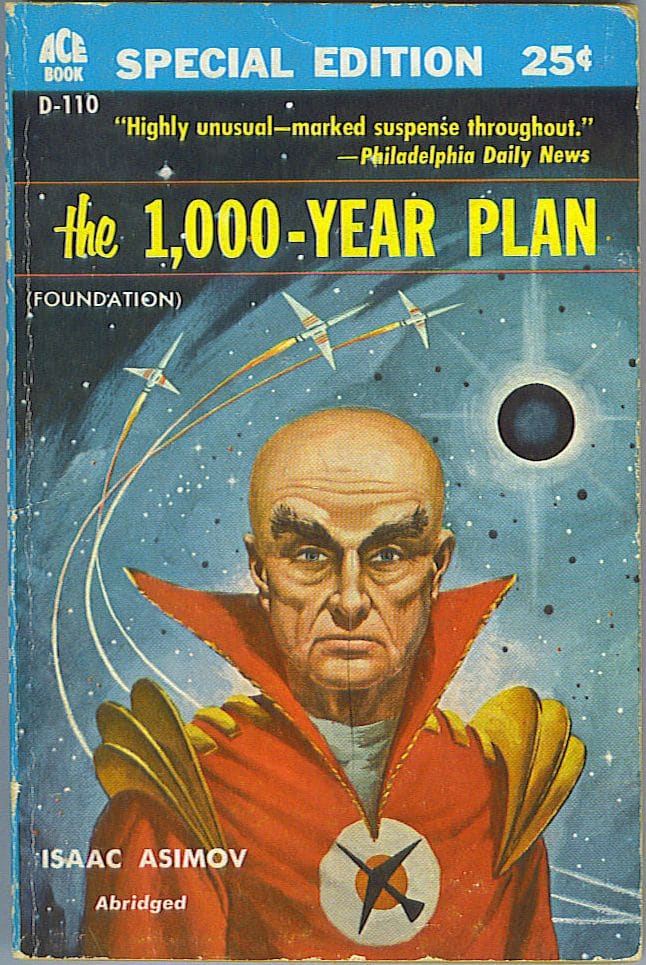

In 1942, fresh from reading Edward Gibbon’s History of the Decline and Fall of the Roman Empire, 22 year-old Isaac Asimov published the first short story in what would become the most famous and influential science fiction series of his or your lifetime – the Foundation Trilogy. In these books, Asimov invented the fictional science of psychohistory, a combination of history, sociology and mathematics that could make accurate predictions about the behavior of crowds.

The scientists who developed psychohistory called themselves the Foundation, and they wrote down their research and principles on a giant screen called the Prime Radiant. The Radiant displayed the Plan, a path forward that recognized how we humans are hard-wired and soft-wired to respond to Narrative and other invisible social interactions in estimatable ways. It was a path to be followed – not to prevent the inexorable and inevitable Dark Age – but to reduce its length from an unimpeded 30,000 years to “only” 1,000 years. All the wisdom in the world is insufficient to stop the great cycles of human history. We do what we can.

The Plan goes awry only a few centuries into its efforts, thrown askew by a unique mutant psychic named the Mule, a force totally unforeseen by the Plan. The Mule’s great power is the ability to manipulate the emotions of any human, a power he first uses to make a planet’s population fearful, then, once conquered, to make them intensely loyal. First the Mule takes over the machinery of Empire, turning the supposed leaders into his puppets. Then he diminishes the Foundation into near irrelevance. And so the galaxy descends into a 30,000 year Dark Age.

But the Radiant survives, kept alive by a small band of psychohistorians determined to get humanity back on the right path, no matter how long of a game they must play. This is the Second Foundation, established at the same time as the highly public Foundation, working in anonymity and behind the scenes. Hunted by both the Mule’s Empire and the still powerful Foundation, it is the Second Foundation, using similar mental powers as those of the Mule, that ultimately prevails.

Just wanted to say thank you. Grew up dirt poor but smart as shit and got sucked into the worst of our narrative-driven ‘elite’ institutions (Ben Bernake was my econ professor - vomit).

Went to actual war a few times in the interim for my troubles. I remember being on a patrol base in Iraq, late 2008, a few random explosions here and there to punctuate the discussion of the US economy falling apart. Telling my soldiers (a bunch of 18-year-old kids from shithole places in the south and midwest like me) how those guys knew what they were doing, necessary to save the economy, yadda yadda yadda. They called bullshit, I disagreed at the time. They were right. Heaps and heaps of bullshit.

Wife has a similar story. Both of us spent the better part of a decade wasting our lives ‘changing the world’ for big tech and big law. We lit it all on fire a few years ago and haven’t looked back. Have a three-year-old daughter now and have tried to live something close to what you have here since she came around. Couldn’t put it into words as well as you have. Godspeed.

P.S. You should read the Stormlight Archive if you can spare time for a fantasy epic- best encapsulation of how to be a decent human in a fallen world I’ve read in a very very long time.

Heard.

I consider myself very well read. You sir, are a struggle to read; and I mean that as a compliment.

I’ve enjoyed Epsilon Theory for the past 2 years and it’s been a wonderful source of education and it goes beyond finance. I find myself drawn to this type of discussion and world view and subscribe to several people with similar styles and perspectives.

However, it dawned on me that my desire for intellectual contrarian financial discussions might be a narrative I’m biased to accepting. The narrative is as follows: Someone on the outside like myself who doesn’t want to be “scammed by the financial system” will use his intelligence and true grit to persevere above the financial charlatans who are currently making money through ignorance. My biggest concern is that this narrative isn’t true and these intellectual discussions of human nature mapped to financial markets with $10 words thrown in is just an illusion to hide the simple fact that…I’m really an idiot. Is it possible that in the pursuit of understanding how foolish others are, we simply just constructed our own narrative and abstractions that commit very same sins as those of who look down upon?

Hope no one is offended. Still love Epsilon Theory though! I just wanted to pose to the community to see if anyone had similar concerns.

For what it’s worth, neither I nor Ben would take any offense at this line of thinking, because…well, because we wonder about the same thing. It was what I had in mind just last week when I was writing Deadly. Holy. Rough. Immediate. (http://www.epsilontheory.com/deadly-holy-rough-immediate/) The basic issue you’ve got your finger on, I think, is that we are all constantly telling each other stories. All communication is passed through a filter of “how I want this person to think,” and “I want all these people to see that finance is full of abstractions and Narrative” is absolutely a story we are telling you.

The question - in my opinion, anyway - is (1) who we will trust, knowing that they will be telling us stories (and we them), and (2) who will work with us in good faith to cut through abstractions in our communication with each other to be more real, tangible, authentic and direct. It’s hard for us, too.

That really helps a lot. Much appreciated

People just love stories don’t they? As a kid “once upon a time” was a magic attention grabber. Very little changes so as you say always ask why you are being told what you are being told.

Ben - the idea of having a process was there in plain sight all the time! I do so enjoy your writings You have helped me to understand why I feel the way I do and feel a lot less “helpless” into the bargain.

I am really looking forward to following your new adventure as well as being a part of it in any way I can. Do let us know when you are going to be in the UK ???

All the best Clive

Thanks, Clive! Will definitely keep the Pack up to date on travel plans and speaking engagements.

I just became a Member of the Pack, and I wanted to comment on this piece as I found it very beautiful and profound, and I believe Ben described it as sort of a new manifesto. I’m firmly ensconced in BigLaw but I’m not an attorney, I work in accounting.

Ironically as I was hemming and hawing over subscribing here, and whether I should do the monthly vs. annual subscription (yup, accounting!), my company announced a bonus due to the end of our (successful) fiscal year which made it very easy to say, “Yes, annual subscription please!”.

I love the thoughtful posts that make me realize things that would never have occurred to me otherwise. I try to surround myself with many different voices so I have a less narrow perspective, and Epsilon Theory has become a huge part of that.

Ok have to bring this home, but one quick shout-out to Andrew Horowitz’s Disciplined Investor podcast (NOT sponsored), because that is where I first came across Ben. He was describing a financial concept using the work of Eadweard Muybridge. Mind. Blown.

Just to be clear, I was going to subscribe regardless – but the bonus made it much easier to choose the annual subscription.