Ben Hunt

Co-Founder and CIO

Ben Hunt is the creator of Epsilon Theory and inspiration behind Second Foundation Partners, which he co-founded with Rusty Guinn in June 2018.

Epsilon Theory, Second Foundation’s principal publishing brand, is a newsletter and website that examines markets through the lenses of game theory and history. Over 100,000 professional investors and allocators across 180 countries read Epsilon Theory for its fresh perspective and novel insights into market dynamics. As Chief Investment Officer, Ben bears primary responsibility for determining the Company’s investment views and positioning of model portfolios. He is also the primary author of materials distributed through Epsilon Theory.

Ben taught political science for 10 years: at New York University from 1991 until 1997 and (with tenure) at Southern Methodist University from 1997 until 2000. He also wrote two academic books: Getting to War (Univ. of Michigan Press, 1997) and Policy and Party Competition (Routledge, 1992), which he co-authored with Michael Laver. Ben is the founder of two technology companies and the co-founder of SmartEquip, Inc., a software company for the construction equipment industry that provides intelligent schematics and parts diagrams to facilitate e-commerce in spare parts.

He began his investment career in 2003, first in venture capital and subsequently on two long/short equity hedge funds. He worked at Iridian Asset Management from 2006 until 2011 and TIG Advisors from 2012 until 2013. He joined Rusty at Salient in 2013, where he combined his background as a portfolio manager, risk manager, and entrepreneur with academic experience in game theory and econometrics to work with Salient’s own portfolio managers and its financial advisor clients to improve client outcomes.

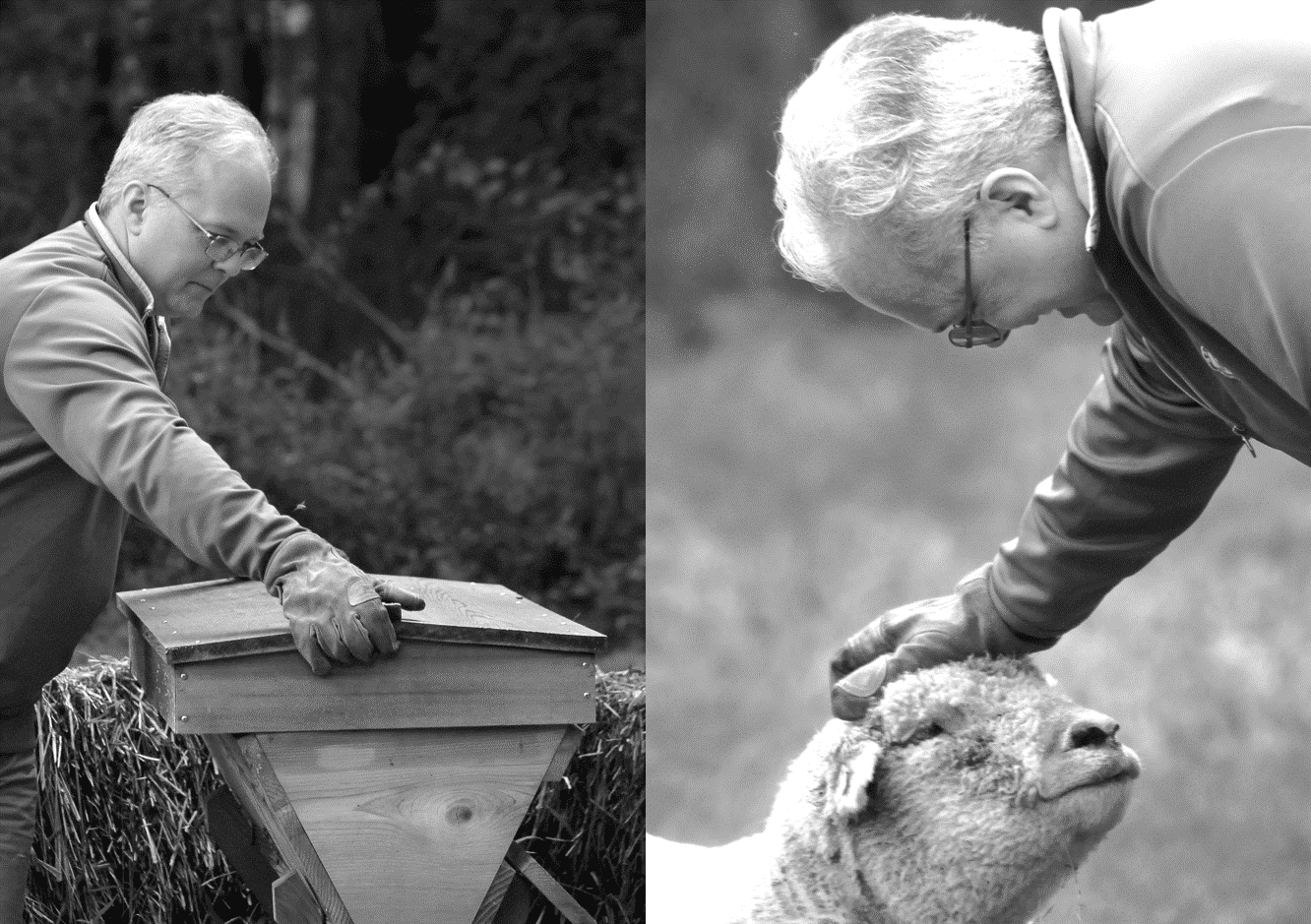

Ben is a graduate of Vanderbilt University (1986) and earned his Ph.D. in Government from Harvard University in 1991. He lives in the wilds of Redding, CT on Little River Farm, where he personifies the dilettante farmer that has been a stock comedic character since Cicero's day. Luckily his wife, Jennifer, and four daughters, Harper, Hannah, Haven and Halle, are always there to save the day. Ben's hobbies include comic books, Alabama football, beekeeping, and humoring Rusty in trivia "competitions".

Articles by Ben:

The closing of the American mind is evolving into its next stage: the welding shut of the American mind.

What’s the difference between closing and welding shut? A closed door can be opened. A welded shut door cannot. We can’t save the minds already lost. We can only prevent our OWN minds from being welded shut.

And we can. Together.

My RBG story …

I thought she’d be all about women’s rights and legal theory this and legal theory that. I was SO wrong.

RBG’s death is an enormous loss for the UNITED States of America.

The go-to move by sophists like Vox and Trump is to claim that “many people” are asserting their made-up premise that justifies an otherwise ludicrous position.

Why do they do this? Because it works.

Why does it work? Because Common Knowledge game. Because of the power of the crowd watching the crowd.

It’s been a full year since I wrote my last Mailbag note, which is kinda pathetic.

Well, better late than never. Reader comments and emails following our publication of Lucifer’s Hammer have been amazing, and it would be a disservice to the Pack if I didn’t collect some of them here. Enjoy!

I’m not saying that we all have to become volatility traders to survive in the market jungle today, any more than we all have to become game theorists to avoid being the sucker at the Fed’s communication policy table.

But if you’re a traditional investor whose sandbox includes big markets like the S&P 500, then you’re only disadvantaging yourself by ignoring this stuff.

I don’t know if this is what SoftBank did.

But this is how I would do it.

Although I wouldn’t because I think it’s probably illegal.

Recent price action in Tesla is the Common Knowledge Game in action.

It is the power of the crowd watching the crowd. It is the power of – not what you think is true, and not what you think the crowd thinks is true – but of what the crowd thinks the crowd thinks is true.

My take on the “massive” VIX election premium? Not massive enough.

This isn’t a “fiscal cliff” we’re talking, which was about as manufactured a “crisis” as I’ve seen. This is an honest to god non-trivial chance that we have an intractably disputed election and Constitutional crisis in the United States, against a backdrop of widespread violence in American cities. If that sounds like a VIX of 30 to you … well, bless your heart.

There’s a comet speeding our way, a comet of endemic urban violence.

And for so many people – especially young men with the voice of Ego now shouting in their heads as the whispers are turned up to 11 by the amps of political party and social media – they think that post-apocalyptic world sounds just dandy.

Massive real-world household formation growth + positively correlated stock and bond prices + ZIRP forever and ever amen = an inflationary shock to your portfolio.

I don’t know when, and I don’t think it happens before the election, but this is the recipe.

The time to start preparing your portfolio for an inflationary shock and the havoc it will wreak on what you think is a well-diversified portfolio of stocks and bonds is NOW.