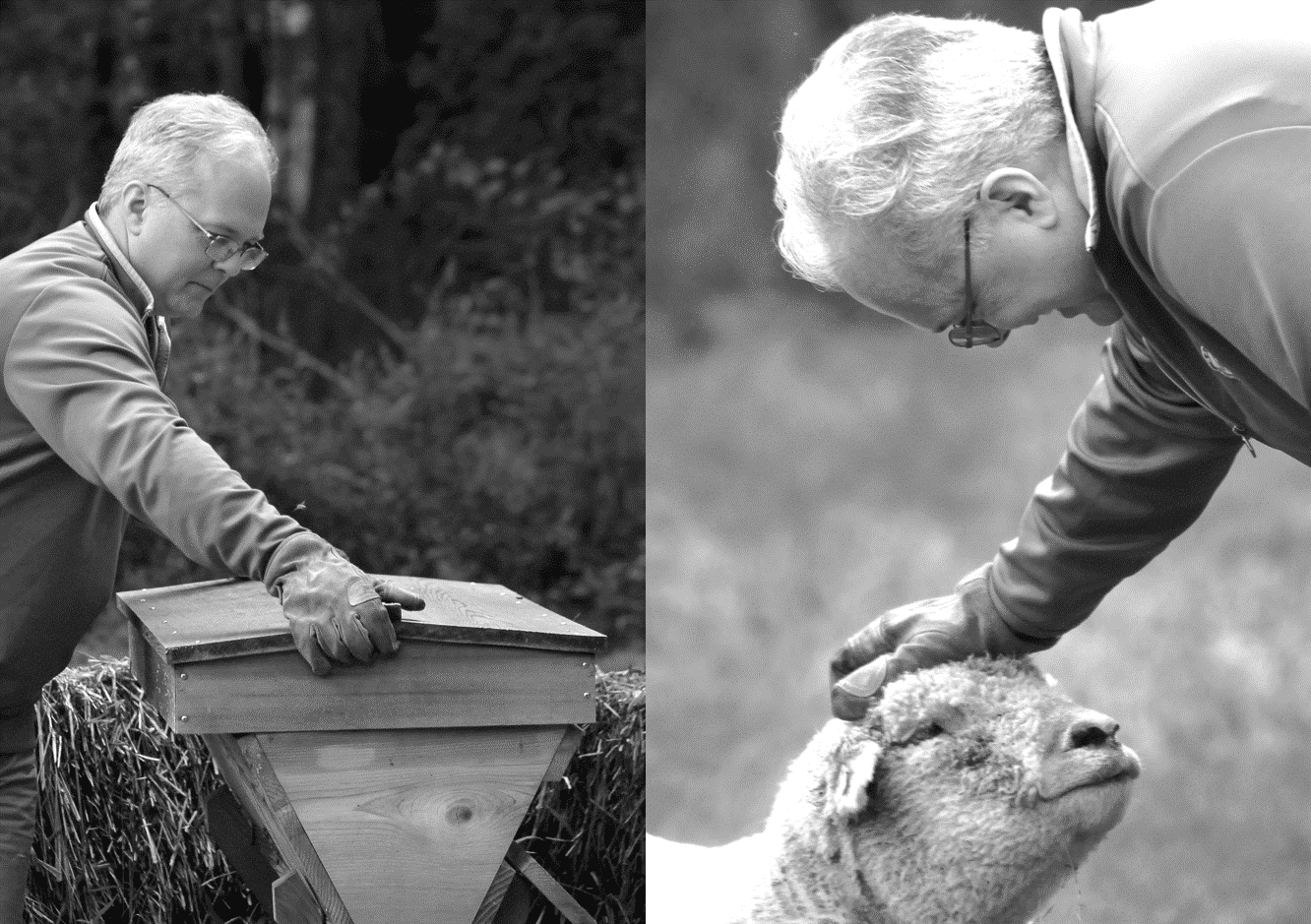

Ben Hunt

Co-Founder and CIO

Ben Hunt is the creator of Epsilon Theory and inspiration behind Second Foundation Partners, which he co-founded with Rusty Guinn in June 2018.

Epsilon Theory, Second Foundation’s principal publishing brand, is a newsletter and website that examines markets through the lenses of game theory and history. Over 100,000 professional investors and allocators across 180 countries read Epsilon Theory for its fresh perspective and novel insights into market dynamics. As Chief Investment Officer, Ben bears primary responsibility for determining the Company’s investment views and positioning of model portfolios. He is also the primary author of materials distributed through Epsilon Theory.

Ben taught political science for 10 years: at New York University from 1991 until 1997 and (with tenure) at Southern Methodist University from 1997 until 2000. He also wrote two academic books: Getting to War (Univ. of Michigan Press, 1997) and Policy and Party Competition (Routledge, 1992), which he co-authored with Michael Laver. Ben is the founder of two technology companies and the co-founder of SmartEquip, Inc., a software company for the construction equipment industry that provides intelligent schematics and parts diagrams to facilitate e-commerce in spare parts.

He began his investment career in 2003, first in venture capital and subsequently on two long/short equity hedge funds. He worked at Iridian Asset Management from 2006 until 2011 and TIG Advisors from 2012 until 2013. He joined Rusty at Salient in 2013, where he combined his background as a portfolio manager, risk manager, and entrepreneur with academic experience in game theory and econometrics to work with Salient’s own portfolio managers and its financial advisor clients to improve client outcomes.

Ben is a graduate of Vanderbilt University (1986) and earned his Ph.D. in Government from Harvard University in 1991. He lives in the wilds of Redding, CT on Little River Farm, where he personifies the dilettante farmer that has been a stock comedic character since Cicero's day. Luckily his wife, Jennifer, and four daughters, Harper, Hannah, Haven and Halle, are always there to save the day. Ben's hobbies include comic books, Alabama football, beekeeping, and humoring Rusty in trivia "competitions".

Articles by Ben:

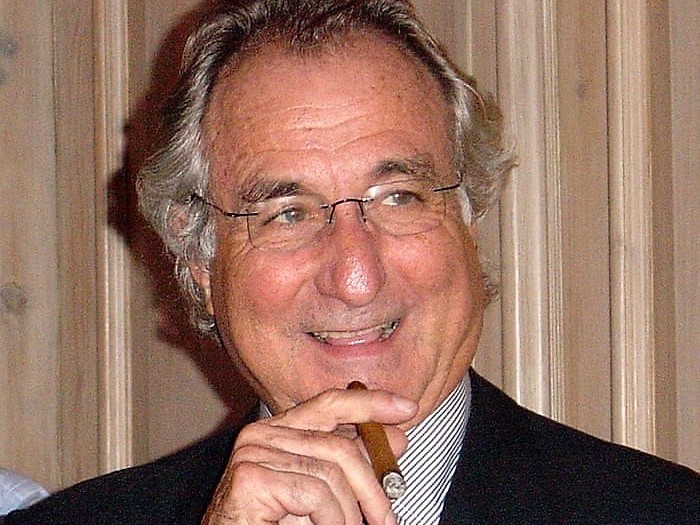

Three blow-ups in three months: Archegos, Greensill, and Melvin Capital.

What do they have in common? Insane leverage employed to maximize private gain while socializing potential losses.

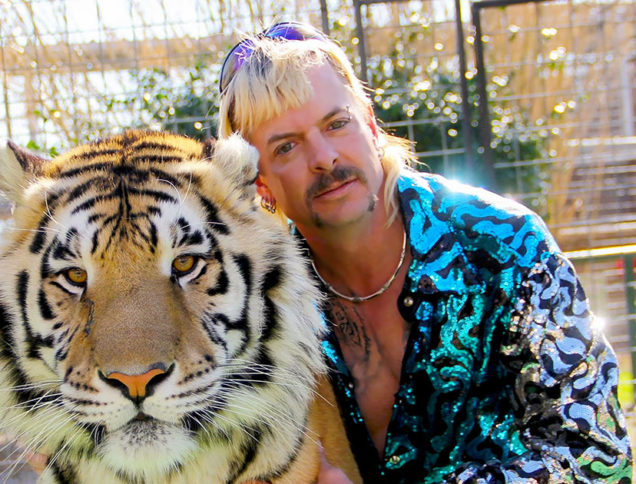

What do you get when you give a Raccoon billions of dollars AND invisibility from regulators? Collusion and insider trading.

There is a tide that is flowing out today, and it’s revealing Lex Greensill and Bill Hwang just as surely as it revealed Jeff Skilling in 2001 and Bernie Madoff in 2008. The big trade around Skilling and Madoff wasn’t directly on their specific scams and frauds, but on what their specific scams and frauds showed us about systemic rot in the financial system.

I think Jay Powell and the Fed have locked themselves into a two to three year commitment to treating inflationary pressures as “transitory”, just like an NFL GM and organization lock themselves into supporting a “franchise” quarterback they draft in the first round.

And that’s pretty exciting for a discretionary alpha-oriented investor like me.

I think we are hitting an inflection point in a thirty-year globalization trade and a forty-year deflation trade at the same time that the Lex Greensills and Masayoshi Sons of the world have had 13 years to build their scams to the breaking point.

The game is afoot!

We’re going to Pack-source a slate of investment strategies for an inflationary world. Here are five tentpoles to organize and support that effort.

I think that the collapse of Greensill Capital has a lot of systemic risk embedded within it, particularly as the fraudulent deals between Greensill and its major sponsors – Softbank and Credit Suisse – come to light.

This is the first Big Fraud I’ve seen in 13 years with the sheer heft and star power to ripple through markets in a systemic way. Not since Madoff.

Is the collapse of Greensill Capital a Madoff Moment for the unicorn market? Honestly, if you had asked me a few weeks ago, I would have told you that a Madoff Moment was impossible in our Narrative-consumed, speak-no-evil market world of 2021. Now I’m not sure.

Increasingly, the Common Knowledge of our investment world – what everyone knows that everyone knows – is that inflation is a problem and you should be focused on it.

In 2008, the US housing market – together with a Fed that thought the subprime crisis was “contained” – delivered the mother of all deflationary shocks to the global economy.

In 2021, the US housing market – together with a Fed that thinks inflationary pressures are “transitory” – risks delivering the mother of all inflationary shocks.

The ET Pack is going to figure this out … together.