with Rusty Guinn in June 2018.

Epsilon Theory, Second Foundation’s principal publishing brand, is a newsletter and website that examines markets through the lenses of game theory and history. Over 100,000 professional investors and allocators across 180 countries read Epsilon Theory for its fresh perspective and novel insights into market dynamics. As Chief Investment Officer, Ben bears primary responsibility for determining the Company’s investment views and positioning of model portfolios. He is also the primary author of materials distributed through Epsilon Theory.

Ben taught political science for 10 years: at New York University from 1991 until 1997 and (with tenure) at Southern Methodist University from 1997 until 2000. He also wrote two academic books: Getting to War (Univ. of Michigan Press, 1997) and Policy and Party Competition (Routledge, 1992), which he co-authored with Michael Laver. Ben is the founder of two technology companies and the co-founder of SmartEquip, Inc., a software company for the construction equipment industry that provides intelligent schematics and parts diagrams to facilitate e-commerce in spare parts.

He began his investment career in 2003, first in venture capital and subsequently on two long/short equity hedge funds. He worked at Iridian Asset Management from 2006 until 2011 and TIG Advisors from 2012 until 2013. He joined Rusty at Salient in 2013, where he combined his background as a portfolio manager, risk manager, and entrepreneur with academic experience in game theory and econometrics to work with Salient’s own portfolio managers and its financial advisor clients to improve client outcomes.

Ben is a graduate of Vanderbilt University (1986) and earned his Ph.D. in Government from Harvard University in 1991. He lives in the wilds of Redding, CT on Little River Farm, where he personifies the dilettante farmer that has been a stock comedic character since Cicero's day. Luckily his wife, Jennifer, and four daughters, Harper, Hannah, Haven and Halle, are always there to save the day. Ben's hobbies include comic books, Alabama football, beekeeping, and humoring Rusty in trivia "competitions".

Articles by Ben:

Media attention to an inflation Narrative turned dramatically in December, and I see signs of it continuing to accelerate to the upside here in January, particularly in sell-side analysis and reports.

This a classic “Emerging Narrative” set-up. We are a couple of CNBC Missionary statements away from everyone knowing that everyone knows that inflation is off and running.

So I downloaded and compiled every SEC Form 4 filing that former Boeing CEO Dennis Muilenburg has ever made, to answer one simple question:

How much money did Dennis Muilenburg suck out of Boeing over the last ten years?

I feel like the Billy Crystal character in Analyze This all the time. There’s always some mob boss politician or central banker or CEO or asset manager pinching my cheek and telling me that it’s all gonna be okay, that I’ve just gotta understand how things are.

My god, I am so tired of having my cheek pinched. I am so tired of being nudged in such an artless, heavy-handed way. I am so tired of being told that 2 + 2 = 5.

Every year, I try to put together a series of notes that captures where I think we are, from both a political and investment perspective. This year, that series is The Long Now. I’ve compiled the four notes in that series into a single PDF, attached here.

We need to get together and talk about all this.

The Long Now has severed the tether between taxation and spending – the most important macroeconomic policy relationship in our social lives as both investors and citizens.

Here’s what that means.

And here’s what we’re going to do about it.

If you don’t see that there is one set of rules for the very rich and another set of rules for everyone else … if you don’t see that there is an unaccountable political power that accrues to the very rich in both big social ways and in small personal ways … well, you’re just not paying attention.

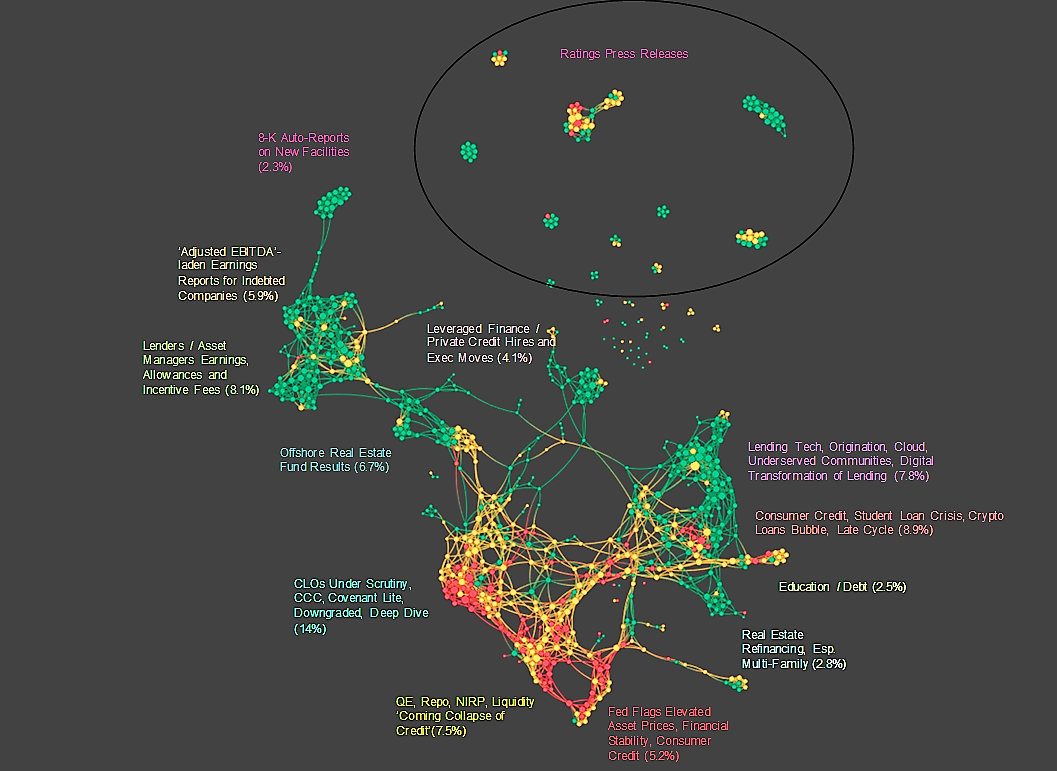

We’re relaunching a Debt and Credit narrative Monitor on ET Pro, as we’ve made some advances in formulating search queries to capture a meaningful signal from all the noise. If you’re involved in FI or credit markets, you’ll want to check this out.

Also, the 2019 Cohesion Crash in macro narratives continues to accelerate, with (I think) important implications for asymmetric trade opportunities.

Regardless of your personal views pro or con, if you don’t see that a powerful narrative backlash is forming against corporate management enrichment, you’re just not paying attention.

The heart of narrative-world is quivering without a stable rhythm of beat of any sort. It’s an expansion of the Silly Season I wrote about in November, with zero investable narratives to be found.

Last month I asked a question: At what point, if ever, do political narratives about Inflation and Fiscal Policy become market narratives about Inflation and Fiscal Policy?

I’ve got an answer now, but you’re not going to like it.

It’s so weird that everyone who would throw an unholy temper tantrum at – gasp! – rent-controlled apartments is just fine with rent-controlled money.

“Yay, crumbs!”