Ben Hunt

Co-Founder and CIO

Ben Hunt is the creator of Epsilon Theory and inspiration behind Second Foundation Partners, which he co-founded with Rusty Guinn in June 2018.

Epsilon Theory, Second Foundation’s principal publishing brand, is a newsletter and website that examines markets through the lenses of game theory and history. Over 100,000 professional investors and allocators across 180 countries read Epsilon Theory for its fresh perspective and novel insights into market dynamics. As Chief Investment Officer, Ben bears primary responsibility for determining the Company’s investment views and positioning of model portfolios. He is also the primary author of materials distributed through Epsilon Theory.

Ben taught political science for 10 years: at New York University from 1991 until 1997 and (with tenure) at Southern Methodist University from 1997 until 2000. He also wrote two academic books: Getting to War (Univ. of Michigan Press, 1997) and Policy and Party Competition (Routledge, 1992), which he co-authored with Michael Laver. Ben is the founder of two technology companies and the co-founder of SmartEquip, Inc., a software company for the construction equipment industry that provides intelligent schematics and parts diagrams to facilitate e-commerce in spare parts.

He began his investment career in 2003, first in venture capital and subsequently on two long/short equity hedge funds. He worked at Iridian Asset Management from 2006 until 2011 and TIG Advisors from 2012 until 2013. He joined Rusty at Salient in 2013, where he combined his background as a portfolio manager, risk manager, and entrepreneur with academic experience in game theory and econometrics to work with Salient’s own portfolio managers and its financial advisor clients to improve client outcomes.

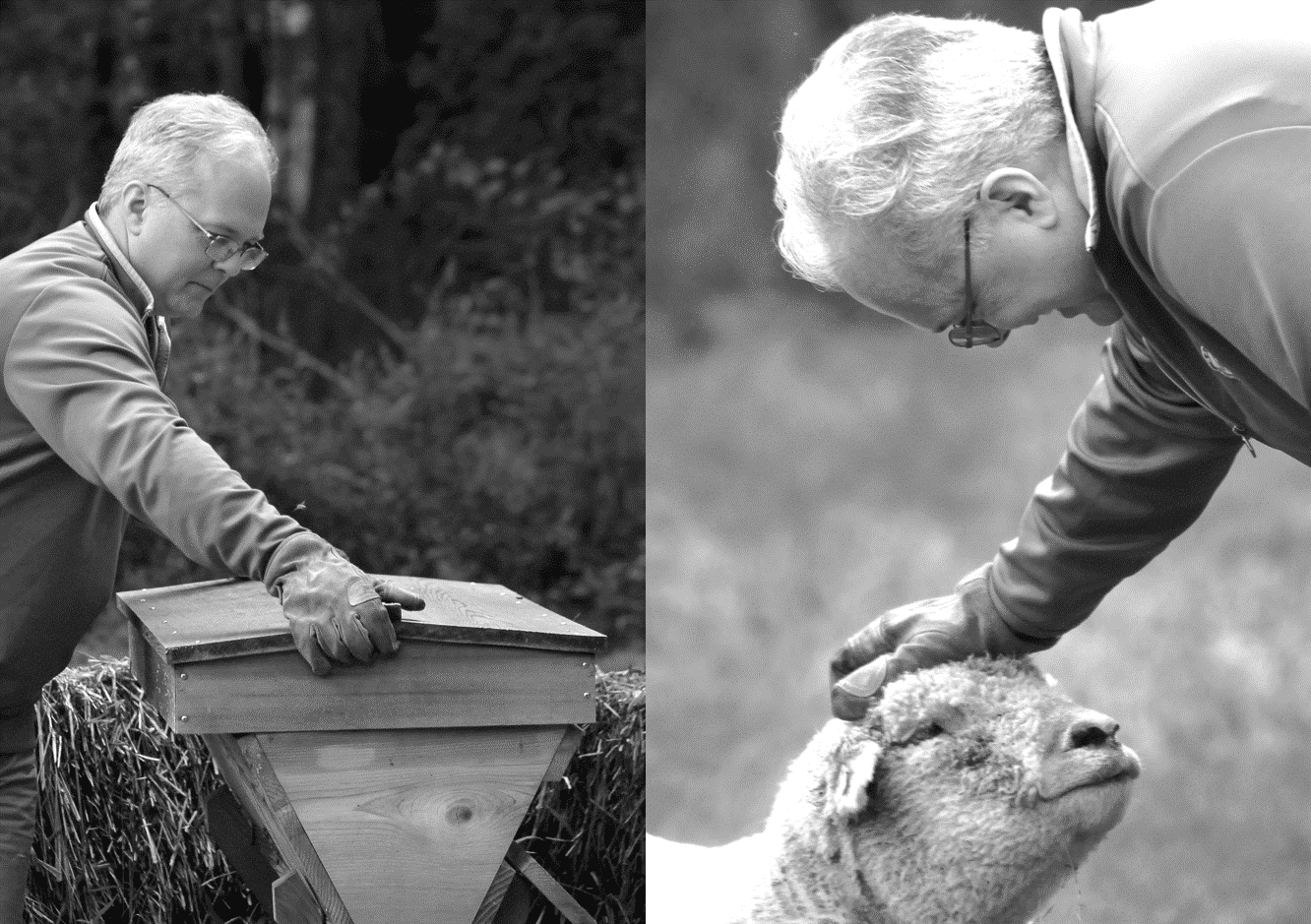

Ben is a graduate of Vanderbilt University (1986) and earned his Ph.D. in Government from Harvard University in 1991. He lives in the wilds of Redding, CT on Little River Farm, where he personifies the dilettante farmer that has been a stock comedic character since Cicero's day. Luckily his wife, Jennifer, and four daughters, Harper, Hannah, Haven and Halle, are always there to save the day. Ben's hobbies include comic books, Alabama football, beekeeping, and humoring Rusty in trivia "competitions".

Articles by Ben:

For compliance and replay purposes, we’re asking participants to register beforehand (name and email address) for our Zoom webinar on Weds, June 26 at 4p ET, where I’ll be walking through my long vol / tail risk scenarios for 2025.

Registration link in post.

My spidey-sense for major systemic risk has sounded an internal alarm three times in my investment career. Once in Q4 2007 over alt-a and subprime RMBS. Once in Jan/Feb 2020 over Covid. And today.

I’d like to invite all Epsilon Theory Professional subscribers to join me on Wednesday, June 26 at 4pm EST to review the full thesis – the triple systemic risk thesis – and how I’m thinking about trading it.

I continue to feel like it’s 2007 all over again, and I’m looking forward to talking this Friday about how we prepare for the 2008 corollary.

Here’s the question we need to ask in order to evaluate the systemic risks of a fundamental change in the provision of credit to the US economy, from highly regulated commercial banks to less regulated asset managers:

How do non-bank private credit issuers fund themselves?

What’s happening today is not only a war between commercial banks and asset managers over credit provision to large US companies, it’s also a war between bank asset managers and non-bank asset managers over investment flows.

Lots of people are going to be squashed beneath the feet of these behemoths or crushed by the collateral damage of their combat. Let’s work together so that it’s not any of us.

The Fed is looking for an excuse to cut, and as soon as they have that excuse, they will.

There are two possible Narrative excuses, one immediate and one with a slower fuse …

My spidey-sense is no longer tingling like crazy about the overall rise in scale and scope of private credit. It’s a profound shift in the core social function of credit provision to the real economy, but I think it moves systemic risk around rather than creating new systemic risk.

The associated transformation of the insurance industry, on the other hand …

It doesn’t happen often, but every few years there’s a real-world shock that leaves the old narrative structures standing but eliminates all the people who believe strongly in them. These events are like neutron bombs for narrative-world, and that’s how I’d describe Iran’s attack on Israel this weekend.

If you were a smart guy like MicroStrategy CEO Michael Saylor and you thought a stagflationary tsunami of enormous proportion was going to wash over the US economy regardless of who wins in November, what would you be doing right now?

I think you might be doing whatever you can to get liquid in the global reserve currency without spooking the marks.

I think everyone in Washington and on Wall Street is in the bag for nominal growth (ie, number-go-up) by any means necessary through November.

Washington is in the bag because their world ends if they don’t win in November. Wall Street is in the bag because it’s their last chance for a big score before a stagflationary vol event of enormous proportion hits the economy regardless of who wins in November.