Ben Hunt

Co-Founder and CIO

Ben Hunt is the creator of Epsilon Theory and inspiration behind Second Foundation Partners, which he co-founded with Rusty Guinn in June 2018.

Epsilon Theory, Second Foundation’s principal publishing brand, is a newsletter and website that examines markets through the lenses of game theory and history. Over 100,000 professional investors and allocators across 180 countries read Epsilon Theory for its fresh perspective and novel insights into market dynamics. As Chief Investment Officer, Ben bears primary responsibility for determining the Company’s investment views and positioning of model portfolios. He is also the primary author of materials distributed through Epsilon Theory.

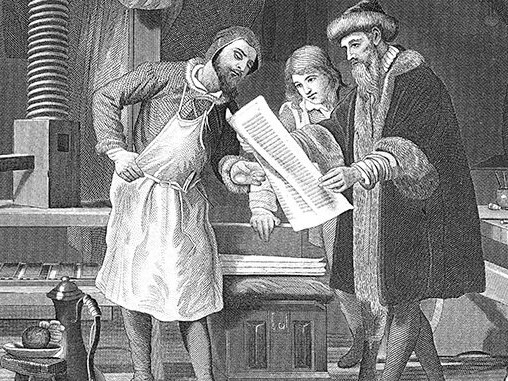

Ben taught political science for 10 years: at New York University from 1991 until 1997 and (with tenure) at Southern Methodist University from 1997 until 2000. He also wrote two academic books: Getting to War (Univ. of Michigan Press, 1997) and Policy and Party Competition (Routledge, 1992), which he co-authored with Michael Laver. Ben is the founder of two technology companies and the co-founder of SmartEquip, Inc., a software company for the construction equipment industry that provides intelligent schematics and parts diagrams to facilitate e-commerce in spare parts.

He began his investment career in 2003, first in venture capital and subsequently on two long/short equity hedge funds. He worked at Iridian Asset Management from 2006 until 2011 and TIG Advisors from 2012 until 2013. He joined Rusty at Salient in 2013, where he combined his background as a portfolio manager, risk manager, and entrepreneur with academic experience in game theory and econometrics to work with Salient’s own portfolio managers and its financial advisor clients to improve client outcomes.

Ben is a graduate of Vanderbilt University (1986) and earned his Ph.D. in Government from Harvard University in 1991. He lives in the wilds of Redding, CT on Little River Farm, where he personifies the dilettante farmer that has been a stock comedic character since Cicero's day. Luckily his wife, Jennifer, and four daughters, Harper, Hannah, Haven and Halle, are always there to save the day. Ben's hobbies include comic books, Alabama football, beekeeping, and humoring Rusty in trivia "competitions".

Articles by Ben:

What made Bitcoin special is nearly lost, and what remains is a false and constructed narrative that exists in service to Wall Street and Washington rather than in resistance.

The Bitcoin narrative must be renewed. And that will change everything.

I’m building a target list of individual companies where I want to do further research in developing a dedicated short or long-vol portfolio with highly asymmetric risk/reward qualities. Here’s what I’ve found so far.

How do we change the world? Not through corporations and political parties from the top-down, but through free-thinking citizens from the bottom-up. Not as an alienated flock, but as a cooperative pack. Not with abstractions and transactions, but with making, protecting and teaching.

Let’s gooooooo!

Here’s what we’re reading and working on this week at Epsilon Theory.

We are now more than 900 Pack members strong on the ET Forum, with more than 1,000 posts contributed by smart, clear-eyed, full-hearted people from all over the world and all walks of life. Like you.

Here, I’ll show you. Here is some of the best and most thoughtful content on the internet today.

Here is the Mailbag that we need.

Here is the Mailbag that we deserve.

The hallmark of Information Theory is this: information is neither true nor false; it is only more or less powerful, with power defined by how much it changes your mind from what you believed before.

For stocks to go up on good news, there must be a negative story of woe and doubt that the good news “overcomes”.

The internal narrative consistency – cohesion in Narrative Machine-speak – changed dramatically in both our Central Bank and Security Analysis Methods monitors this month. This is the necessary next step in the creation of market Common Knowledge and (I suspect) a longer-term investable trade/direction for markets.

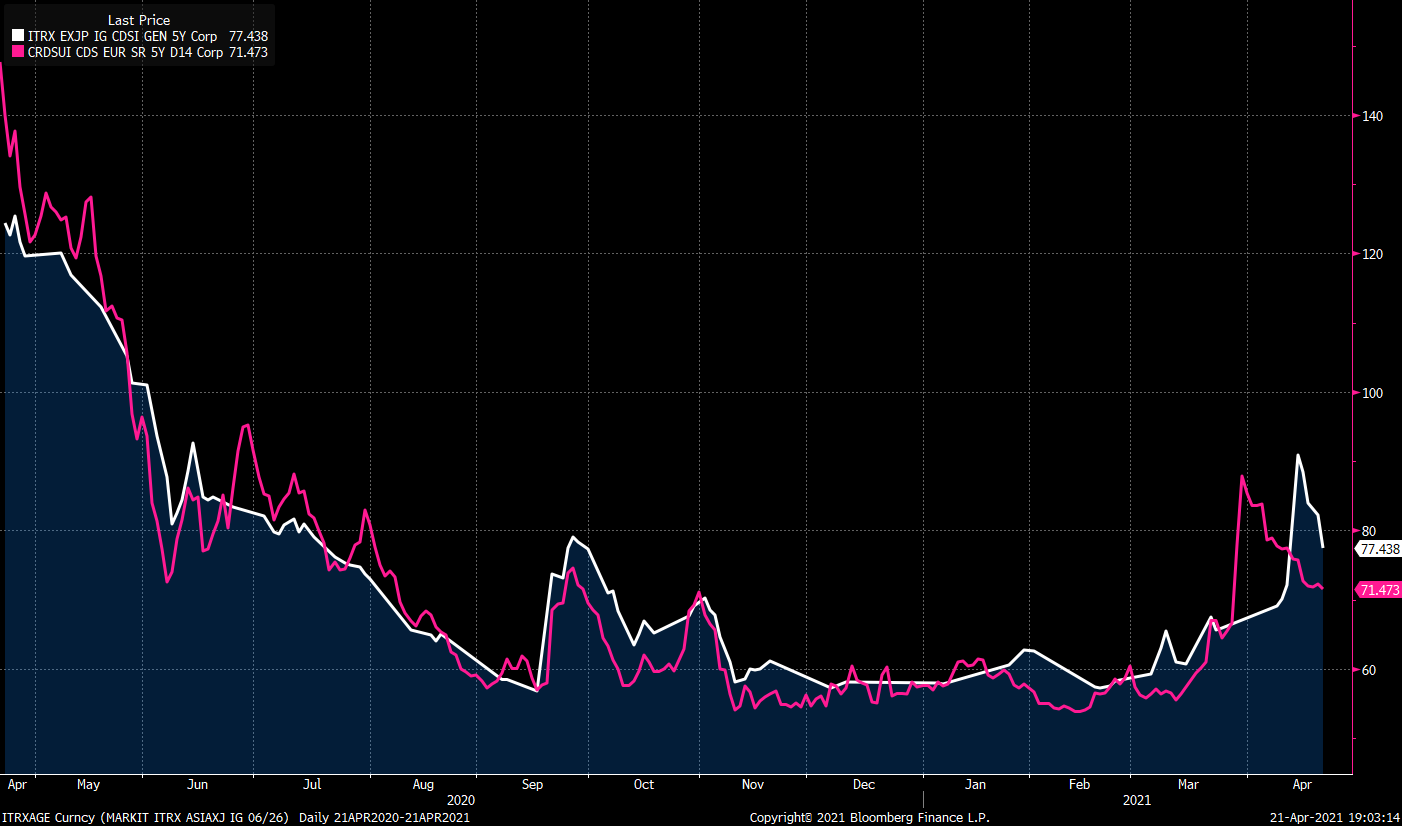

Three blow-ups in three months: Archegos, Greensill, and Melvin Capital.

What do they have in common? Insane leverage employed to maximize private gain while socializing potential losses.

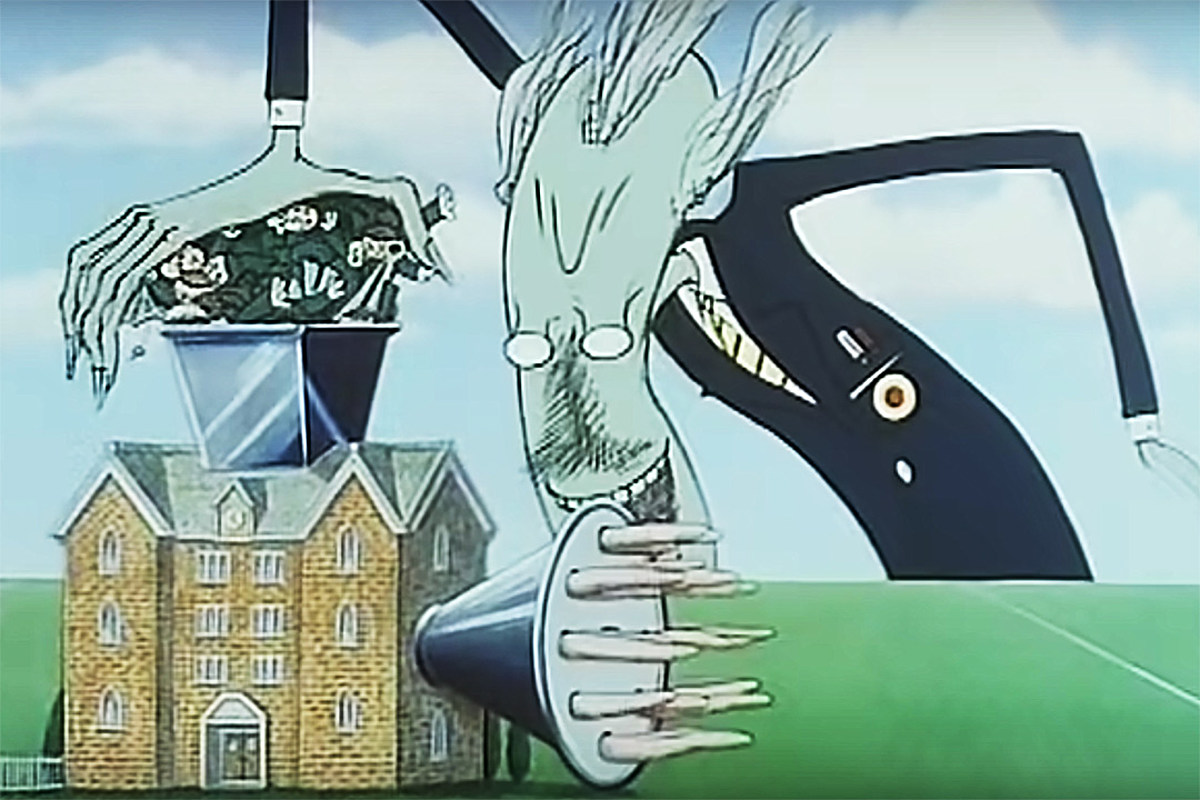

What do you get when you give a Raccoon billions of dollars AND invisibility from regulators? Collusion and insider trading.

There is a tide that is flowing out today, and it’s revealing Lex Greensill and Bill Hwang just as surely as it revealed Jeff Skilling in 2001 and Bernie Madoff in 2008. The big trade around Skilling and Madoff wasn’t directly on their specific scams and frauds, but on what their specific scams and frauds showed us about systemic rot in the financial system.