Ben Hunt

Co-Founder and CIO

Ben Hunt is the creator of Epsilon Theory and inspiration behind Second Foundation Partners, which he co-founded with Rusty Guinn in June 2018.

Epsilon Theory, Second Foundation’s principal publishing brand, is a newsletter and website that examines markets through the lenses of game theory and history. Over 100,000 professional investors and allocators across 180 countries read Epsilon Theory for its fresh perspective and novel insights into market dynamics. As Chief Investment Officer, Ben bears primary responsibility for determining the Company’s investment views and positioning of model portfolios. He is also the primary author of materials distributed through Epsilon Theory.

Ben taught political science for 10 years: at New York University from 1991 until 1997 and (with tenure) at Southern Methodist University from 1997 until 2000. He also wrote two academic books: Getting to War (Univ. of Michigan Press, 1997) and Policy and Party Competition (Routledge, 1992), which he co-authored with Michael Laver. Ben is the founder of two technology companies and the co-founder of SmartEquip, Inc., a software company for the construction equipment industry that provides intelligent schematics and parts diagrams to facilitate e-commerce in spare parts.

He began his investment career in 2003, first in venture capital and subsequently on two long/short equity hedge funds. He worked at Iridian Asset Management from 2006 until 2011 and TIG Advisors from 2012 until 2013. He joined Rusty at Salient in 2013, where he combined his background as a portfolio manager, risk manager, and entrepreneur with academic experience in game theory and econometrics to work with Salient’s own portfolio managers and its financial advisor clients to improve client outcomes.

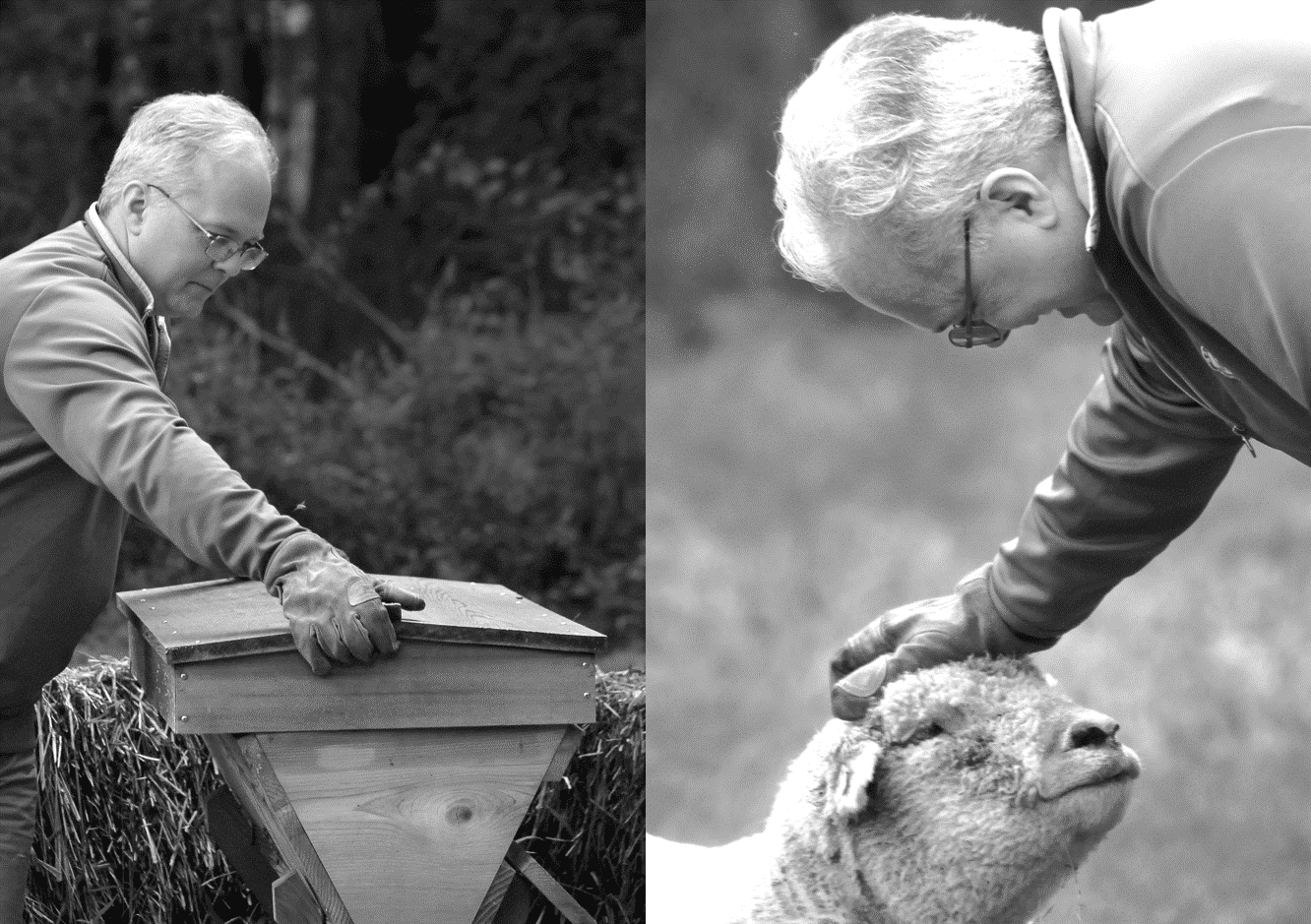

Ben is a graduate of Vanderbilt University (1986) and earned his Ph.D. in Government from Harvard University in 1991. He lives in the wilds of Redding, CT on Little River Farm, where he personifies the dilettante farmer that has been a stock comedic character since Cicero's day. Luckily his wife, Jennifer, and four daughters, Harper, Hannah, Haven and Halle, are always there to save the day. Ben's hobbies include comic books, Alabama football, beekeeping, and humoring Rusty in trivia "competitions".

Articles by Ben:

Lemonade (LMND) isn’t just an insurance company. No, no … they’re an AI Company! ™.

Plus Chamath is up to his old tricks.

I hate raccoons.

P&C insurer Lemonade (LMND) went public last year and now has a $5 billion market cap. They’re not just a sleepy insurance company, of course.…

Honestly, I kinda like Chamath-the-CNBC-talking-head. He’s iconoclastic and smart. A little too much Ben Shapiro / college debate team-esque with the “if I talk really…

Good chart out from Barclays this morning showing the key problem for investors and financial advisors as inflation fears take root: bonds no longer provide…

The head-on narrative collision between ESG and crypto, which has been building for months, finally happened.

It’s the biggest threat that Wall Street’s Bitcoin! ™ has ever faced.

I think a homeschooling VMPT is a natural for the ET Forum! On last week’s Office Hours conversation, ET Pack member Dan W. brought this…

Pack member Rob H. brought this up at last week’s Office Hours, and it deserves its own thread (as well as some attention from the…

The Bitcoin Is Art thesis that I put out back in 2015 (The Effete Rebellion of Bitcoin) and recently put forward again (In Praise of…

An ET Pack member sent me this. Anyone else come across ads that directly call out inflation expectations? Would love to collect more screenshots like…

This has been a bad week for Bitcoin and Bitcoin! TM alike. There’s no getting around that.

But whenever Paul Krugman and the Wall Street Journal agree on something … I want to be on the other side of that trade!