Ben Hunt

Co-Founder and CIO

Ben Hunt is the creator of Epsilon Theory and inspiration behind Second Foundation Partners, which he co-founded with Rusty Guinn in June 2018.

Epsilon Theory, Second Foundation’s principal publishing brand, is a newsletter and website that examines markets through the lenses of game theory and history. Over 100,000 professional investors and allocators across 180 countries read Epsilon Theory for its fresh perspective and novel insights into market dynamics. As Chief Investment Officer, Ben bears primary responsibility for determining the Company’s investment views and positioning of model portfolios. He is also the primary author of materials distributed through Epsilon Theory.

Ben taught political science for 10 years: at New York University from 1991 until 1997 and (with tenure) at Southern Methodist University from 1997 until 2000. He also wrote two academic books: Getting to War (Univ. of Michigan Press, 1997) and Policy and Party Competition (Routledge, 1992), which he co-authored with Michael Laver. Ben is the founder of two technology companies and the co-founder of SmartEquip, Inc., a software company for the construction equipment industry that provides intelligent schematics and parts diagrams to facilitate e-commerce in spare parts.

He began his investment career in 2003, first in venture capital and subsequently on two long/short equity hedge funds. He worked at Iridian Asset Management from 2006 until 2011 and TIG Advisors from 2012 until 2013. He joined Rusty at Salient in 2013, where he combined his background as a portfolio manager, risk manager, and entrepreneur with academic experience in game theory and econometrics to work with Salient’s own portfolio managers and its financial advisor clients to improve client outcomes.

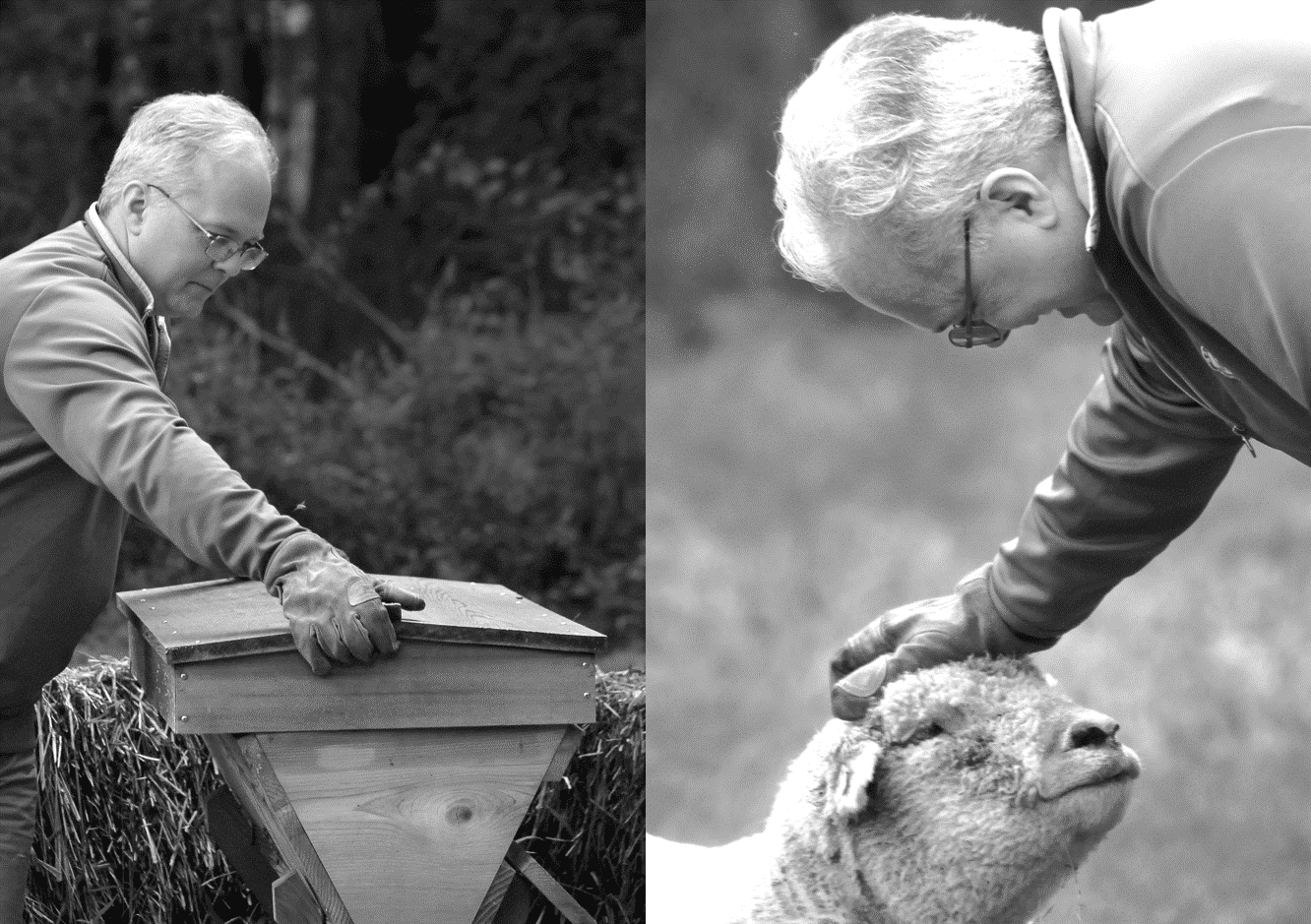

Ben is a graduate of Vanderbilt University (1986) and earned his Ph.D. in Government from Harvard University in 1991. He lives in the wilds of Redding, CT on Little River Farm, where he personifies the dilettante farmer that has been a stock comedic character since Cicero's day. Luckily his wife, Jennifer, and four daughters, Harper, Hannah, Haven and Halle, are always there to save the day. Ben's hobbies include comic books, Alabama football, beekeeping, and humoring Rusty in trivia "competitions".

Articles by Ben:

“Narrative Stability, Hanging by a Thread” is a badly mixed metaphor, but it conveys exactly what we’re seeing in narrative-world these days.

We are in a market where we are one inflation shock or one jobs shock (like the one last Friday) from broadly reshaping the narrative landscape. But for now it’s steady as she goes.

Nothing gets my spidey-sense tingling more than a market that looks benign enough, but has enormous carnage occurring just below the surface. And that’s exactly what’s happened so far in 2023, where risk assets in general and the US stock market in particular have been strong but momentum strategies have been absolutely destroyed.

The craziest thing happens when there’s no audience, when you’re talking with other actual human beings for the right reasons … you not only have actual conversations, you not only move quickly past politics into subjects that are far more interesting and far more relevant to our actual lives than politics, but you make actual friends

The modern American system of higher education – especially its most prominent public and private universities – is less our Superman than our Homelander, a smiley-faced faux superhero who does The Man’s dirty work in exchange for wealth, privilege and … our cheers.

Whether or not Blackstone and Starwood are successful in maintaining the Story of Adequate Liquidity and preserving their private REIT franchises through this storm depends on one thing and one thing only – how bad is the storm going to get? If it’s a “soft landing” or a “mild recession”, then they’ll sail through this fine. But if it’s a bad recession …

Unfortunately for private REIT managers and their LPs, I think the odds of a bad recession in 2023 went up substantially this week.

I expect Wall Street and financial media to trumpet the “soft landing” thesis pretty loudly over the next few weeks. Is this correct? Personally, I don’t think so. Six months from now, will we have a soft landing or a hard landing? Personally, I think it’ll be a hard landing.

But who cares what I think!

2022 was our ninth year of publishing Epsilon Theory. It was also our best.

We’re changing the way the world sees the invisible water in which we swim – narratives.

And we’re just getting started.

Covid is China’s Vietnam War, and the current outbreak is their Tet Offensive.

This is how Common Knowledge changes, as now everyone knows that everyone knows that the CCP is not just a liar, but an incompetent, failed liar.

If you are responsible for Other People’s Money, you sever ties with your undercapitalized, overlevered broker before there’s a run on the bank. You get out when you suspect, not when you know for sure. And if your friends are unhappy about that … well, tough.

This is the business we have chosen.

A webinar on recognizing and navigating the confidence games, big and small, of our investing world, and coming out the other side with our integrity and assets intact.