Ben Hunt

Co-Founder and CIO

Ben Hunt is the creator of Epsilon Theory and inspiration behind Second Foundation Partners, which he co-founded with Rusty Guinn in June 2018.

Epsilon Theory, Second Foundation’s principal publishing brand, is a newsletter and website that examines markets through the lenses of game theory and history. Over 100,000 professional investors and allocators across 180 countries read Epsilon Theory for its fresh perspective and novel insights into market dynamics. As Chief Investment Officer, Ben bears primary responsibility for determining the Company’s investment views and positioning of model portfolios. He is also the primary author of materials distributed through Epsilon Theory.

Ben taught political science for 10 years: at New York University from 1991 until 1997 and (with tenure) at Southern Methodist University from 1997 until 2000. He also wrote two academic books: Getting to War (Univ. of Michigan Press, 1997) and Policy and Party Competition (Routledge, 1992), which he co-authored with Michael Laver. Ben is the founder of two technology companies and the co-founder of SmartEquip, Inc., a software company for the construction equipment industry that provides intelligent schematics and parts diagrams to facilitate e-commerce in spare parts.

He began his investment career in 2003, first in venture capital and subsequently on two long/short equity hedge funds. He worked at Iridian Asset Management from 2006 until 2011 and TIG Advisors from 2012 until 2013. He joined Rusty at Salient in 2013, where he combined his background as a portfolio manager, risk manager, and entrepreneur with academic experience in game theory and econometrics to work with Salient’s own portfolio managers and its financial advisor clients to improve client outcomes.

Ben is a graduate of Vanderbilt University (1986) and earned his Ph.D. in Government from Harvard University in 1991. He lives in the wilds of Redding, CT on Little River Farm, where he personifies the dilettante farmer that has been a stock comedic character since Cicero's day. Luckily his wife, Jennifer, and four daughters, Harper, Hannah, Haven and Halle, are always there to save the day. Ben's hobbies include comic books, Alabama football, beekeeping, and humoring Rusty in trivia "competitions".

Articles by Ben:

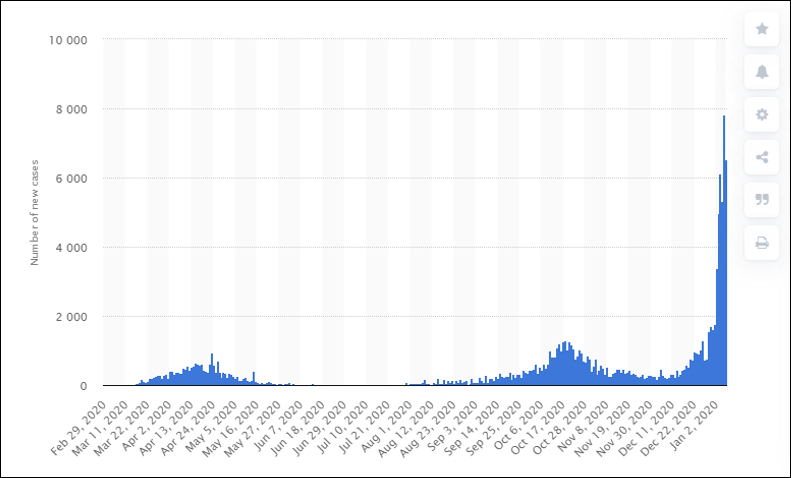

I believe there is a non-trivial chance that the United States will experience a rolling series of “Ireland events” over the next 30-45 days, where the Covid effective reproductive number (Re not R0) reaches a value between 2.4 and 3.0 in states and regions where a) the more infectious UK-variant (or similar) Covid strain has been introduced, and b) Covid fatigue has led to deterioration in social distancing behaviors.

Right now, Wall Street is trying to identify which inflation Narrative will be an investment thesis that makes lots of people nod their heads.

Recognizing THAT – and maybe even trying to get ahead of THAT – is how you play the game of markets successfully.

On Christmas Day, Nashville was attacked by a suicide bomber terrorist. But not by a “Suicide Bomber”. Not by a “Terrorist”.

Why not? Because his terrorist goals didn’t fit neatly into a useful political narrative like “Antifa!” or “Proud Boys!”

Here’s what this looks like in The Narrative Machine.

A conversation with Brian Portnoy, author of The Geometry of Wealth, about the role of money in shaping a life of meaning. How do we give better advice about money to others … and to ourselves?

This weekend’s regulatory news on Bitcoin is a big step forward in creating “flow” in the form of a highly liquid, easily transacted financial product that Wall Street can administer. But it’s a death knell for any “revolutionary” application for Bitcoin, as it becomes just another highly regulated game in the Wall Street casino.

We are seeing language in both the Central Bank and Security Analysis narrative regimes that would have been unthinkable even a few months ago, language that is market-negative. It’s not enough to change the market-positive narrative regimes in place today, but it’s definitely enough to make my risk antennae start to tingle.

In this kick-off Epsilon Theory webcast, I’m joined by renowned cryptocurrency miner and trader @notsofast for a wide-ranging conversation on Bitcoin and crypto. Here’s the core topic:

Can Bitcoin preserve its revolutionary potential after a Wall Street bear hug?

I’m highly skeptical, but @notsofast has some ideas on how to make this work.

Wall Street is redefining Bitcoin to be an Inflation Hedge™ product.

This is how Wall Street creates flow. This is how Wall Street makes money. All that stands in the way is the unregulated nature of Bitcoin. So that’s gonna change.

The Wall Street narrative machine is in overdrive to create a “Yay, Value!” rally here at year-end.

Like any effective advertising campaign, it will work. I’m not saying this rally isn’t real.

I’m saying that you should reconsider what “real” means.

The American Medical Association is not a charitable organization.

The American Medical Association is not an educational organization.

The American Medical Association is a tax-exempt hedge fund and licensing corporation, designed from the ground up to enrich its executives and serve its own bureaucratic interests.

Burn. It. The. Fuck. Down.