Ben Hunt

Co-Founder and CIO

Ben Hunt is the creator of Epsilon Theory and inspiration behind Second Foundation Partners, which he co-founded with Rusty Guinn in June 2018.

Epsilon Theory, Second Foundation’s principal publishing brand, is a newsletter and website that examines markets through the lenses of game theory and history. Over 100,000 professional investors and allocators across 180 countries read Epsilon Theory for its fresh perspective and novel insights into market dynamics. As Chief Investment Officer, Ben bears primary responsibility for determining the Company’s investment views and positioning of model portfolios. He is also the primary author of materials distributed through Epsilon Theory.

Ben taught political science for 10 years: at New York University from 1991 until 1997 and (with tenure) at Southern Methodist University from 1997 until 2000. He also wrote two academic books: Getting to War (Univ. of Michigan Press, 1997) and Policy and Party Competition (Routledge, 1992), which he co-authored with Michael Laver. Ben is the founder of two technology companies and the co-founder of SmartEquip, Inc., a software company for the construction equipment industry that provides intelligent schematics and parts diagrams to facilitate e-commerce in spare parts.

He began his investment career in 2003, first in venture capital and subsequently on two long/short equity hedge funds. He worked at Iridian Asset Management from 2006 until 2011 and TIG Advisors from 2012 until 2013. He joined Rusty at Salient in 2013, where he combined his background as a portfolio manager, risk manager, and entrepreneur with academic experience in game theory and econometrics to work with Salient’s own portfolio managers and its financial advisor clients to improve client outcomes.

Ben is a graduate of Vanderbilt University (1986) and earned his Ph.D. in Government from Harvard University in 1991. He lives in the wilds of Redding, CT on Little River Farm, where he personifies the dilettante farmer that has been a stock comedic character since Cicero's day. Luckily his wife, Jennifer, and four daughters, Harper, Hannah, Haven and Halle, are always there to save the day. Ben's hobbies include comic books, Alabama football, beekeeping, and humoring Rusty in trivia "competitions".

Articles by Ben:

Three times in my professional life as an investor, I have felt a trade in my bones, by which I mean a certainty that there is a massive disjuncture between a real world poised for sharp secular decline and a market world at buoyant Narrative highs. The first time was in the summer of 2008. The second time was in February of 2020. The third time is today.

In the summer of 2008 and February of 2020 I saw the trade to, yes, make money from those real world calamities. I do NOT see the trade here.

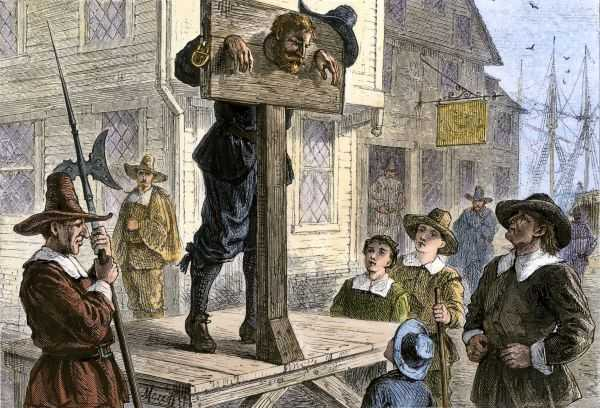

Polls create the plays. Election models create the score. Fivey Fox and “Nate Silver” announce the game. All to create engagement with a diversified media corporation.

No one understands how to create and sell a spectator sport better than Disney.

The insight of Schrödinger’s Cat is that the cat is alive AND the cat is dead before the box is opened. It’s not merely unknown whether the cat is alive or dead. The cat is actually alive AND actually dead at the same time.

In our real-life world of investing in markets, we frequently deal with real-life cats that are both alive AND dead at the same time. Like US Treasuries.

Three weeks ago, I didn’t see a narrative path for Trump to win a turnout-based election hinging on four or five swing states.

Today I do.

It’s the same funny feeling I got in 2016, but with a twist.

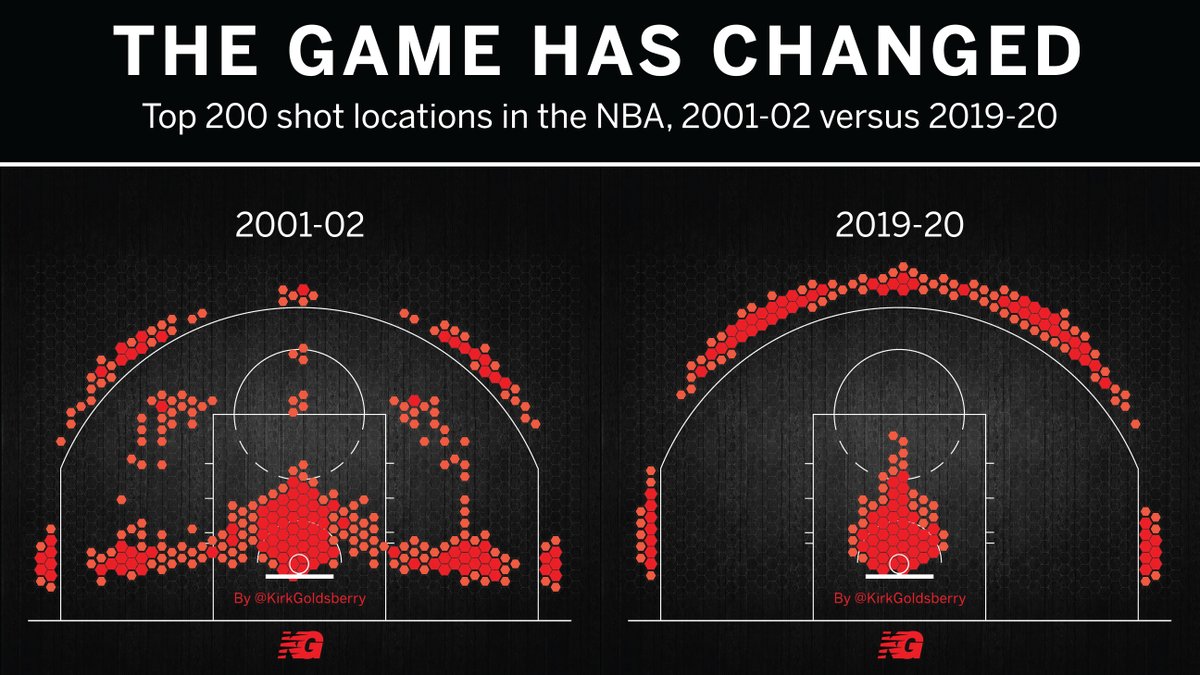

Once Daryl Morey’s new idea became the Common Knowledge of the NBA – once everyone knows that everyone knows that the way to win NBA games is to maximize 3-point shots and lay-ups – then it became a permanent feature of the way professional basketball is played. It became an equilibrium.

It’s exactly the same with politics.

Every once in a very rare while, we see what we call a Missionary statement (an action or a speech by a famous person or organization on a ubiquitous media platform) that has the potential to change the Common Knowledge (what everyone believes that everyone believes) about an important aspect of our investment lives.

Here’s one.

Sometimes a grift isn’t in what you say, but in the difference in what you say to different audiences.

It’s not the information. It’s the meta information.

We are only given the world once. Usually that’s not a big deal from an investing standpoint, because the possible parallel universes aren’t that far apart in their market consequences. Over the next three weeks (and maybe longer than that!), the fact that we are only given the world once is a very big deal indeed.

The frustrated money manager is almost always a smart, accomplished professional in his own field who believes VERY much in the existence of The Smart Money ™.

The frustrated money manager is almost always a liiiittttle bit on the make.

Like a Vatican cardinal.

Markets happen at the margins. So does narrative impact on the market.

That’s important for understanding our semi-bearish narrative monitor signals here in October, as well as for understanding why they may not matter very much right now.